No Betamax On Your Wrist: Startup Strap Looks To End Wearables Platform Wars

Wearables like personal fitness trackers and smartwatches are undeniably surging in popularity. It’s not surprising, then, that Ohio-based startup Strap has raised $1.25 million to help change the way software developers will make these devices increasingly useful for the masses.

Like the Windows vs. Mac debate from the PC era, or the VHS-Betamax square-off before it, the wearable platform wars are truly a thing. The market is in the earlier stages of the boom-to-come and is already seeing fragmentation.

It's common for mobile app developers to stick to one platform as they create software for smartphones. They will commonly serve iOS devices first; a blockbuster hit in the iTunes App Store makes markedly more money than one inside of Google Play. A similar scenario will likely play out with wearables. But that means that apps downloaded for one device probably won’t work on another.

Strap aims to change the landscape in which smartwatch applications are created. Strap Kit, the company's hybrid framework for wearable applications, will see developers write once (in JavaScript) before deploying the completed application for many wrists, regardless of the device. An application created inside of Strap Kit will be compatible across wearable platforms, be they Android, Apple, Pebble, or even Google Glass.

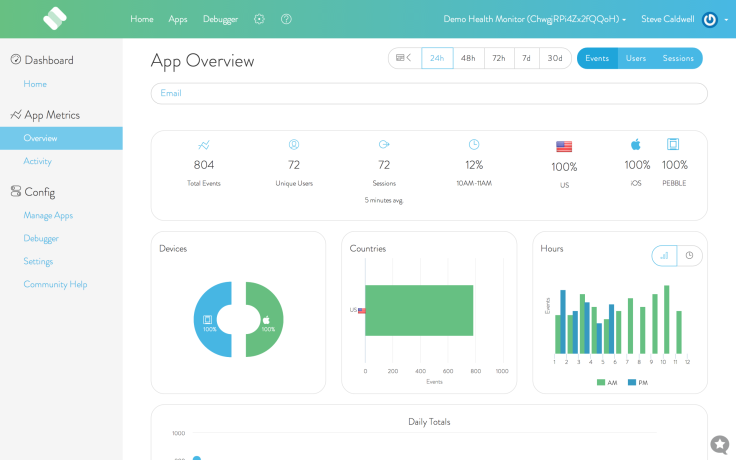

Strap also offers developers smart analytics to reveal how users interact with the app to make future improvements easier.

Wearable computing platforms can make all kinds of interesting things possible with software. Walgreens has already unveiled a program that connects to MapMyFitness. If a user's wearable fitness tracker should indicate he or she is reaching a fitness milestone, the drugstore chain will send that person rewards and offers. "It's about incorporating new types of data into existing business logic," said Strap CEO Steve Caldwell, in an interview. By enabling wearable applications on a wide variety of platforms, Strap can help companies avail themselves of data that people are already tracking for themselves.

Of course, that’s only if customers want to opt in. The wearable surge-to-come will likely see new and increased worries over privacy. Amazon already knows customers’ credit card numbers, but how will it sit with a user if her Apple Watch knows that she has a heart murmur? Many people “will like providing fitness data to a grocery retailer that's going to use that data to incentivize them with products they love. Others don’t want Walmart knowing how many steps they take in a day," said Caldwell. "Privacy is a chief concern. The simplest thing is that users have to be able to opt out."

There are other considerations, as well. Consumers’ sense of what is appropriate to wear will likely change as wearable technology more commonly inserts itself into our lives. Google Glass is presently considered a wildly indiscreet thing to adorn oneself with because wearing computers on one's body is hardly the norm, and it might be used to record surreptitiously. This is where smartwatches have a chance to shine — they present themselves not as flagrant displays of technology, but as a watch that can also do a bunch of cool stuff.

Caldwell sees the Apple Watch, Android Wear, and Pebble dominating the market in the months ahead and also has eyes on the Samsung Tizen, “which remains to be seen if it'll take off." Consumers will primarily weigh battery life and price as they decide what to buy, Caldwell said. "Price point will keep Pebble around for a while, and its seven-day battery life will appeal to a lot of people. Apple makes a more premium product, and Android Wear is somewhere in the middle, offering high-end devices by Samsung and LG."

Strap pegs the wearables market at $9 billion currently, and expects that to triple next year.

© Copyright IBTimes 2024. All rights reserved.