Microsoft, Alphabet Results Raise Hopes About Big Tech Weathering Slowdown

Microsoft Corp and Alphabet Inc results sparked a relief rally on Wednesday in heavyweight technology and growth shares as investors expressed confidence in Big Tech's ability to navigate a recession.

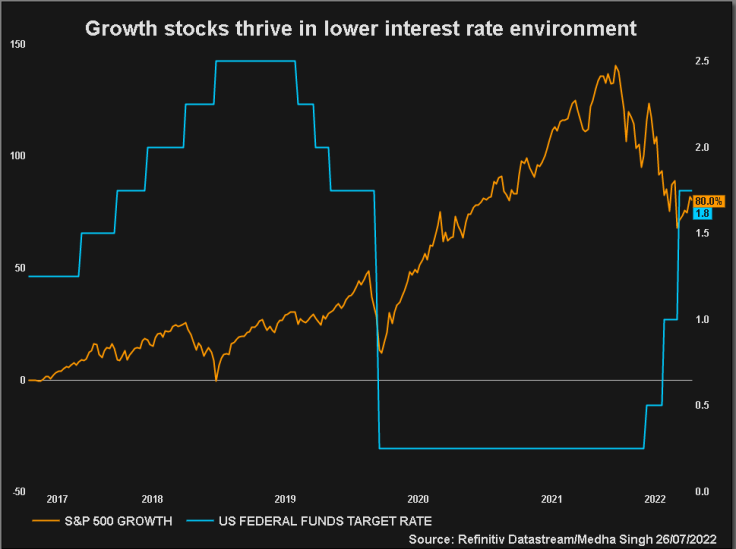

High-growth and megacap companies have powered the U.S. stock market for the past decade, but rising interest rates to combat decades-high inflation as well as a recent sharp rally in the dollar have taken a toll on the stocks.

The rate-sensitive growth stocks fell 25% this year as the Federal Reserve began its monetary policy tightening, compared with a near 18% fall in the S&P 500 index.

An eagerly-anticipated interest rate decision by the Fed later on Wednesday will be pivotal for the rate-sensitive group. The central bank is expected to raise rates by 75 basis points.

Alphabet shares rose 4.5% after the company reported better-than-expected Google ad sales, while Microsoft rose 3.1% after it said it targets double-digit growth in fiscal revenue.

"The guidance was pretty good and that helped the market know that the landscape is definitely slowing but at the end of the day, good companies are going to navigate it well," said Burt White, chief strategy officer at Carson Group.

"The market has rebounded and is now looking for leadership from some of the big tech names."

Focus will now be on ad revenue at Facebook owner Meta Platforms after disappointing results from Snapchat's owner Snap Inc last week sparked a selloff in social media and ad tech firms.

Meta shares rose 2.7%, while Apple Inc and Amazon.com Inc, which are slated to post reports on Thursday, firmed 2.5% and 0.5%, respectively.

GRAPHIC: Growth stocks and interest rates (

)

That would conclude results from the largest U.S. firms - Apple, Microsoft, Alphabet and Amazon - which together account for nearly a quarter of the weight in the benchmark S&P 500 index.

© Copyright Thomson Reuters 2024. All rights reserved.