With Markets, Economy Reeling, All Eyes Turn to Fed

Analysis

Generally, when the U.S. Federal Reserve releases its statement on monetary policy, the traders at the New York Stock Exchange do not like surprises.

But on Tuesday when the Fed meets, after the a week-long market sell-off and tumult following Standard & Poor's stunning and controversial decision to downgrade the credit rating of the U.S. Government, Wall Street traders and specialists may very well welcome a surprise from the Fed, in both words and deeds.

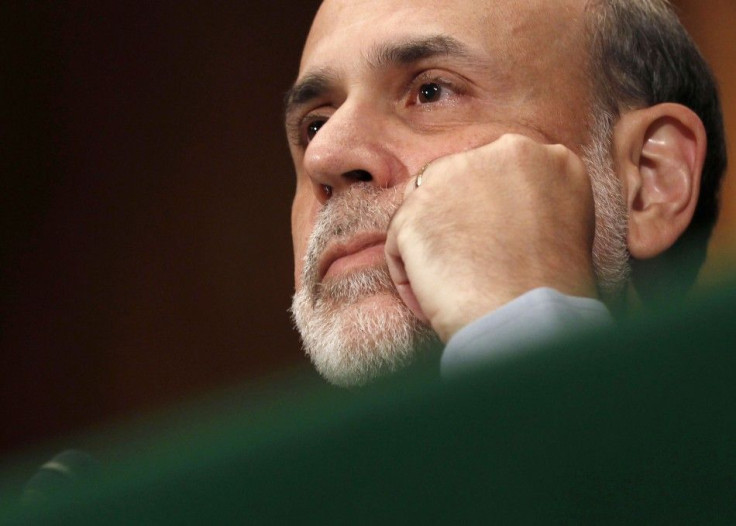

What the market's major participants may want to hear from Federal Reserve Chairman Ben Bernanke is a continuation of low, short-term interest rates -- that's a given -- an almost 100% certainty.

'Q3! Q3! Q3!'

Second, market participants would like to hear, at minimum, that the Fed remains at-the-ready to deploy a third phase of its quantitative easing program, QE3, if the U.S. economy slows further.

The reason? The U.S. economy has already slowed to a crawl. Add the "asset destruction / wealth destruction" (also called the negative wealth effect) that occurs when the stock market drops more than 1,000 points, and the economy could slow even more, perhaps tipping back into a recession.

Don't misunderstand -- Bernanke who understands full well the relationship between wealth effect and the economy, would not implement QE3 solely to increase asset prices, but if the declines are such that both balance sheets and liquidity are damaged to such a degree, Bernanke may conclude that implementing QE3 is prudent.

Further, at least some traders on the floor of the New York Stock Exchange Monday favored additional unconventional actions by the Fed. They were shouting, "QE3! QE3! QE3!" at the close of trading Tuesday, Bloomberg News reported.

To be sure, some Fed members will oppose a QE3, arguing that inflation, while not a problem yet, is trending higher. Even so, Bernanke has enough price stability data to refute this likely protest by the inflation hawks on the Fed.

Will Fed Comment on Nation's Fiscal Condition?

Third, Wall Street traders and specialists would like to hear Bernanke say a word or two on fiscal issues of note.

Moreover, Bernanke may use the above phraseology because it's consistent with Fedspeak, which must be strategically opaque.

Traders would like to hear Fed note that "Recent discussion in public forums has centered around the budget deficit and the U.S. economy's ability to service that deficit."

Traders would like Bernanke to reiterate that, long-term, deficit reduction must occur, but that nothing in the Fed's research suggests the United States will not be capable of servicing that debt, provided the nation's leaders address deficit reduction.

Bernanke could then underscore that: 1) the policy choices that are made are up to Congress, as they are political questions, of which the Fed has no role, and that 2) the important point, from a fiscal health standpoint, is that Congress address the budget deficit, long-term.

Monetary/Economic Analysis: Every Fed interest rate announcement is important, but in light of where the U.S. and global economies are, and the recent somber tones echoing in Wall Street's Concrete Canyon, Tuesday's meeting and subsequent news conference by Chairman Bernanke is especially important.

Further, an announcement by Bernanke of at least the start of a "mini-Q3" and some pertinent points about U.S. wealth, the nation's productive capacity, flexible economy, and enormous debt service capacity, would help chase away the doom-and-gloom crowd, and the view from here argues Bernanke will not disappoint on Tuesday.

© Copyright IBTimes 2024. All rights reserved.