Asian stocks edged up and the euro clawed back lost ground as investors waited for the end later on Wednesday of a Federal Reserve policy meeting expected to announce further steps to stimulate the flagging U.S. economic recovery.

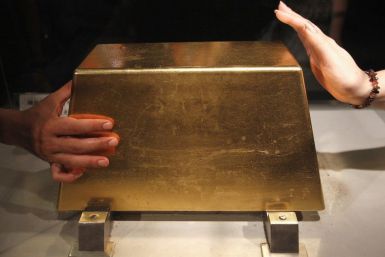

Gold's rally will extend beyond $2,000 an ounce in the next year, but won't match the torrid record-breaking climb of the last 12 months, according to gold investors and analysts attending the London Bullion Market Association's (LBMA) annual conference.

Drawn by a handwritten notice, a handful of customers sift through stacks of sports shoes and rows of clothes at a Li Ning discount outlet in China's boom town of Shenzhen on a Sunday afternoon.

Japan's exports rose in the year to August at less than half the pace expected as a global economic slowdown, a strong currency and Europe's sovereign debt crisis put Japan's own recovery increasingly in doubt.

Asian stocks drifted slightly lower and the euro clawed back lost ground as investors waited for the end later on Wednesday of a Federal Reserve policy meeting expected to announce further steps to stimulate the flagging U.S. economic recovery.

The Federal Reserve opened a two-day meeting on Tuesday that is expected to end with a decision to stock up on longer-term Treasury notes in a bid to boost a fading economic recovery.

Eight offshore banks are the subject of United States federal grand jury investigations examining whether they helped Americans evade taxes, a sign that authorities may be ready to issue subpoenas to those banks as part of a crackdown on offshore tax cheating.

Bank of America Corp dismissed 13 investment bankers in its industrials group and may cut more, Bloomberg reported on Tuesday, citing two people with direct knowledge of the actions.

Glam Media, a collection of highly curated blogs mainly centered around fashion, beauty and health, is acquiring Ning, the social media platform co-founded by Marc Andreessen.

United Technologies Corp is negotiating final terms of an all-cash acquisition of aircraft components maker Goodrich Corp with the goal of reaching a deal in the next few days, people familiar with the matter said on Tuesday.

Guggenheim Partners LLC is merging 11 asset management businesses into a new $119 billion firm and changing its name to Guggenheim Investments as part of a broad effort to target financial advisers and institutional clients.

Design software maker Adobe Systems Inc's sales outlook for the fourth quarter was buoyed by new customer additions, allaying investor fears of a slowdown in its growth.

UBS Chief Executive Oswald Gruebel will ask the Swiss bank's board to back plans for a radical overhaul of investment banking under his leadership at a meeting in Singapore, after unauthorized trading caused a $2.3 billion loss.

Strong policies are urgently needed to increase economic growth and reduce the risk of a double-dip recession in the developed world, the International Monetary Fund (IMF) said in its revised World Economic Outlook. The IMF also decreased its 2011 global GDP growth forecast to 4 percent, down 0.3 percentage points from the June 2011 forecast.

The chances of an interloper appear slim in the ongoing deal discussions between United Technologies Corp and Goodrich Corp , according to people familiar with the matter, removing one potential hurdle for United Tech in acquiring the aerospace company.

Europe needs to get its act together and deal with its worsening sovereign debt crisis, the International Monetary Fund said on Tuesday, warning of the risk of severe repercussions for global growth.

A former Silicon Valley sales manager was found guilty of conspiracy charges on Tuesday in connection with the U.S. government's crackdown on insider trading.

Rupert Murdoch's News Corp bought back more than $1 billion of its shares in the last month, according to a filing, as it seeks to improve relations with shareholders frustrated by what they say is the media company's unpredictable capital allocation strategy.

Greece promised more cuts to its bloated public sector on Tuesday and held a second conference call in two days with its international lenders, whom it must convince to extend more loans to prevent its coffers running dry next month.

Silver mining companies rose in aftermarket trading Tuesday even as the price of silver gave up gains achieved earlier in the day.

If AT&T Inc fails to convince U.S. regulators that its proposed purchase of Deutsche Telekom AG's T-Mobile USA should go ahead, the pair may end up having to settle for a lesser relationship.

Stocks ended little changed on Tuesday as investors waited to see if the Federal Reserve would offer more economic stimulus and if Greece made progress in talks to avoid a default.

Gold's rally will extend beyond $2,000 an ounce in the next year, but won't match the torrid record-breaking climb of the last 12 months, according to gold investors and analysts attending the London Bullion Market Association's (LBMA) annual conference.

Any effort by the United States to pare its massive public debt without bringing in more revenue and tackling expensive benefit programs will lack credibility, the International Monetary Fund said on Tuesday.

First Majestic Silver Corp. said Tuesday it completed a key phase of an expansion at its La Parrilla Silver Mine in Mexico, which will result in the facility being able to double production to more than 3 million ounces of silver per year.

Stocks advanced on Tuesday, although they eased off session highs, on tentative hopes the U.S. Federal Reserve will offer more economic stimulus and signs of progress in Greek debt talks.

Europe will come under heavy pressure from other economic powers this week to stem its deepening debt crisis but talks among the self-proclaimed guardians of global finance are unlikely to make much headway.

New construction of homes fell more than expected in August, dragging on economic growth and keeping pressure on President Barack Obama to do more to help the sputtering economy.

Gold prices rose over the $1,800 mark Tuesday on expectations that the Federal Reserve will decide this week on further steps to stimulate the economy and fresh evidence that the economy needs some stimulation.

Stocks pushed higher on Tuesday afternoon as investors were cautiously optimistic that the U.S. Federal Reserve will offer more economic stimulus and that Greek debt talks were progressing.