Maryland Shift of Pension Cash to Wall Street Delivered Below-Median Results: Study

Maryland has joined a not-very-exclusive club: States that have moved pension funds into riskier Wall Street investments and received, in return, below-median results. That underperformance by Maryland's $40 billion public pension fund cost state taxpayers more than $1 billion in unrealized returns in fiscal year 2014 alone, according to a new study by Jeffrey Hooke, a former investment banker, and the Maryland Public Policy Institute's John Walters.

The Maryland data lands amid a simmering debate over whether public pension systems should continue moving retiree money into private equity, hedge funds, venture capital firms, real estate. Over recent years, pension officials have shifted more money into these so-called alternative investments, vs. less-risky and less-complex investments with lower fees, like mutual funds and stock index funds.

Last week, the nation's largest public pension system, CalPERS (the California Public Employees' Retirement System), announced its decision to divest from all of its hedge fund holdings, and the nation's sixth-largest pension fund, the Teacher Retirement System of Texas, slashed its hedge fund allocations. Those moves followed legendary investor Warren Buffett urging San Francisco pension officials to avoid investing in alternatives. It also followed revelations that public pension systems in New Jersey, Rhode Island and North Carolina have delivered below-median returns after making major investments in alternatives.

In Maryland, officials have pushed to increase the pension system's alternative-investment portfolio. Bloomberg News reported in 2013 that the state "increased its holdings in private equity, hedge funds and real estate to about 29 percent of its portfolio from 14.6 percent in 2008."

According to Walters and Hooke, a former Lehman Brothers executive, that shift coincided with below-median returns for Maryland's public pension system.

"Ironically, as the fund’s relative performance has declined, its Wall Street money management fees have risen," the report says. "In fiscal year 2014 alone, the Maryland state pension fund paid out roughly $300 million in fees to Wall Street money managers. Over the past 10 years, these money management fees amounted to over $1.5 billion, according to the fund’s annual financial reports. Nevertheless this high-priced advice resulted in 10-year returns that were $3.22 billion (net of fees) below the median."

If the fund had matched median returns for public pension systems across the country, "the state could have awarded 80,000 poor children with $40,000 four-year college scholarships," Hooke and Walters wrote.

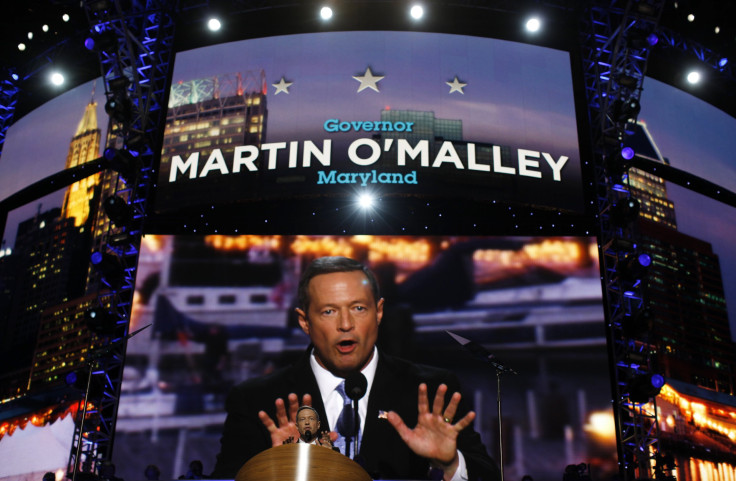

Maryland's shift into alternative investments happened while the securities and investment industries made more than $292,000 worth of campaign contributions to Democratic Gov. Martin O'Malley, who appoints some members of the Maryland pension system's board of trustees. Vice News has reported that the Private Equity Growth Capital Group is a financial backer of a 501(c)4 group co-founded by O'Malley. In May, Pensions and Investments magazine reported that the Maryland governor appointed a managing director of an alternative investment firm called The Rock Creek Group to head a state task force on retirement policy. Meanwhile, the chief investment officer of Maryland's pension system was recently appointed to a senior position in the U.S. Treasury Department overseeing public pension policy.

In 2013, Republican State Delegate Steve Schuh pushed legislation to reduce the state's investments in alternatives, but the bill did not pass the state legislature.

Hooke has testified before the legislature in support of putting more pension money into low-fee stock index funds.

"Eliminating active managers, selling alternative investments, and adopting indexing for 90 percent of the state’s portfolio would ensure median performance," his report concludes. "These actions would also save the state huge amounts in money management fees."

© Copyright IBTimes 2024. All rights reserved.