Monday's Stock Market Close: US Equities Rise As China Cut Tariffs On Hundreds Of Imports, Dow Boosted By Boeing

KEY POINTS

- Stocks set record for third straight session in light holiday trading

- China will cut tariffs on more than 850 imported goods

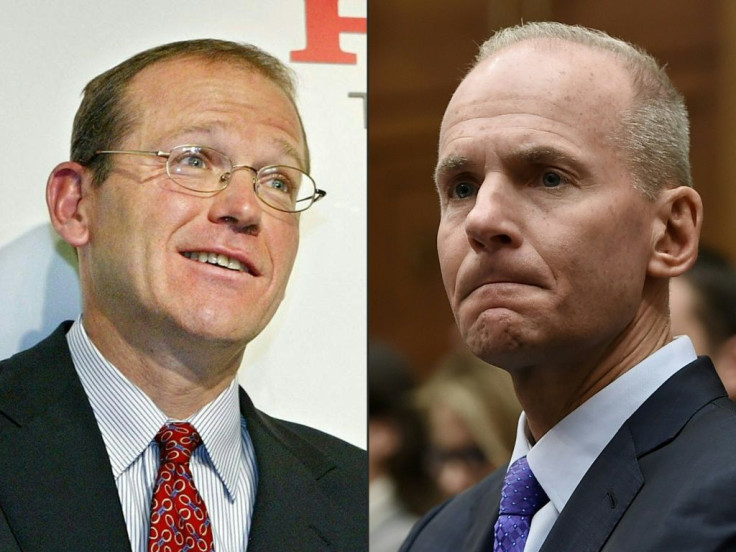

- Boeing fired CEO Dennis Muilenburg

U.S. stocks climbed higher on Monday in relatively light holiday trading after China said it will reduce import tariffs on a broad array of goods. Traders also cheered the decision by Boeing (BA) to fire its embattled CEO.

All three indexes finished at records for third straight session. The Dow Jones Industrial Average gained 96.61 points to 28,551.70 while the S&P 500 climbed 2.79 points to 3,224.01 and the Nasdaq Composite Index rose 20.69 points to 8,945.65.

Volume on the New York Stock Exchange totaled 2.29 billion shares with 1,570 issues advancing, 198 setting new highs, and 1,397 declining, with 12 setting new lows.

Active movers were led by Intra-Cellular Therapies Inc. (ITCI), Advanced Micro Devices Inc. (AMD) and Aurora Cannabis Inc. (ACB).

China’s Finance Ministry said Sunday that beginning Jan. 1, it will cut import tariffs on 859 products, including frozen pork, avocados, some wood and paper items and some kinds of semiconductors, to boost its economy by easing trade barriers.

China will also enact negotiated tariff rates with 23 countries starting next year.

Boeing (BA) fired CEO Dennis Muilenburg largely over his failure to handle the crisis surrounding its 737 Max jet aircraft. The 737 Max had been grounded since March following two deadly crashes. Boeing shares climbed 2.91% in Monday trading.

CNBC’s Jim Cramer opined Muilenburg had to be axed so Boeing’s 737 MAX jet would receive regulatory approval from the Federal Aviation Administration.

“It was impossible to get clearance with all these different entities as long as [Muilenburg] was there because he presided over what happened,” Cramer said.” “Someone had to pay the price, and it has to be him.”

In economic news, sales of new U.S. homes climbed 1.3% to a 719,000 annualized rate in November. For the three months through November, new home purchases averaged 720,000 per month, the best three-month performance since 2007.

Orders for durable goods in the U.S. dropped 2% in November -- the biggest such decline since May. Economists had expected a 1% increase in durable orders in November.

The Chicago Fed National Activity Index for November surged from negative-0.71 to 0.56, beating forecasts.

“Stocks are grinding relentlessly higher into year-end on continued momentum from the positive resolution of four key events: A phase one trade deal, a dovish Fed, economic data that isn’t getting worse and Brexit resolution,” Tom Essaye, founder of Sevens Report, said Monday.

“It’s a combination of low volume but also the fact that you’ve seen some progress with China and it’s really causing the bulls to jump in here,” Dunkin Allison, director of portfolio management at Delegate Advisors, said. “There’s not a lot of losses out there so most people, in context to last year, we don’t see a lot of selling pressure today.”

Overnight in Asia, markets finished mixed. The Hang Seng gained 0.13% while Japan’s Nikkei-225 edged up 0.02% and China’s Shanghai Composite dropped 1.4%.

European markets finished mixed with the FTSE 100 up 0.54% while Germany's DAX fell 0.13% and France's CAC 40 edged up 0.13%.

Crude oil futures rose 0.45% at $60.71 per barrel and Brent crude gained 0.32% at $65.63. Gold futures gained 0.57%.

The euro gained 0.14% at $1.1093 while the pound sterling slipped 0.48% at $1.2938.

The yield on the 10-year Treasury rose 0.94% to 1.935% while yield on the 30-year Treasury gained 0.72% to 2.363%.

© Copyright IBTimes 2024. All rights reserved.