Midterm Elections 2014: Midterm Years Are Historically A Stock Market Downer--Until Now

How are financial markets like college slackers? They hate midterms. Historically, midterm election years have been a real downer for the stock market. That is, until now, according to a handful of experts who look at financial market performance through the prism of U.S. voting cycles.

Analysts say 2014 isn’t lining up with previous patterns, which bodes well for the full-year performance of the Dow Jones Industrial Average, the S&P 500 and the Nasdaq Composite.

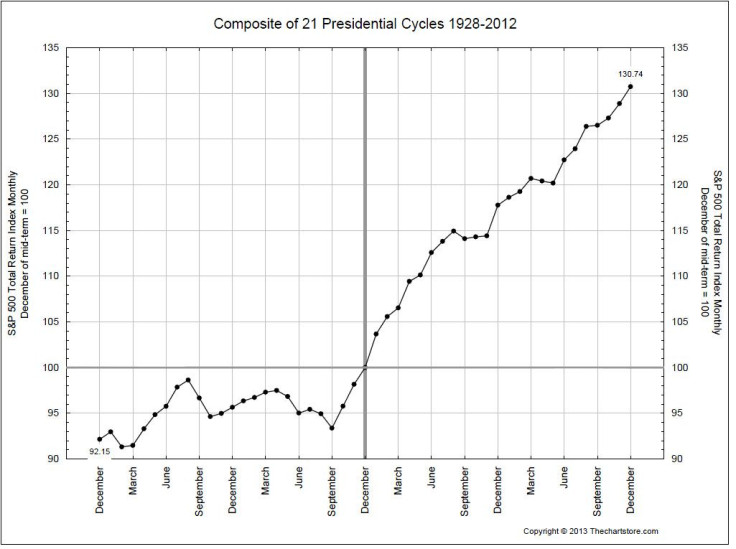

Predicting market behavior is difficult, but since the 1920s, midterm election years have been some of the worst for the U.S. stock market, while years preceding presidential elections tend to be boom years. Now, that pattern is likely to be reversed.

"Midterm election years are usually not good years, but right now were are up," said Karl Snyder, chief market strategist at Garden State Securities. "This year has not correlated whatsoever to what a normal midterm election year should look like."

What makes this year different? Almost every midterm election year has seen the Dow decline an average of 18 percent, yet none of the major indices have experienced as much as a 10 percent dip in more than three years. The absence of such a correction has led researchers to believe that 2014 will end well.

"The stock market did better in the beginning of the year, then rolled over recently, but now we’ve bounced back following volatility earlier this month,” said Snyder. "But the underperformance that we saw in the latter part of September and early October, that’s actually not correlated to what typically happens during a midterm election year. We would have started seeing the market perform better at the beginning of October."

Next year, however, doesn’t look so good. Although years preceding presidential elections have historically been good years, experts think 2015 won’t live up to expectations.

“I’m not of the opinion that next year will boom,” said Mark Newton, chief technical analyst at Greywolf Execution Partners.

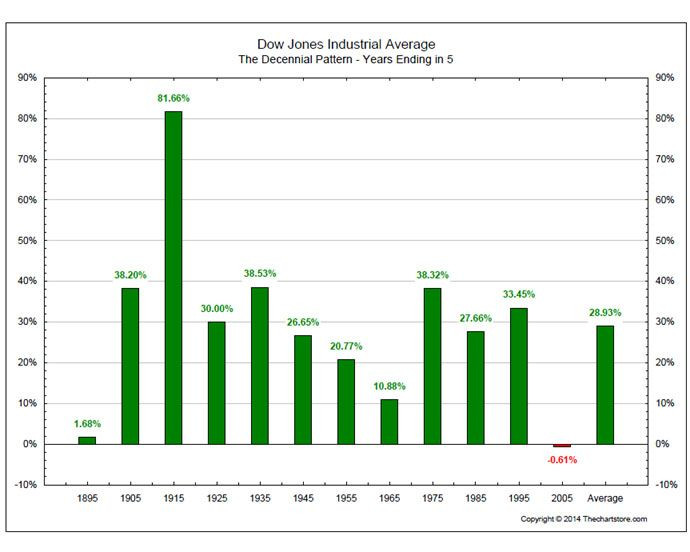

On the surface, investors should be bullish in their outlook for next year because 2015 falls in the middle of two key cycles: the presidential cycle and the decennial cycle. The latter reveals that since 1895 the fifth year of nearly every decade has ended positive in the Dow. But given that the U.S. stock market in 2014 hasn’t followed historic norms of previous midterm election years, next year is likely to be an abnormal year and may wind up looking similar to 2005 when the Dow ended the year flat.

“Forecasting a full year out is never something that's typically all that accurate, but I'd be willing to bet that next year is a down year,” Newton said.

© Copyright IBTimes 2024. All rights reserved.