Stocks were flat on Friday as data showed inflation remained in check last month as the domestic economy continues to improve, but consumer sentiment slipped.

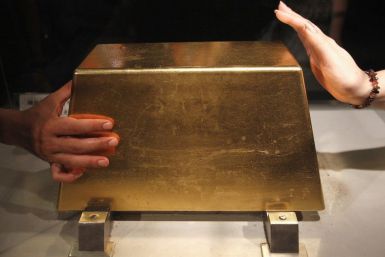

India, the world's No. 1 gold buyer, plans to double the duty on imports of the precious metal, according to reports Friday, its second such move this year. Gold prices fell nearly 1 percent.

Gold rose Thursday, reversing a three-day plunge that left prices beneath their critical 200-day moving average.

Newmont Mining Corp. is reevaluating the cost of its delayed Conga gold and copper project in Peru, the company's senior vice president in South America said on Wednesday.

Zimbabwe's monthly gold production has fallen short of the targeted 1,100 kilogrammes since the start of 2012, according to figures published by the finance ministry on Wednesday, throwing into doubt a projected annual output of 13 tonnes for the year.

Precious metals miner Claude Resources Inc said measured and indicated gold resources rose 43 percent as it discovered more gold at its Seabee property in Saskatchewan.

Gold fell to its lowest since mid-January on Wednesday after a modest upgrade of the U.S. Federal Reserve's economic outlook added zip to the dollar and gave investors an excuse to lighten holdings of bullion.

Harmony Gold, South Africa's third-largest bullion miner, said on Tuesday it would consider a Hong Kong listing once its massive Wafi-Golpu project in Papua New Guinea is up and running in around 5 years time.

South Africa's Impala Platinum said on Wednesday that the Zimbabwean government would have to find the money to buy the 31 percent stake it wanted in its local unit Zimplats or the stake would not be transferred.

Platinum rallied for a fifth day in a row on Tuesday, its longest streak of gains since October that took the price above that of gold for the first time in six months, while gold itself fell below $1,700 an ounce ahead of a U.S. rate decision later.

Gold prices may have risen for more than a decade and surged in the last few years. But hedge fund manager Kyle Bass' prediction for 2012 and beyond is that prices still have a lot further to go.

Gold fell on Monday, under pressure from a softer euro and from dwindling expectations for the Federal Reserve to signal the need for more measures to keep U.S. rates low, although longer-term investors took their bullion holdings to a fresh record.

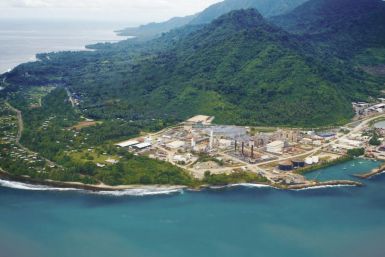

Work at the Grasberg mine in eastern Indonesia run by Freeport-McMoRan Copper & Gold Inc resumed as expected on Monday for the first time since a suspension on Feb 23, according to the company and the union.

Ghana's full-year gold production declined by a few percentage points last year but is expected to rise in 2012, the head of its Chamber of Mines said on Friday.

Gold edged lower on Monday after equities reversed gains and the U.S. dollar rallied to the highest in more than a month, but some investors opted to stay on the sidelines ahead of a U.S. Federal Reserve meeting this week that could weigh on the precious metal.

Back in late 2010, billionaire hedge fund manager John Paulson told “a standing-room-only crowd at New York’s University Club” that US inflation could hit double-digits in 2012. His forecast on gold and inflation, however, haven’t panned out so far in 2012.

Stocks rose on Friday, adding to their best two-day run in nearly three months, after a report showed the economy added more jobs than expected in February.

A war of words between South Africa's Impala Platinum and Zimbabwe intensified on Thursday, when the world's second-biggest platinum producer denied offering to hand over a stake in its local unit to the government.

A new Indonesian regulation that changes the rules on foreign ownership of mines applies to all foreign companies and is not aimed specifically at the largest of those, Freeport McMoRan Copper & Gold Inc (FCX.N), the deputy energy and mining minister said on Thursday.

Gold rose Thursday, led by a climb in the euro on the back of growing confidence in Greece's ability to complete a bond swap to avoid defaulting on its debt, and by evidence that this week's decline to six-week lows had lifted investor demand.

Freeport Indonesia said on Wednesday it was confident the government would honour all existing contracts as it re-negotiates a royalty contract over its Grasberg mine, which is the world's biggest gold mine and second biggest copper mine.

Impala Platinum, the world's second-biggest producer, has made an irrevocable offer to hand over a 29.5 percent stake in its Zimplats unit to a state-run fund, a senior Zimbabwe minister said on Wednesday.

Tens of thousands of South Africans staged a one-day national strike on Wednesday, hitting mining production, as the biggest labour group in the continent's largest economy flexed its muscles to remind the ruling ANC of its political clout.

Gold prices snapped three days of losses to rise on Wednesday, helped by the euro paring losses versus the dollar, which eased negative currency effects on the precious metal, and by a tentative recovery in demand for physical gold at lower prices.

Gold regained some ground Wednesday as jewellers in Asia snapped up the metal after prices dropped 2 percent in the previous session, but investors were cautious because of lingering fears about a possible Greek default.

Precious metals and the broader market plunged on Tuesday, with gold diving to its lowest point in six weeks, driven down by concerns about the global economy.

Peru insists its biggest mining project to date, Newmont Gold's $4.8 billion Conga gold and copper project, will go ahead, although the final shape and form has yet to be decided.

Industrial and Commercial Bank of China Ltd , the world's most valuable lender, said in a statement that its gold leasing business reached 62.8 tonnes of physical metal in 2011.

Gold fell 2 percent in heavy volume on Tuesday after breaching a key support, as renewed concerns about Greece's debt triggered economic fears, while some analysts say the metal looks oversold and poised for a rebound.

The Fairtrade Foundation will begin working with African gold miners for the first time this year, the organisation said on Tuesday, 12 months after it launched the Fairtrade Gold brand with metal sourced from Latin America.