Gold prices rose more than 4 percent Tuesday, breaking a three-day losing streak, on optimism that Germany this week will approve an expansion of Europe's bailout fund and a decline in the U.S. dollar.

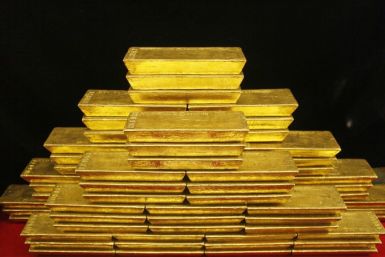

One thing is clear. There's nothing like a gold standard when it comes to analyzing the way the precious metal prices have behaved in the past three months. Gold's decade-long bull run peaked in the last three months when the prices went up by around 30 percent.

Spot gold rallied more than 1 percent and U.S. gold futures as much as 4 percent on Tuesday, snapping four consecutive sessions of losses as a weaker dollar helped battered commodities stage a comeback.

Gold prices rose more than 3 percent on Tuesday as a drop in the dollar index helped the precious metal snap a four-day run of losses and after an early rout in the previous session tempted price-sensitive physical buyers back to the market.

Gold tumbled nearly 4 percent Monday, hit by momentum selling and heavy liquidation by commodity hedge funds triggered by another sharp margin hike.

Silver rose more than 2 percent Monday after investors gained confidence that Europe leaders would be able to handle a Greek default without letting the rest of the continent or its struggling banks suffer.

Gold prices fell 2.7 percent Monday, its fourth day in a row to decline, as investors raised cash to cover losses and a touch of optimism about Europe drew investors back into the stock market.

Silver prices, which have lost more than a quarter of their value in the last four trading sessions, clawed back Monday into positive territory as bargain hunters took advantage of the white metal's recent discount.

Record high gold prices will allow Mali and its partners to continue producing from the country's top gold mine until 2020, seven years past the initial closure date, the government said on Monday.

Gold will continue to serve as a hedge against risk on a longer-term basis despite recent falls, given the lack of other safe-haven assets to protect investors against global economic uncertainty, a manager at Stenham Asset Management said.

Gold's toppling from record highs, culminating in Monday's unprecedented $120 price plunge, has investors asking whether a decade-long bull run is over. History would suggest that while gold has taken a beating, it is far from down and out.

Gold prices, which lost 20 percent of their value since early this month, will rise for four reasons, say analysts.

Goldgroup Mining Inc. said Monday it will buy Almaden Minerals Ltd.'s 30 percent stake in the Caballo Blanco project in a deal that will make Goldgroup the 100 percent owner of the Mexican gold project.

Gold prices recovered from huge overnight losses Monday before paring losses to about 1 percent. Still in the last three days the precious metal has now lost more than 9 percent of its value in its biggest three-day drop since 1983.

Mindoro Resources Ltd. said it found high-grade gold at its Lobo mine in Batangas Province, the Philippines.

Copper slumped to a 14-month low on Monday, adding to sharp falls from the last three weeks, as fears of a Greek debt default and the threat of a global recession sparked heightened concerns about demand for industrial metals.

The Mongolian government will seek to accelerate the timetable to increase its stake in the country's giant Oyu Tolgoi copper-gold project to 50 percent, Mining Minister Dashdorj Zorigt said on Sunday.

Gold was set for its biggest three-day loss in 28 years on Monday, as investors fled commodity markets in a scramble to secure cash in the face of mounting fear over the impact of a potential Greek debt default on the rest of the euro zone.

Spot gold fell 5.2 percent and silver dropped by the most in three years, extending Friday's rout as investors bolted for the ultimate safe havens of cash and the dollar.

Global mining giant Rio Tinto will respond to any request from the Mongolian government to discuss its investment in the country's giant Oyu Tolgoi copper-gold deposit, but still expects the original 2009 agreement to be honoured.

World stocks came off their lows and the euro inched up from an earlier 10-year trough against the yen on Monday as speculation that the European Central Bank might cut interest rates to help the economy countered concern over the euro zone debt crisis.

The Dow Jones industrial average on Friday suffered its worst week since the depths of the financial crisis in 2008, stung by severe anxiety over Europe's spiraling debt crisis and a warning from the Federal Reserve about the U.S. economy.

The CME Group, the world's largest commodities exchange, raised its margin requirement on trading 100-ounce gold futures by 21.4 percent, the third rise since July.

Gold prices slumped more than $100 an ounce on Friday, the biggest fall on record in dollar terms, as traders sold to cover losses, while global stocks edged up on expectations the European Central Bank will take new measures to contain the euro zone debt crisis.

In years past, gold often acted as a safe haven when stocks were falling, and it hit a record in August while equities struggled. Now, however, it's mired in its worst selloff in decades. What does it mean for investors who see gold as a core portfolio holding?

Gold crashed more than $100 lower on Friday as a slide turned into a freefall, with weeks of volatility, renewed strength in the dollar and talk of hedge fund liquidation wrecking its safe-haven status.

Let's face the mounting facts and just say it in plain language: The world is slipping into Global Recession 2011 and governments don't have the gunpowder to ward it off. The U.S. economy is barely growing at all. Companies aren't hiring. The federal budget deficit is above $14.5 trillion. Companies are stockpiling cash because, as Ford CEO Alan Mulally said in a press conference this week, because the consumer has pulled back.

Silver mining companies suffered acute losses Friday, with many posting double-digit drops in their share prices.

Gold prices plummeted Friday, at one point tumbling to 15 percent below the level of three weeks ago, as investors started buying stocks and, to a lesser extent, euros. Silver is now down 25 percent from its mid-week level.

World stocks came off 14-month lows on Friday on expectations policymakers would take further action to ease the Eurozone debt crisis, while commodities fell broadly on worries about a global economic slump.