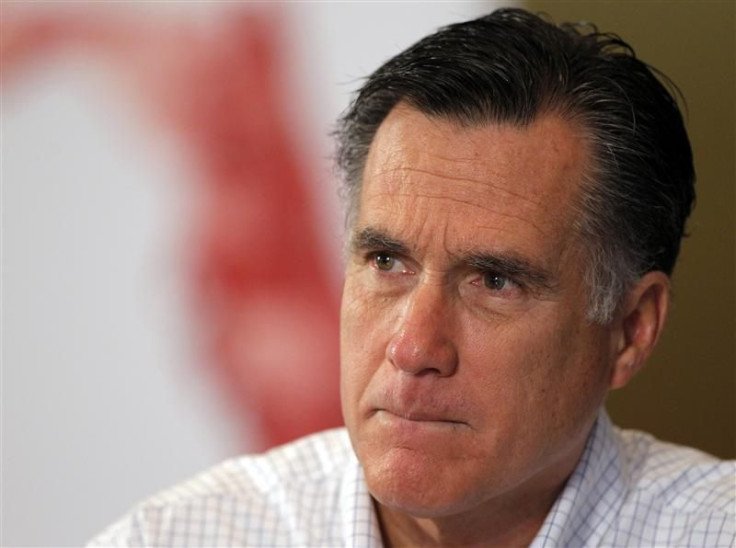

Mitt Romney Tax Return: He'd Pay Nothing Under Gingrich's Plan - Or His Own

At Monday's Republican debate in Tampa, Fla., Mitt Romney said, by way of criticizing Newt Gingrich's tax plan, that he, Romney, wouldn't pay any taxes under it.

It's a funny criticism for Romney to make, considering that he wouldn't pay any taxes under his own tax plan, either. In fact, Rick Santorum is the only Republican candidate with a tax plan under which Romney would pay any taxes.

This is because Romney, Gingrich and Ron Paul have all proposed eliminating taxes on capital gains and dividends, which are already taxed at a preferential rate: 15 percent, as opposed to the 35 percent maximum rate on wages. This is what allowed Romney to pay just 13.9 percent in federal taxes in 2010, and if capital gains and dividends were made tax-exempt, people like Romney, who get most or all of their income from investments rather than wages, would get off scot-free.

The candidates don't talk about this when they call capital gains and dividends taxes unfair, but their plans would exempt many people from taxes altogether, just as many lower-income Americans are exempt from federal income taxes under current law. These are the same candidates who say they want to broaden the base -- that is, tax more people, not fewer, in order to lower rates across the board.

Given the public outcry surrounding the 13.9 percent effective tax rate shown in Romney's 2010 tax returns, it seems unlikely that the majority of Americans would be enamored with a tax-reform plan that allowed people like Mitt Romney to pay no taxes at all.

And they aren't enamored with it, according to a CBS News/New York Times poll released Tuesday.

The poll found that, far from agreeing that capital gains and dividends should be tax-exempt, 52 percent of Americans think such investment income should be taxed at the same rate as work income -- that is, at a maximum of 35 percent, not 15 percent. Just 36 percent said capital gains and dividends should be taxed at a lower rate than work income, and that 36 percent includes both people who believe those taxes should be eliminated and people who simply think the current 15 percent preferential rate should be maintained.

Polls have also consistently shown that the majority of Americans support the so-called Buffett Rule, or the idea that wealthy taxpayers should pay more than they do now. The CBS News poll found that 55 percent of Americans believe the wealthy pay less than their fair share of taxes, and just 25 percent believe the current rates for the wealthy are fair.

© Copyright IBTimes 2024. All rights reserved.