Obama’s Latest Executive Order Designed To Break Up Monopolies And Boost Market Competition, Starting With Cable Boxes

The Obama administration will direct federal agencies to root out anticompetitive behavior in the economy and shake up concentrated industries, the president announced Friday. The executive order gives agencies 60 days to lay out a game plan for tackling the barriers to competition in the sectors of the economy they oversee.

The announcement comes amid a flurry of rule-making and executive orders favored by the White House, such as new investor protection guidelines for financial advisers issued by the Department of Labor, which aim to reduce fees on retirement savings.

These sorts of rules, Obama said in an interview with Yahoo Finance, “seem small-bore initially because they don't get a lot of attention, but they can add up to billions of dollars out of the pockets of consumers.” Indeed, the newly unveiled effort to boost market competition may be among the most far-reaching of Obama’s last acts as president, with the potential to touch every corner of the U.S. economy.

The president said his administration is starting with cable company set-top boxes, whose prices have soared 185 percent in recent years. But that's just the beginning. Here’s why the White House’s new initiative to spur more competition in the economy matters.

Why Now?

Over the past few decades, U.S. industries have undergone a long wave of consolidation. Data show that nearly every segment of the market, from retail trade to banking, has grown more concentrated since the 1990s.

The outcome for consumers: fewer choices and higher prices. That’s according to a report released Friday by the White House’s Council of Economic Advisors, surveying the landscape of the American business world. “Competition is good for consumers,” Obama said.

In many corners of the economy, however, competition is relegated to just a handful of firms. A Justice Department-approved merger last year between Expedia and Orbitz, for instance, put 95 percent of the online-travel-bookings market in the hands of one company, according to the American Hotel & Lodging Association.

And eight years after a financial crisis blamed partly on the oversight of the credit ratings industry, just three providers of credit ratings — Fitch, Moody’s and Standard and Poor’s — dominate 97 percent of that market.

Though it varies case by case, such extreme concentration can harm ordinary consumers. “When there is little or no competition, consumers are made worse off if a firm uses its market power to raise prices, lower quality for consumers or block entry by entrepreneurs,” the report said.

What Can the Government Do?

Antitrust regulation goes back more than a century. The Sherman Antitrust Act of 1890 declared illegal “every contract, combination in the form of trust or otherwise, or conspiracy, in restraint of trade or commerce,” and it is still in use today, alongside numerous other laws and regulations.

Oversight of mergers and combinations that might limit competition is split primarily between the Federal Trade Commission and the Antitrust Division of the Justice Department. In recent years, these regulators have nixed numerous tie-ups, from the proposed T-Mobile-AT&T merger to Comcast's ill-fated attempt to acquire Time Warner.

But the fevered pace of corporate deal-making in recent years has put antitrust regulators on their heels. In March, officials from the Justice Department and FTC sounded off before a Senate committee hearing on antitrust measures, bemoaning the burdens placed on their agencies.

“There was mention of a merger wave. We kind of look at it as a tsunami,” Bill Baer, head of the Antitrust Division, told senators at the hearing. Edith Ramirez, chairwoman of the FTC, added: “We are incredibly busy. We are asking for more resources.”

Obama’s regulators have squashed more than $370 billion in proposed mergers, but advocates have raised questions around the administration’s overall approach. Last month the American Antitrust Institute published an analysis of recent antitrust actions showing that while highly concentrated industries have seen a crackdown, “merger control in moderately concentrated sectors appears to have virtually ceased.”

Obama’s new effort is a promise to spread the task of improving competition across a greater swath of the government.

What Does it Mean for Business?

Obama pitched the new rules not only as a boon for consumers but also for entrepreneurs. “Ultimately it's good for business,” Obama said. “That's the way the free market works. The more competition we have, the more products, services, innovation takes place.”

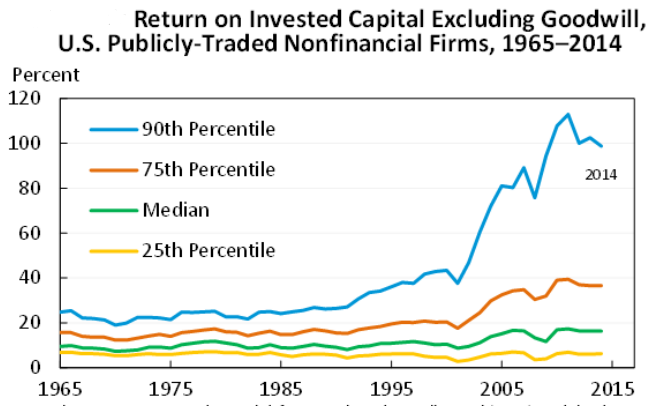

The rate of entrepreneurship in the U.S. has lagged in recent years as the largest corporations have captured a growing slice of market revenue in most industries. As the CEA report showed, the return on assets for the top 10 percent of companies has far outstripped that of the rest of the business world.

During the same time, the entry rate of new companies has fallen from more than 17 percent in 1977 to below 9 percent today, owing to both increased regulatory hurdles and unsurmountable competition from corporate behemoths.

But that doesn’t mean the business community will welcome the new focus with open arms. The Chamber of Commerce has resisted FTC rule-making during the Obama administration, and businesses in emerging digital industries have deployed increasing muscle against antitrust regulators.

A dustup uncovered by the Wall Street Journal last year illustrates just how steep those challenges may be. In 2012, FTC officials concluded in an internal study that Google had abused its monopoly position to the detriment of consumers — a finding later confirmed by independent researchers.

During that same time, Google was busy strengthening its now-formidable lobbying arm and scheduling personal meetings between co-founder Larry Page and FTC officials. In 2013, FTC leadership eventually voted to disband its investigation into the search giant without mentioning the findings of the internal study.

Which is all to say that regulators have their work cut out for them.

© Copyright IBTimes 2024. All rights reserved.