NVIDIA's Gaming Business Got Sideswiped

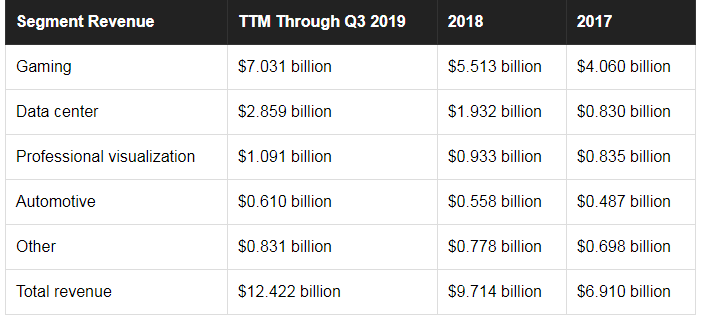

Shares of NVIDIA (NASDAQ:NVDA) were hammered following what was overall a solid earnings report, with revenue and non- GAAP earnings per share up 21 percent and 38 percent year over year, respectively. Although strong top-line growth reflected robust demand for the company's graphics processing units (GPUs), revenue of $3.18 billion for the quarter was less than what Wall Street analysts were expecting.

This article originally appeared in The Motley Fool.

The problem was that management underestimated how long it would take prices for Pascal graphics cards to decline after the collapse of the cryptocurrency market. This likely kept some gamers from being able to buy new midrange Pascal cards like the GTX 1060 -- because prices were too high. CFO Collette Kress said, "Although the cryptocurrency wave has ended, the channel has taken longer than expected to normalize."

To correct the supply issue, NVIDIA has halted shipments of midrange Pascal cards to allow excess inventory to sell through, which may take as long as two quarters. However, Kress said, "while channel inventory situation presents a near-term headwind, it does not change our long-term fundamentals."

This appears to be a short-term issue that is causing a hiccup in the company's near-term growth, but it shouldn't worry long-term investors.

Gaming market remains healthy

NVIDIA posted 13 percent year-over-year growth in its gaming segment. That was well below the growth rates investors have gotten used to lately following back-to-back quarters of more than 50 percent growth in each of the last two quarters. Some of that growth reflected strong demand from cryptocurrency miners, but even before crypto demand cranked up about a year ago, NVIDIA had been enjoying a strong upgrade cycle since launching its Pascal-based GPUs in 2016.

Looking beneath the headline numbers, it's clear that NVIDIA's gaming segment growth is far from over. The company just launched its new Turing-based GPUs at the end of the third quarter, which promise to make games look more photo-realistic with a graphics rendering technique called "ray tracing." The company claims these new cards are two times faster than Pascal, and six times faster when ray-traced graphics are enabled.

The RTX 2080 has a steep price tag that starts at $800, while the RTX 2080 Ti Founders Edition sells for $1,200 and is currently sold out on NVIDIA's online store. Despite those high price tags, CEO Jensen Huang said, "The demand on the high-end products are fantastic."

Also, sales of gaming notebooks in China -- the largest gaming market in the world -- soared 50 percent year over year. NVIDIA has had a lot of success with its Max-Q gaming notebooks. Sales of these notebooks are probably the best pure indicator for how much gaming demand is out there since gaming notebooks are not bought for mining cryptocurrency, but to play games.

Despite the supply problem, management feels optimistic heading into the holidays. NVIDIA is solidly positioned in the midrange tier of Pascal GPUs, which is currently the most popular and affordable way for most gamers to upgrade without breaking the bank. Huang said the "[GeForce GTX 1060] is the number one selling graphics card in the world."

In addition, NVIDIA is currently in control at the high-end range with the RTX 2080 and the more affordable RTX 2070. The new line of RTX graphics cards are currently the only GPUs on the market that can run the latest games at smooth frame rates on a 4K resolution display. Adoption of these displays could pick up since they are getting cheaper, and consumers seem to feel good about spending money at the moment. That would certainly boost demand for RTX graphics cards.

Electronic Arts just released Battlefield V, one of the industry's most popular shooter games, which allows an RTX card to take full advantage of ray tracing. Huang mentioned there is a pipeline of about 30 other games that will feature ray-traced graphics. "I'm expecting it to be just a fantastic new generation," Huang said.

What to expect

Management guided for total revenue to be down about 7 percent year over year in the fourth quarter. That's because the Pascal midrange cards make up about one-third of the gaming segment's revenue, and NVIDIA has halted shipments of these cards until current channel inventory is cleared out.

Since NVIDIA has stopped shipping its midrange cards, there won't be any sales from those products for the company to report next quarter. So, investors should watch the sales of high-end RTX cards and gaming notebooks, as those will provide clues as to the underlying demand for gaming cards.

The strong trends in favor of these dynamics should continue, as Huang mentioned that "there's nothing about the gaming marketplace or the gaming business that we see that is fundamentally different." Therefore, investors should expect NVIDIA to resume growth once excess supply has been cleared out in the next few quarters.

Meanwhile, the baton will have to be taken up by the data-center segment, which posted 58 percent growth year over year in the third quarter. This performance was fueled by the recently launched Turing T4 Cloud GPU. Kress said the T4 "has received the fastest adoption of any server GPU," which bodes well for continued growth in the company's second-largest segment.

John Ballard owns shares of Nvidia. The Motley Fool owns shares of and recommends Nvidia. The Motley Fool recommends Electronic Arts. The Motley Fool has a disclosure policy.