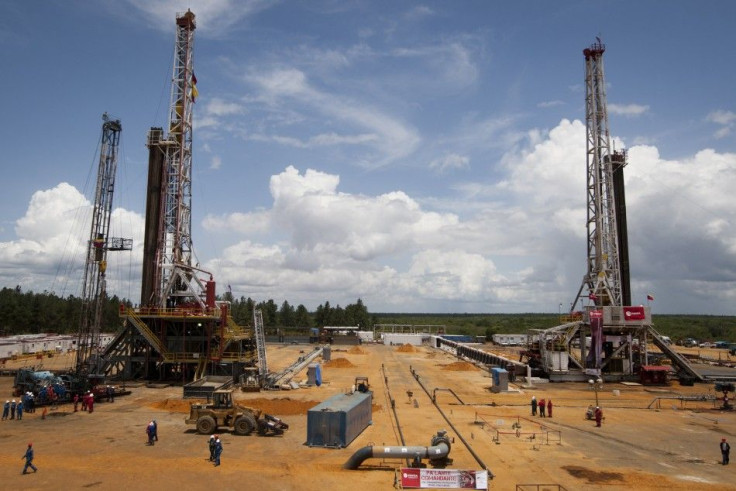

North Dakota: Site Of A Natural Gas And Oil Fracking Boom

(Reuters) - Collapsing natural gas prices have yielded an unexpected boon for North Dakota's shale oil bonanza, easing a shortage of fracking crews that had tempered the biggest U.S. oil boom in a generation.

Energy companies in the Bakken shale patch have boosted activity recently thanks to an exceptionally mild winter and an influx of oil workers trained in the specialized tasks required to prepare wells for production, principally the controversial technique of hydraulic fracturing.

State data released this month showed energy companies in January fracked more wells than they drilled for the first time in five months, suggesting oil output could grow even faster than last year's 35 percent surge as a year-long shortage of workers and equipment finally begins to subside.

As output accelerates, North Dakota should overtake Alaska as the second-largest U.S. producer within months, extending an unexpected oil rush that has already upended the global crude market, clipped U.S. oil imports, and made the state's economy the fastest-growing in the union.

Six new crews trained in well completion -- fracking and other work that follows drilling -- have moved into North Dakota in the past two months alone, according to the state regulator and industry sources. Back in December, the state was 10 crews short of the number needed to keep up with newly drilled wells.

Three to four months ago, the operators were begging for fracking crews, said Monte Besler, who consults companies on fracking jobs in North Dakota's Bakken shale prospect. Now companies are calling, asking if we have a well to frack.

For the last three years, smaller oil companies with thin pockets were forced to wait for two to three months before they could book fracking crews and get oil out of their wells. As more and more wells were drilled, that backlog has grown.

Last year, an average 12 percent of all oil wells were idled in North Dakota. Even so, output in January hit 546,000 barrels per day, doubling in the last two years and pushing the state ahead of California as the country's third-largest producer.

FEWER WELLS IDLE

Fracking, which unlocks trapped oil by injecting tight shale seams with a slurry of water, sand and chemicals, has drawn fierce protests in some parts of the country, but it has not generated heated opposition in North Dakota.

The number of idle wells waiting to be completed in the state reached a record 908 last June, the result of a new drilling rush and heavy spring floods. Only 733 wells were idle in August as crews caught up, but the figure crept steadily higher until the start of this year.

Now, the industry may be turning a corner in North Dakota, the fastest-growing oil frontier in the world.

Both rig count and hydraulic fracturing crews are limiting factors. Should they continue to rise together, production will not only increase, it will accelerate, said Lynn Helms, director of the state Industrial Commission's Oil and Gas Division.

The tame winter likely played an important role in helping reduce the number of idle wells -- those that have been drilled but not yet fracked and prepped for production. That number fell by 11 in January, as oil operations that would normally be slowed by blizzards were able to carry on, experts said.

