Nvidia's outlook beats Street, shares soar

Nvidia Corp forecast a larger-than-expected jump in quarterly revenue and its CEO said the chipmaker's mobile business was accelerating, sending its shares skyrocketing.

Nvidia, once known for graphics cards but which has stepped up a foray into mobile devices such as tablets, said its phone business ramped up toward the second half of the just-ended second quarter and that more devices carrying its Tegra chips are going into production.

Nvidia, whose name is well-known to a community of gamers, graphic designers and other high-end users, this year made a splash at the Consumer Electronics Show in Las Vegas, where it unveiled a series of "design wins" -- electronics manufacturers agreeing to use its mobile chips in phones and tablets.

On Wednesday, Nvidia said Samsung Electronics is using the Tegra in the new Galaxy R smartphone, the first time Asia's biggest electronics firm has used that chip in one of its phones.

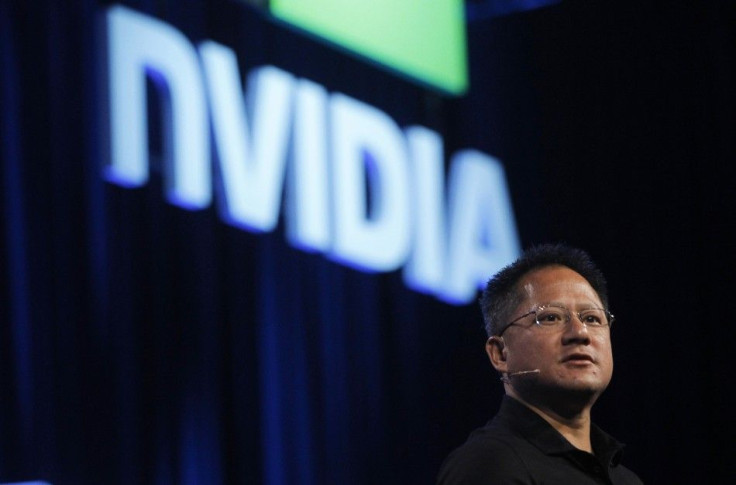

"In terms of if the (mobile) business is on track, the business is doing better than 'on track' in the sense that our design win momentum is better than ever," Chief Executive Jen-Hsun Huang told analysts on a conference call.

But while other business segments will grow, revenue from Tegra will hold steady this quarter from the last, added Huang, a Taiwanese native who co-founded Nvidia in the 1990s and is known in Silicon Valley for his love of Ferraris and other fast cars.

That may have dulled Nvidia's after-hours share rally, Evercore Partners analyst Patrick Wang said.

Shares of Nvidia jumped 19 percent in extended trade after it said revenue will rise between 4 and 6 percent in the third quarter from the second. The gains were pared to 12 percent by the end of Nvidia's conference call with analysts.

"They're doing something right because they're growing the number of (product lines) they're selling into -- but unfortunately that has not yet translated into revenues," Wang said.

The quarterly guidance implies revenue of $1.06 billion to $1.08 billion, compared with analysts' average forecast of $1.05 billion.

Its outlook on Thursday comes despite mounting economic uncertainty and concerns that spending on consumer electronics during the upcoming holiday shopping season may fall short of expectations.

CHIPPING AWAY AT THE IPAD

Anxious to move beyond personal computers, which are suffering from lackluster sales, Nvidia has jumped into mobile devices this year, with its chips appearing in tablets and phones made by Samsung, Motorola Mobility and LG Electronics.

But while several tablets have been launched, none have become a real challenge to Apple Inc's iPad and sales have been lower than expected.

Following a rally in January, shares of Nvidia had fallen 43 percent due to growing worries about the PC market and sales of mobile gadgets using Nvidia's chips.

New processors launched by Intel Corp this year have led PC manufacturers to build an increased number of high-end laptops using discrete graphics chips provided by Nvidia.

But a trend toward including graphics horsepower on central processors is seen eroding demand for low-end graphics chips that Nvidia also sells.

A few weeks ago, Intel trimmed its forecast for 2011 personal computer unit sales, warning of softness in mature markets but pointing to healthy expansion in China.

Nvidia's revenue of $1.02 billion in the quarter ending July 31 was slightly above the $1.01 billion average estimate of analysts polled by Thomson Reuters I/B/E/S.

The company reported non-GAAP earnings of $193.5 million, or 32 cents a share, up from $47.6 million, or 8 cents a share, in the year-ago period.

Nvidia's shares rose to $15.10 in extended trading, from $13.41 at the Nasdaq close.

© Copyright Thomson Reuters 2024. All rights reserved.