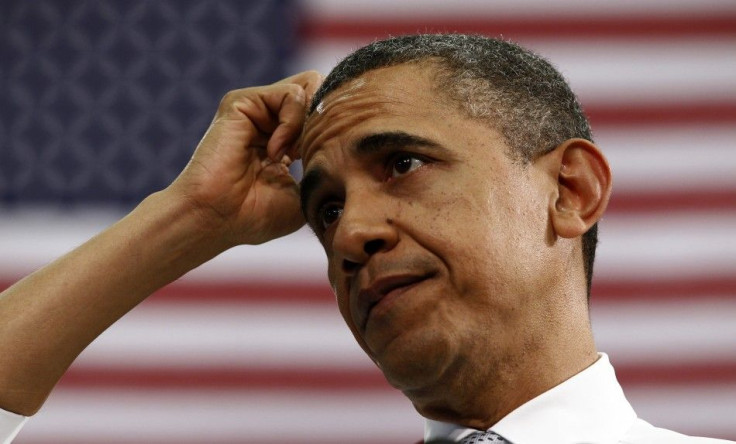

More Proof of Obama's Disdain for the Rich

Opinion

Concerning the rhetoric coming from the White House recently, much of the punditry has found itself shocked and alarmed. I, on the other hand, have been asking why we are shocked at the class warfare, opportunism, and socialist language coming from the president and his puppets. It's a mere byproduct of the president's worldview, after all. That said, a review of this week's White House commentary leaves even me flabbergasted at the administration's overt attempt at pitting the rich against the poor.

Last week, President Barack Obama chose to travel the country, advocating the Buffett rule, -- a rule that would guarantee the wealthy pay 30 percent in income taxes. Having made 20-plus speeches on the Buffett rule, it appears to be one, if not the central issue, of his re-election effort. Too bad the Senate didn't vote in its favor Monday, instead going against it with a tally of 51-45.

At its core, the Buffett rule is nothing more than an outright attempt at inflaming the masses and, in doing so, circumventing what should be the main topic of the 2012 election: job creation.

One of the ways the White House is trying to sell the plan is by saying it will raise much-needed revenue and help to satisfy our debt. But what you'll never hear is that annual revenue raised from the Buffett rule would not even cover one day of government borrowing.

The president's outright disdain, derision, and disgust for the rich -- except for himself and his affluent campaign donors, of course -- has never been clearer.

Perhaps the strongest evidence for this is the new Buffett rule calculator his campaign released last week. It asks you to put in your income and marital status. For someone entering $30,000 and single, a bar graph will come up that reads: A typical household like yours pays 18.6 percent.

After waiting a moment, a second bar appears accompanied by the following text: Mitt Romney's Tax Rate 13.9 percent. Mitt Romney would protect a tax code that allows millionaires like himself to take advantage of loopholes and tax havens.

Below that, the calculator asks: Think that's fair? I countered with my own question: How is this nothing more than an evident attempt at invoking class warfare? It didn't answer back.

Then you have the continual verbiage of rich vs. poor. Responding to the news that Obama and his wife paid a tax rate of 20.5 percent on $789,674 of income, a rate lower than his secretary, White House spokesman Jay Carney said: That is the point of the Buffett rule. The tax code should not be written in a way that allows the wealthiest Americans to pay taxes at a lower rate than middle-class Americans.

And we must not forget the particularly insightful White House gaffe last week when Hilary Rosen, a communications strategist with close ties to the Obama campaign, took a shot at Ann Romney, saying she has never really worked a day in her life. Before giving a half-hearted apology, Rosen doubled down on her statement in an interview with CNN when she commented: This is about the waitress in a diner somewhere in Nevada who has two kids, and whose daycare funding is being cut off because of the Romney-Ryan budget and she doesn't know what to do...

Forget the fact that the Ryan budget has not even become law, making a waitress' lack of daycare funding an impossible side effect; this is yet another effort by an Obama-related figure to engender animosity toward the rich.

If the Democrats insist on playing the class warfare card, they should look to some of their own party members. We tend to forget the recent past... and a certain presidential candidate from 2004. At the time, John Kerry and his wife, Teresa Heinz Kerry, had a net worth of $750 million, according to a Forbes 400 survey estimate. That's almost three times the estimated $200 million net worth of Romney. Kerry's tax rate was 13.1 percent the year before the 2004 presidential election, a full .8 percent lower than Romney's, who paid a rate of 13.9 percent in 2010.

But all of this is beside the point. Those who have pursued the American dream, worked relentlessly, and put in the long hours should not have to justify the derivative of their toil -- wealth. As a country that now has the highest corporate tax in the world and already confiscates around one fifth of an individual's wealth (and that's low-balling it), the wealthy should not have to pay even more. And the individuals in the top brackets who are the backbone and sustainers of our government sure as anything should not have to be the hated target of this administration.

Kayleigh McEnany is a writer and political activist who graduated from the Georgetown University School of Foreign Service and studied at Oxford University. She is the founder of www.RealReaganConservative.com. She writes every Tuesday for the International Business Times.

© Copyright IBTimes 2024. All rights reserved.