Netflix Could Add More Subscribers Than Disney+ Or HBO Max Over The Next 5 Years

Many investors are worried big global launches of streaming services from Disney (NYSE:DIS) and AT&T's (NYSE:T) WarnerMedia will cut into Netflix's (NASDAQ:NFLX) user growth going forward. But there's at least one analyst who thinks the streaming leader is still extremely under-penetrated in certain markets and could nearly double its subscriber count by 2025.

Stifel analyst Scott Devitt expects Netflix to top 300 million subscribers by mid-decade, adding around 150 million to its current subscriber count of 166 million. Subscriber additions will be driven by improved penetration in each of Netflix's reporting segments, but particular strength will be showcased in the Europe, Middle East, and Africa (EMEA) and Asia-Pacific regions.

For comparison, Disney's outlook for Disney+ is to reach 90 million subscribers by 2024, although early success suggests the company may have underestimated the streaming service's appeal. AT&T said HBO Max could reach 75 million to 90 million subscribers by 2024, but includes the 34 million existing HBO subscribers in the U.S. in that count.

Despite already being the most popular subscription video streaming service in the world, Netflix's subscriber growth could outpace even its most promising competitors. Here's how.

Doubling penetration in growing addressable markets

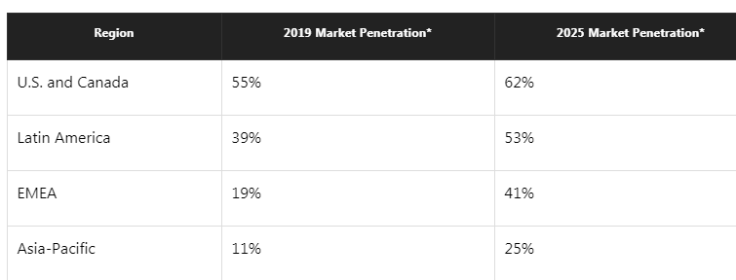

Devitt published his estimates for Netflix's penetration rate in each of its reporting regions:

The key to Netflix's growth over the next five years is improving its penetration in markets where it's severely under-penetrated now. On top of that, the addressable market in those regions ought to grow considerably as access to high-speed internet improves. Devitt estimates Latin America, EMEA, and Asia-Pacific will together represent a target market of more than 600 million households by 2025.

In order to improve its market penetration, Netflix is investing heavily in non-English language content. Devitt estimates Netflix has released 340 non-English original titles in EMEA languages, 195 in Asia-Pacific languages, and 191 in Latin American languages since 2017. Netflix is notably making a concentrated effort to attract Indian consumers, with plans to invest 30 billion rupees (about $420 million) in developing and licensing content for the Indian market over the next two years.

Neither Disney nor HBO have announced region-specific programming for their services despite their global ambitions. That said, Disney's content travels extraordinarily well outside of the United States, as its success with international theme parks and box offices can attest to. HBO has had international hits before, like Game of Thrones, but its success isn't nearly as consistent as Disney.

Focusing on region-specific content should help Netflix dramatically improve penetration in most markets to levels comparable with its Western English-speaking markets. Devitt still expects relatively low penetration in Asia-Pacific, though.

Netflix's pricing could play a big role in its subscriber growth

Netflix introduced a new mobile-only plan in India and Malaysia that's priced well below its standard plan. Indian consumers will pay just 199 rupees (about $2.81) per month for the mobile option compared to 649 rupees ($9.18) for its standard plan. In Malaysia, the plan is slightly more expensive, 17 ringgit ($4.18), but its standard plan is also more expensive in that country.

Netflix is also experimenting with offering subscribers discounts for long-term commitments. New subscribers in India saw discounts as high as 50% for signing up for three, six, or 12 months at a time.

Offering lower average prices in Asia-Pacific -- where the standard of living is lower -- will be key to Netflix's subscriber growth. Investors will be able to keep an eye on how the new pricing affects average revenue per subscriber in Netflix's new reporting segments.

It is, however, unlikely Netflix will raise prices in its more established markets like North America, Latin America, or Europe over the next year or two. The competition from Disney, AT&T, and others will put pressure on Netflix's pricing in the near term, especially considering Disney's aggressive $7 per month price point.

Netflix has consistently raised prices over the last five years, so a slowdown in price increases should produce positive results in subscriber additions. Bernstein analyst Todd Juenger believes the lack of a price increase in 2020 will lead to a lack of "price-related churn and gross demand suppression" compared to 2019.

While everyone is focusing on how Disney+, HBO Max, and the other big media companies entering into the streaming wars will scale their businesses, Netflix's untapped growth potential may have slipped under the radar.

This article originally appeared in the Motley Fool.

Adam Levy owns shares of Walt Disney. The Motley Fool owns shares of and recommends Netflix and Walt Disney and recommends the following options: long January 2021 $60 calls on Walt Disney and short April 2020 $135 calls on Walt Disney. The Motley Fool has a disclosure policy.