Residents of the northern Midwest state -- accustomed to temperatures as low as minus 40 degrees Fahrenheit (-40 Celsius) in winter and snow piles as high as 107 inches -- this year enjoyed the fourth warmest since 1894, according to the National Weather Service.

The milder conditions also helped prevent the usual exodus of warm-weather workers that occurs when blizzards set in.

Not everyone wants to work in North Dakota in the winter, Besler said.

The backlog of unfinished wells has also begun to subside because the pace with which new wells are drilled has leveled off. The state hasn't added new rigs since November.

The latest state data shows oil companies brought 37 new rigs to North Dakota's in 2011 but have not added more since November. The rig count held steady at 200 in January 2012, although more than 200 new wells were drilled in that period.

SLUMPING NATGAS PRICE PROVIDES RELIEF

North Dakota has gotten a boost from the fall-off in natural gas drilling due to the collapse in prices to 10-year lows. Energy companies such as Chesapeake and Encana have shut existing natural gas wells and cut back on new ones. Last week, the number of rigs drilling for gas in the United States sank to the lowest level in 10 years as major producers slimmed down their gas business, according to data from Houston-based oil services firm Baker Hughes. [ID:nL2E8EG9OY] The fewer gas wells drilled, the less need for skilled fracking crews in the country's shale gas outposts.

Fracking in oil patches is similar to the process used in gas wells, except for the inherent power of the pumps employed. Crews inject high-pressure water, sand and chemicals to free hydrocarbons trapped in shale rock. So big service firms such as Halliburton, Baker Hughes and Schlumberger are reshuffling crews from shale gas fields to oil prospects in the badlands. We have moved or are moving about eight crews. Some of those crews are moving as we speak, Mark McCollum, Halliburton's chief financial officer, said at an industry summit in February.

Halliburton declined to specify where the crews were moving.

Calgary-based Calfrac moved one crew into the Bakken in late 2011, according to an SEC filing. Privately owned FTS International no longer works in the gas-rich Barnett shale but has set up operations in the Utica, an emerging prospect in Ohio and western Pennsylvania, according to a company representative.

The reallocations come with some efficiency losses. Halliburton had to scale back its 24-hour operations and is still trying to solve logistical problems. You actually take the crew from one basin and they have to go stay in motels, you have to pay them per diems for a while. And then you have to double up your personnel while you're training new, locally based crew on the equipment once it is moved, McCollum said.

At the same time, a shortage of key equipment such as pressure pumps is easing as companies start taking delivery of material ordered months or even years ago.

It takes about 15 such pumps to frack a gas well, and many more for oil wells. The total pressure-pumping capacity in the United States at the end of 2012 will be 19 million horsepower, two-and-a-half times more than in 2009, according to Dan Pickering, analyst with Tudor Holt and Pickering in Houston.

FRACKING AROUND THE NATION

Easing personnel constraints suggest recruiters may be meeting with success in nationwide campaigns to attract workers with specialized knowledge of complex pumps and hazmat trucks -- and a willingness to brave harsh conditions.

Even with U.S. unemployment at 8.3 percent, such skilled labor remains in short supply despite salaries from $70,000 to $120,000 a year. In North Dakota, unemployment was just 3.2 percent in January, the lowest rate in the nation.

Fracking crews, much like roughnecks on drilling rigs, clock in 12-hour shifts for two straight weeks before getting a day off. They live in camps far from cities and towns. Jobs are transient -- a few weeks at a single location. Most workers divide their time between the California desert, Texas ranchlands and the freezing badlands of the Midwest state.

Companies have scrambled to nab talent, with recruiters scouring far and wide. Military bases have gotten frequent visits, and some companies have hired truckers from Europe.

There's definitely a push to look all over for people who have good experience since it takes at least six months to train someone how to use a fracking pump, said David Vaucher, analyst with IHS Cambridge Energy Research.

© Copyright Thomson Reuters 2024. All rights reserved.