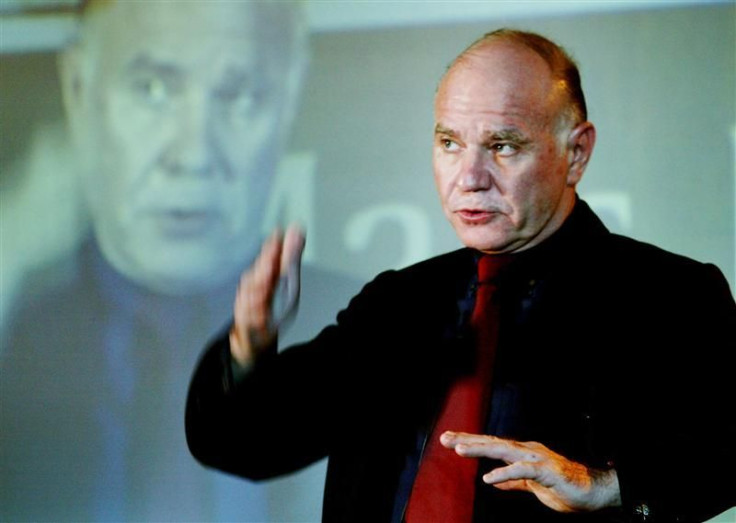

Marc Faber Warns Of Wealth Destruction Via Inflation, Deflation, Unrest

Marc Faber, the fund manager who publishes The Gloom, Boom & Doom Report, is warning of massive wealth destruction sometime down the line, citing unresolved financial excess accumulated globally over the past few decades.

Asked how much destruction he foresees, the Swiss investor told CNBC in an interview that some rich individuals could lose as much as 50 percent of their wealth.

Faber, a Barron's Roundtable participant, believes the destruction come will in the form of high inflation, deflation and/or social unrest.

Inflation destroys wealth by eroding currencies' purchasing power, while deflation does so by pushing down prices of financial assets. Social unrest, which can either cause or be a result of inflation/deflation, may also lead to destruction of physical assets such as buildings and stores.

Maybe all of it will happen but at different times, said Faber, one of several prominent commentators who expect monetary instability -- the dual threat of inflation and deflation.

People have this extraordinary view that inflation and deflation are opposites, but of course they're not opposites at all. [The opposite] is monetary stability, said Jonathan Ruffer, a fund manager who oversees about $19 billion.

Before the global financial crisis, the most dominant force of financial markets was arguably excessive borrowing, which drove up the prices of financial assets.

After the massive leveraging bubble popped, financial markets were driven by the battle between the natural process of deleveraging, or reducing debt, and government interventions to stop it.

The Federal Reserve, for example, increased its balance from less than $1 trillion to nearly $3 trillion to combat the threat of deflation.

Whether financial markets will suffer from inflation or deflation at a particular time, therefore, depends on which force is winning the battle.

Hugh Hendry, a fund manager overseeing more than $700 million, thinks deflation will occur first, with inflation to follow as the world's central banks respond by printing money in massive fashion.

Faber, however, believes asset inflation will be first, as central banks take the slightest sign of an economic slowdown or financial weakness as their cue to resume printing money.

The Federal Reserve's primary dealers seem to agree that U.S. monetary policy is extremely loose, as 15 of 21 expect a third round of quantitative easing from the U.S. central bank, according to Bloomberg News.

At that point, the natural process of deflation will take over, according to Faber.

As for investors who wish to protect themselves against looming wealth destruction, Faber advises diversification: Allocate assets to four classes of 25 percent each -- equities, precious metals, cash and bonds, and real estate.

© Copyright IBTimes 2024. All rights reserved.