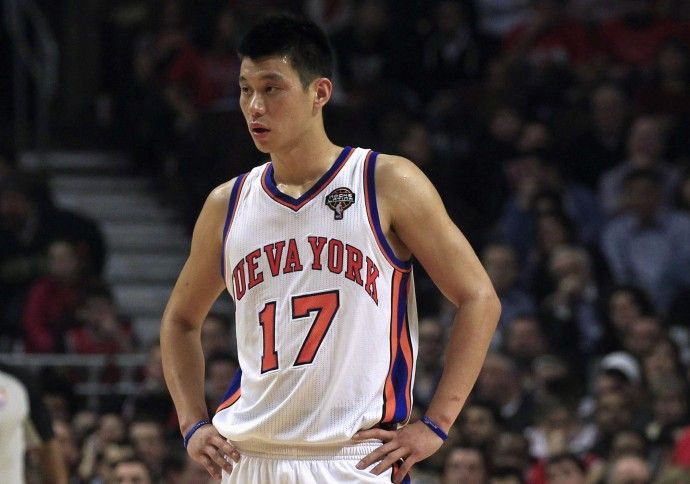

New York Knicks News: Does It Make Financial Sense to Re-Sign Lin?

ANALYSIS

The New York Knicks have decided that Jeremy Lin's three-year, $25 million contract offer from the Houston Rockets is too rich for them and will let the talented point guard walk, according to multiple reports.

The Knicks had indicated they'd be willing to match any offer for Lin, whose performance at Madison Square Garden caused Linsanity throughout the world, but ultimately appear willing to let Lin leave for nothing rather than pay massive luxury tax penalties to keep him.

Cleverly, the Rockets put together a back-loaded, poison pill contract offer for Lin that would force the Knicks to pay Lin $14.8 million for the 2014-15 season, the third and final year of his contract. The contract would make Lin one of the highest paid players on the Knicks and that didn't set well with the team's biggest star, Carmelo Anthony, who called the offer ridiculous.

Ridiculous or not, the biggest reason why the Knicks will let Lin walk is to avoid paying as much as $68 million in luxury tax fees. The NBA's new collective bargaining agreement is meant to severely punish teams that consistently go over the salary cap, which the Knicks would be forced to do if they matched the Rockets' offer.

Not wanting to endure that much in luxury tax payments for Lin is reasonable, but is it the smart decision for the Knicks' parent company, Madison Square Garden Company (Nasdaq: MSG)?

The answer is complicated, to say the least.

During the initial run of Linsanity, the Harvard graduate was described by Forbes as a one-man, global economic stimulus package. He created a buzz around the country that has rarely been seen, with fans willingly opening up their wallets to buy Lin memorabilia and Knicks tickets.

Increased merchandise sales, including Lin jerseys and t-shirts, benefit MSG less than you might think, though. The Knicks are forced to share jersey sales revenue with the 29 other teams in the NBA, unless the jerseys are sold in Madison Square Garden. David Joyce, an analyst at Miller Tabak & Co., told Bloomberg News that additional merchandise sales would be worth single digit millions to Madison Square Garden Co.

Secondary ticket-sellers such as StubHub saw increased traffic and escalating ticket prices, but neither of those had any short-term effect on the Knicks' bottom line. If the Knicks kept Lin long-term they could conceivably raise season ticket prices, but that move could upset the team's rabid fan base, which already pays lofty amounts for tickets.

Another area of potential for MSG with Lin is his ability to help it tap into Asian markets, as the Rockets did with center Yao Ming in the early 2000s. Lin, the first Taiwanese-American to play in the NBA, is incredibly popular in Asia, as multiple Asian TV partners added Knicks games during the season.

Ming was incredibly popular in his native China and doubtless contributed to the NBA landing multiple sponsorship deals in China, but his financial impact on the Rockets is a bit tougher to decipher. IEG, a company that specializes in sponsorships, estimated that the Rockets earned between $800,000 and $1.25 million a year from all China-related sponsorships.

That figure wouldn't make it worth it to keep him and that's not even factoring in that Ming, during his prime, was a significantly bigger cultural phenomenon than Lin.

The numbers don't suggest any major revenue stream for the Knicks keeping Lin, but yet shares of MSG continue to fluctuate with Lin news. After Lin guided the Knicks to five straight victories in February, MSG shares rose 9.2 percent. The company ultimately gained approximately $600 million in market cap since Lin's first start, according to Five Thirty Eight's Nate Silver, and were able to end a dispute with Time Warner due to Lin's popularity.

Since news of Lin's likely departure, MSG shares dropped 1.61 percent, or 59 cents, to $36.00 as of Monday's close. In midday trading Tuesday shares were down a further 28 cents to $35.72. The loss in market cap could have made up a good chunk of the luxury tax payments, but it's impossible to decipher whether it's pure coincidence that MSG dropped on Monday or whether it was directly tied to Lin's impending departure.

That's one of the biggest issues with arguments that the Knicks, and more importantly MSG, can easily pay for the luxury tax payments due to all of the money Lin generates for the organization. Lin brings in more interest and appeal than Raymond Felton, the team's presumed replacement for him, but his actual financial impact is largely conjecture and opinion.

Lin brings in revenue for the company, but his ability to generate as much as $68 million -- to cover the luxury tax payment -- is difficult to prove at best, doubtful at worst.

© Copyright IBTimes 2024. All rights reserved.