New Use Cases Drive Activity In Onchain Economy, Institutions Locked In: Blockchain Report

KEY POINTS

- There has been increasing activity around non-DeFi applications such as gaming and digital collectibles

- The 50% spike in RWAs' total value year-to-date indicates increasing institutional participation onchain

- Stablecoin activity continues to rise, with volumes passing $300 billion

- The onchain job market is very active, but there remains a shortage in crypto developers

Leading cryptocurrency research firm Delphi Digital has released its Onchain Economy Report this week, delving into the recent growth of the onchain economy and tackling the entry of institutions into the blockchain industry.

The report takes a deep dive into the various facets that helped drive onchain growth this year, including non-financial use cases such as collectibles, gaming, and social media convergence among others.

Non-Financial Use Cases are Evolving

Blockchain's financial potential has been proven over the years, but new onchain use cases beyond financial speculation are now evolving, as evidenced by increasing activity around non-DeFi applications.

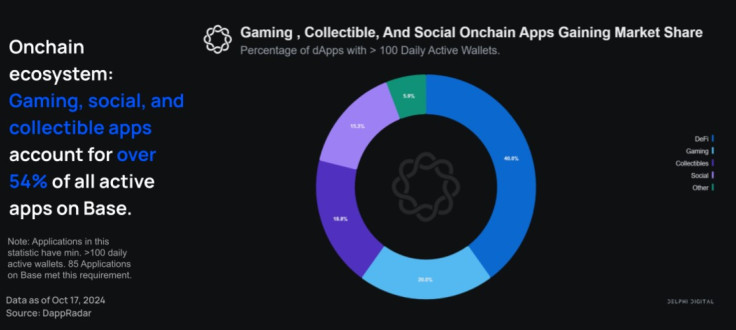

The report noted how 66% of all active onchain applications are non-DeFi, including digital collectibles (18.8%), social apps (15.3%), and gaming (20%). Ethereum layer 2 Base is playing a key role in the development as it provides unmatched developer experience that boosts the momentum among onchain builders.

DeFi apps are definitely leading the charge as a single category on Base, but gaming and collectibles have shown significant usage this year, accounting for more than 54% of all active apps on the blockchain layer.

The numbers suggest that more users are now embracing all types of onchain applications, and for Delphi Digital, it signals good health within the overall onchain system as diversity beyond monetary-centric applications continues to evolve.

RWA Value Highlights Increased Institutional Participation

Real-world assets (RWA) have taken the financial world by storm, and it underscores the apparent interest of institutions on the said onchain offerings.

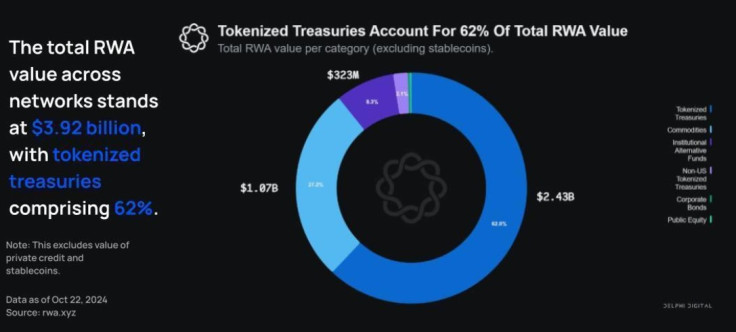

The total value of RWAs year-to-date has increased by 50%, from $8.3 billion to $13.25 billion, the report revealed. Across networks, the total RWA value is at $3.92 billion, and tokenized treasuries make up an impressive 62% of the said value.

There are various metrics to assess the growth of institutional adoption of onchain products and services, but as per Delphi Digital, the best metric at present is the total RWA growth.

"Tokenization, which can be thought of as moving traditional web2 assets natively onchain is the future for Institutions and is seeing tremendous attention across both world governments and the private sector," Delphi Digital researchers wrote.

Stablecoin Activity is Surging Significantly

Stablecoins, which are now nearing a staggering $200 billion market cap, continue to gain traction across the board.

The report revealed that weekly stablecoin transfer volumes stand at $302 billion, up a whopping 235% year-to-date. Again, Base is a major player in this growth as its stablecoin market cap reached $3.3 billion, marking a stellar 1,900% surge from $170 million in January.

"Notably, the percentage increase surpasses that of economic value over the same period, indicating that the Base ecosystem is not only growing but starting to mature," the report said.

Onchain Engineering Hiring is Booming

Delphi Digital also looked into the onchain job market, revealing that there has been an increase in hiring for engineers with smart contract expertise.

In the first two quarters of the year, there was a sharp increase in hiring for engineers who can fulfill onchain development roles, the report revealed, citing market sources. Notably, the sources observed how onchain jobs were more focused on building infrastructure, which has allowed for more developers to work on infrastructure-related issues.

Also, in Q1 and Q2 2024, there was an explosion in demand for crypto-native people tasked to run socials, aligning with the spike in protocols launching products or tokens.

The sources noted, though, that "companies within the crypto industry continue to place a strong emphasis on prestige." For instance, factors like attending an Ivy League schools were often major points of value in the hiring of candidates, even for crypto-native job hunters.

The Shortage in Crypto Developers is Apparent

Demand continues to outpace the available talent for the onchain economy, Delphi Digital revealed. Quite interestingly, the sources said many traditional developers are affecting the shortage in crypto developer talent due to their perception that the industry is "unstable."

As more industry giants like Coinbase continue to push for regulatory clarity, it is expected that progress should not only attract more talent into the industry but also contribute the onchain economy's overall growth.

© Copyright IBTimes 2024. All rights reserved.