Newly Minted Meme Stock Darling AMTD Slides After Eye-popping Surge

Shares of AMTD Digital plunged 40% on Wednesday to snap an eye-popping rally fueled by retail investors this week that briefly took the Hong Kong-based fintech's market value past that of Facebook-owner Meta Platforms.

The company's market capitalization closed above $300 billion in a 128% jump on Tuesday, reminding investors of the meme stock mania last year that drove record rallies in shares of companies such as GameStop and AMC.

The stock has risen about 21,000% since its July IPO, when it listed at a price of $7.80. It was trading at $1014.98 on Wednesday.

"It sure looks a lot like a pump-and-dump," Nate Anderson, founder of Hindenburg Research, said, adding that it does not have a position in AMTD Digital. "It seems to have caught on among retail investors, which is often the fuel for these situations."

In a typical pump-and-dump scheme, investors create artificial demand to boost companies' stock prices and then sell their own shares at a profit causing prices to fall, saddling others investors with losses.

AMTD Digital was also the most-mentioned stock on Reddit.com, the social media platform central to the meme stock craze of 2021.

The company said on Tuesday there was no material change or event related to the company's business and operating activities since the IPO date and that it was monitoring the share volatility.

The fintech firm, which provides loans and services to startups in exchange for fees, has a low float and is tightly controlled by parent company AMTD Idea.

AMTD Idea's shares also slid 4% after closing Tuesday with a market value of $2.6 billion.

"(AMTD Digital) is clearly the newest meme stock with bands of retail traders purchasing the stock at the same time, pushing the price sharply higher," said Victoria Scholar, head of investment at Interactive Investor.

There has been a similar, but smaller, surge in some other recently listed U.S. companies, including Getty Images which jumped over 200% since its debut on July 25.

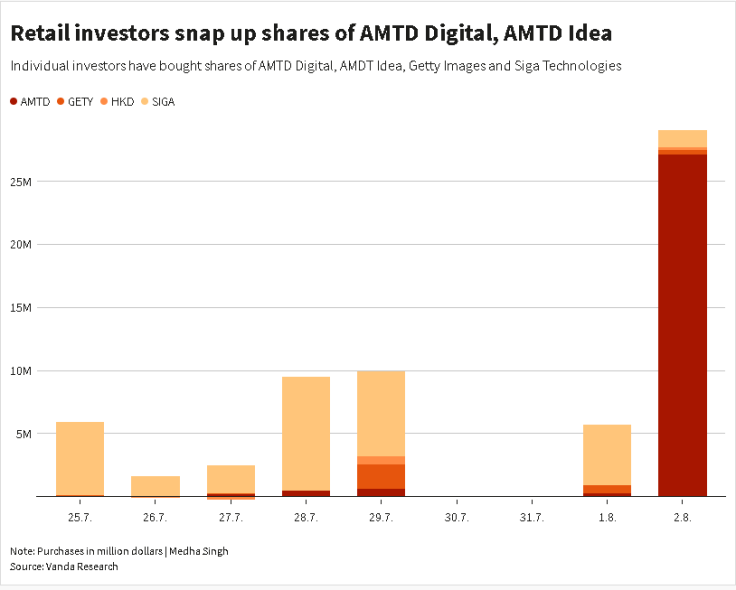

"Should this market rebound have more legs, we expect retail investors' appetite for speculative stocks to continue, as they seek the opportunity to further scratch back the losses they've accumulated through the year," said Lucas Mantle, a data science analyst at Vanda Research.

GRAPHIC: Retail investors snap up shares of AMTD and others (

)

© Copyright Thomson Reuters 2024. All rights reserved.