NBC Is Ditching Nielsen Ratings For Some Advertisers, But Who’s Buying?

For about as long as there’s been TV, there’s been TV advertising and TV ratings from Nielsen. And for about as long as there have been Nielsen ratings, people have been complaining about their accuracy. Yet the ratings have always been the backbone of the $70 billion-a-year TV ad industry, the standard upon which networks and advertisers have agreed.

Of late, though, more and more networks have been attempting to unshackle themselves from having to use traditional Nielsen ratings in their dealmaking. The networks’ argument is that the Nielsen standard everyone has agreed on no longer provides a complete picture of how people watch TV — viewers can now go to tablets, smartphones and apps to get the same content on different screens.

Consequently, live Nielsen ratings have been plunging ever lower, and networks have been pushing advertisers to pay for eyeballs delivered through seven days. Now, the networks say, people are still watching ads beyond that seven-day limit, and those people should be counted toward ratings guarantees.

Turner has been making some deals that don’t involve Nielsen guarantees since 2015; 21st Century Fox, parent company of Fox and cable networks like FX and NatGeo, has pledged to do the same starting this year. Viacom, which struggled with massive ratings losses that only recently have begun to abate, has become something resembling a media agency itself.

NBC Universal announced Thursday that it, too, is ditching Nielsen ratings guarantees for its advertisers. Well, for certain advertisers. Well, it plans to, anyway.

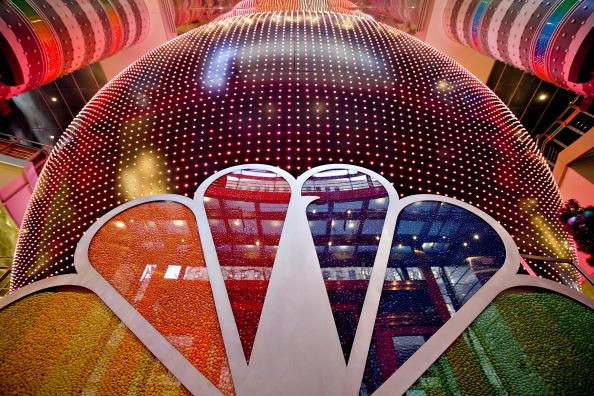

The Comcast-owned TV giant intends to start selling ad inventory to “select advertisers” based on viewership data that come from Comcast set-top boxes and consumer data from other sources like NBCU-owned Fandango, rather than the traditional ratings from Nielsen.

The timing of all these announcements isn't a coincidence. The networks are looking to make a splash before mid-May, when NBC Universal, Turner, Fox and the other big broadcasters reveal what shows the American public will be watching in the fall. In what’s been an annual tradition for more than 50 years, they unveil their new schedules at elaborate, expensive presentations to masses of advertisers, hoping to impress. Depending on the year, up to 80 percent of the ad inventory for the next TV season gets sold in deals done in the two months after these “upfront” presentations.

Advertising still provides a huge chunk of networks’ revenue — anywhere from 40 to 60 percent, depending on the network — so getting ad buyers on board with paying for viewing done outside seven days or on screens that aren't TVs is crucial.

For those “select” advertisers, then, NBCU will use their own data blend to guarantee a particular number of viewers that are, say, frequent patrons of the cinema who also buy laundry detergent. If NBCU fails to serve up that number of moviegoers, they have to give the advertisers more ad time to make good on those guarantees.

That sounds like a no-brainer to those outside the industry — instead of promising big, seemingly useless demographics like 18-49, why not guarantee the kind of person who’s more likely to watch the ad and be affected by it?

The truth is, most ad agencies that buy TV time already do this kind of research themselves, and the buyers aren’t necessarily buying this spiel. It’ll be a while yet before the bulk of advertisers agree to these kinds of deals.

“Nielsen is the currency. That’s it,” Ed Gaffney, GroupM’s director of tactical planning research, said at an industry conference the day before NBCU announced its new intentions. GroupM is the largest media agency out there, controlling billions of dollars’ worth of TV money.

“We work with every last bit of data we have, but we come back to the currency, because that’s the only thing we can consistently agree on,” Gaffney said on a panel with researchers from networks NBC and ABC. “How I calculate something is going to be different from how you calculate something.”

And the more specific a target audience, the higher the rate a network can charge an advertiser for spots. Therein lies the rub, according several media buying sources. The agencies are already doing the targeting, so why fork over more money for guarantees that aren’t based on the industry standard?

That’s not to say everyone on the buy side of the table is opposed to this gradual shift away from those big, clunky demographics. Some agencies are willing to play ball, for various reasons: It looks cool to certain brands, that kind of targeting really does lift sales, etc.

“The whole thing is a futures market anyway,” said Jane Clarke, CEO and managing director of the Coalition for Innovative Media Measurement, an industry group that’s looking for a new way to measure how people are watching TV and the ads that help support it. “You’re always just trying to predict what’s going to hit.”

For some on both sides of the negotiating table, moving away from those big-box demos is a step in the right direction. For others, it’s just that — a step.

“We’re playing poker with seven cards, and you have five, and we enjoy that advantage,” Gaffney said. “We’re not going to stop that.”

© Copyright IBTimes 2024. All rights reserved.