Microsoft Is Making More Money From Sales Of Feature Phones Than Smartphones

LONDON -- Microsoft's most recent set of results show that it is making more money from feature phones than smartphones. No, you didn't read that incorrectly, and you haven't just traveled back in time to 2006. Microsoft, which is attempting to break the iOS-Android duopoly in the smartphone market, made more money in the three months to the end of September by selling phones with tiny screens and physical numberpads than it did from selling cutting-edge smartphones like its Lumia line.

Figures shared with International Business Times by research company IDC show that Microsoft's Lumia range of smartphones brought in $754 million in the third quarter of 2015, while its feature phone business, a legacy of its disastrous purchase of Nokia in 2014, brought in $765 million. Indeed, the company's feature phone sales jumped significantly from just over $600 million in the previous quarter.

Windows Phone sales have never been stellar, but Microsoft was, for a period, seeing some small growth in its market share. Now, it is seeing massive decline, to the point where its smartphone business is being overtaken by the feature phone business, a segment also in rapid decline. In the second quarter of 2014, Microsoft's smartphone business raked in over $2 billion and in just over a year it has seen that decline by almost two-thirds.

So could feature phones be the future of Microsoft's mobile ambitions? Not according to IDC analyst Francisco Jeronimo, who says the feature phone business is declining at up to 40 percent per year and will disappear almost completely in the next couple of years, in developed markets at least.

"The feature phone segment will continue to exist, even if it represents a very small percentage of the market, but it will only be an opportunity for very small companies focusing on niche segments." One such example is Swedish company Doro which develops easy-to-use smartphones for the elderly.

Jeronimo believes the feature phone business is likely to disappear in the next couple of years and that Microsoft will already have a plan in place for phasing out that business "and when they reach a point where they are [shipping] under 10 million units per quarter, or probably even less than that, it will be very difficult to justify the resources."

Premium

While Sony and LG have successfully transitioned from feature phone to smartphone by offsetting the decline in one with growth in the other, Microsoft has simply been unable to do that. Microsoft's smartphone market share is currently less than 3 percent and declining, making the company's bold 2013 claim that it would reach 15 percent market share by 2018, now seem far fetched.

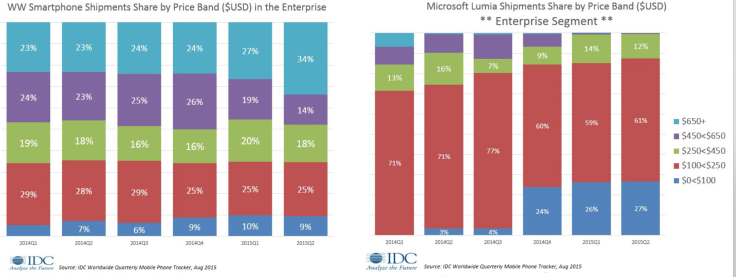

Not only is the company not selling a lot of smartphones, the ones it is selling are very much at the low end of the market. According to IDC's latest figures the vast majority of sales have come for devices under $250. In the premium enterprise market, where Microsoft sees a major opportunity to push its cross-platform capabilities and its new Lumia 950 and Lumia 950 XL smartphones, the company has been losing market share while the segment as a whole has been growing.

The premium segment of the enterprise market is growing, with 48 percent of all sales for devices costing more than $450, 34 percent of which are for devices above $650. Yet in the last quarter, Microsoft sold no smartphones in either of these price brackets. "Clearly Microsoft will have a major challenge to sell the Lumia 950 and the 950 XL at $500-plus when they have no traction in the high-end," Jeronimo said. "The new strategy of focusing in the high-end only will be very risky and jeopardize the entire Windows Phone eco-system, unless they give enough support to their partners to launch low-end Windows 10 handsets."

No Partners

The big question is whether Microsoft will keep its phone business in the long term or if it will remain a very small part of the business to show the market what they can do with a Windows device. This is a similar strategy to what Google has been doing with its Nexus range of smartphones for the last five years, highlighting the key aspects of its Android software by partnering with various manufacturers including Samsung, HTC and LG. The problem for Microsoft is that it simply has no smartphone maker to partner with.

Microsoft Lumia devices accounted for over 95 percent of Windows Phone shipments in the second quarter of this year as it struggles to get any major manufacturer to build smartphones running its latest software.

"The problem is, how many partners will [launch Windows-based smartphones] when they don't see the Windows Phone market share growing -- indeed it's declining -- and when you have a market that represent 1-2 percent of total smartphone shipments, it is very unlikely that any vendor will be attracted to launch Windows Phone in the future."

The future of Windows on smartphones will depend almost entirely on whether or not Microsoft can convince manufacturers to produce Windows 10-based smartphones at a variety of price points to address all sectors of the market. While there may be a couple of very small manufacturers signed up, it will take the support of a major OEM, such as Samsung, LG, Sony or Huawei, to significantly move the dial in Microsoft's favor, and even then it is going to be a big challenge.

© Copyright IBTimes 2024. All rights reserved.