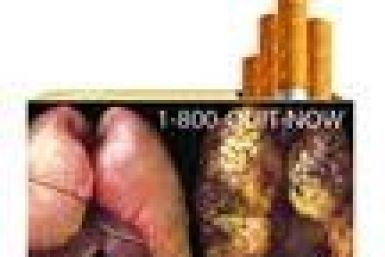

Mandatory anti-smoking warnings on U.S. cigarette packs are being challenged, this time by researchers who say the combination of grotesque images and explicit messages may not be effective in curbing smoking.

A federal judge ruled that the Federal Deposit Insurance Corp has to face a $10 billion lawsuit tied to the failure of Washington Mutual Bank.

You can’t blame investors for feeling slightly queasy about the U.S. stock market these days. One day of relatively positive data points is followed by a day with enough bad news to keep a stock investor up at night. But based on a condensed, cross-methodological analysis, in which direction is the Dow likely to head in the next six months?

Switzerland's biggest bank UBS AG is to axe 3,500 jobs to shave 2 billion Swiss francs ($2.5 billion) off annual costs as it joins rival investment banks in reversing the post-crisis hiring binge and preparing for a tough few years.

European banks like Societe Generale and Dexia SA are reeling from bad loans, but they are also suffering from a less obvious problem: their reliance on bond markets to fund operations.

Bank of America Corp shares posted their steepest drop in 2-1/2 years on Tuesday as investors worried that the biggest U.S. bank might face big writeoffs.

U.S. bank earnings continue to increase but the prospects for earnings growth are dimming as banks are having trouble boosting revenue.

Stocks shot 3 percent higher on Tuesday on speculation Federal Reserve Chairman Ben Bernanke this week would signal new help for the economy, giving investors hope a four-week rout was nearing an end.

Online tracking service comScore Inc siphons confidential data including passwords, credit card numbers and Social Security numbers from unsuspecting users, according to a lawsuit filed on Tuesday.

Gold prices were falling steadily late Tuesday in electronic trading as investors took profit from recent gains and bought stocks in expectations that the Federal Reserve will intervene in the bond market to give the anemic U.S. economy a lift.

Warren Buffett has a Chinese car problem, and he may be tempted to fix it himself -- at a cost of billions of dollars.

Electronic trading on the CME Comex division of the New York Mercantile Exchange continued Tuesday despite the effect of an earthquake that measured 5.8 on the Richter scale.

Facebook is making it easier for users to control who sees their information, and to have more say over the photographs they appear in, as the world's No. 1 social networking service seeks to assuage privacy concerns.

Stocks bounced on Tuesday with major indexes rising more than 2 percent as investors jumped into the market before a highly anticipated address by Fed Chairman Ben Bernanke later this week.

Gold closed down 1.6 percent as investors ignored mixed economic news to take profits from recent gains and to put their confidence in the head of the U.S. central bank whom they hope will use a speech later this week to signal support for the ailing American economy.

Billionaire Investor/Philanthropist George Soros has provided more thought-provoking commentary on the markets, and he says a U.s. double-dip recession is more likely now.

“The negotiations are far from over.”

Factory output in the U.S. central Atlantic region dropped to a two-year low in August and new home sales hit a five-month low in July, the latest signs to suggest the economy is at risk of stalling.

Stocks surged on Tuesday, with the S&P 500 and the Nasdaq up more than 2 percent, as buyers emerged before a highly anticipated address by Federal Reserve Chairman Ben Bernanke later this week.

Billionaire Carlos Slim Helu has increased his stakes in newspaper company New York Times Co and luxury retailer Saks Inc.

Less than a year since it went public, NetSpend Holdings Inc's depressed stock price and cut-throat competition in the pre-paid debit card market make it a potential takeout target.

New home sells fell in July to a 298,000-unit annual rate, the third straight monthly decline for the beleaguered sector. The slump means housing is likely to be a drag on U.S. GDP at least for the next two quarters, and perhaps for longer. New home prices are attractive, but potential buyers should traead carefully: they may drop in many markets.

Bank of America Corp shares fell as much as 6 percent on Tuesday morning amid fears the bank would have to raise more capital.

New U.S. single-family home sales fell more than expected in July to hit a five month low.

Germany's top court will give its verdict early next month on whether the government broke the law with last year's bailouts of debt-stricken euro zone countries -- a ruling which could limit Berlin's room to manage the region's debt crisis.

Stocks gained 1 percent on Tuesday as stronger-than-expected data from overseas sparked buying before a keenly awaited speech by Federal Reserve Chairman Ben Bernanke this week.

Factory output in the U.S. central Atlantic region contracted again this month and new home sales fell to a five-month low in July, adding to signs of a weak second-half economic expansion at best.

Societe Generale boss Frederic Oudea is having to work harder to keep his promise of a new dawn after the bank's devastating trading scandal in 2008.

You thought the U.S. debt deal ended the feud between Democrats and Republicans? Hardly. The U.S. Government's new fiscal year, fiscal 2012, starts Oct. 1 -- and a budget must be passed by Sept. 30. A key unknown is: will the Tea Party threaten to shut down the government again, if it doesn't get most of what it wants?

A minister in Angela Merkel's conservative party propelled Germany into a debate about guarantees on bailout payments to Greece, backing a demand from Finland for collateral, but Berlin distanced itself from her comments.