October 2013 US Auto Sales Preview: New Car Buyers Shrugged At 16 Days Of Partial Government Shutdown; Toyota, Ford Seen Gaining Most Ground

Partial government shutdown? What partial government shutdown?

Fears that 16 days of congressional gridlock would hit consumer confidence and hammer new-car sales will be abated when the world’s top automakers roll out their monthly sales report on Nov. 1.

Forecasts by all major auto market intelligence providers see sales up around 12 percent year-over-year and high single digits growth from September, which was hit by an anomaly regarding the odd timing of the Labor Day weekend at the end of August and the lowest number of selling days in a month since November 2009.

The seasonally adjusted annual rate (SAAR), a monthly benchmark that measures the health of the auto market, should come in around 15.4 or 15.5 million, up from the 15.2 million in September and 14.3 million in October of last year.

The story for 2013 isn’t changing much this month. Estimates for total car and light truck sales (which excludes heavier pickup trucks like the F-350 that are typically used commercially) this year are still in line to hit around 15.5 million, or a million more vehicles than were sold in the U.S. last year. The stars continue to line up for 2014 to be the year the auto sector returns to pre-2008/09 recession sales volume.

Despite the peals from auto dealers amid the shutdown that they were starting to see less traffic to their lots, the congressional snafu that shut many government functions for over two weeks didn’t last long enough to have much of an effect as buyers continued to fuel a rebound from the 2009 industry crisis that sent auto sales to historic lows after the banking system nuked the economy with toxic debt. “It looks like the government shutdown ended just in the nick of time,” said Jessica Caldwell, senior analyst for auto market information provider Edmunds.com. “The week-by-week data suggests that consumers started to get jittery by the middle of the month.”

Also, remember what happened at the end of October last year? Hurricane Sandy washed away sales along densely populated parts of the east coast, which also resulted in helping boost new-car replacements in the ensuing months, which could affect year-over-year comparisons across the fourth quarter.

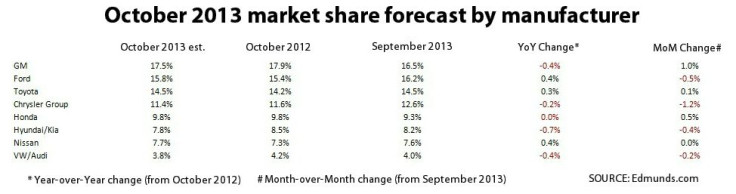

Kelley Blue Book, the automotive pricing and information server, sees Toyota, with its newly designed 2014 Corolla, and Ford, maker of the bestselling F-Series pickup truck, the recently redesigned Fusion mid-sized sedan and Escape compact crossover, showing the greatest gains. Ford and Toyota often trade the No. 2 slot behind General Motors Co. (NYSE:GM), the perennial top automaker in the country. Nissan, Ford and Toyota are expected to wrest some year-over-year market share from the other top automakers.

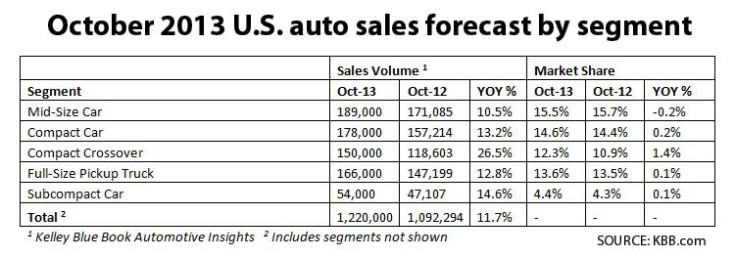

Besides pickup trucks (America loves their pickup trucks, though historically less than they used to), the hot segment right now is small crossovers, like the ubiquitous Honda CR-V and the Nissan Rogue. Expect good numbers from introductions and redesigns like Chrysler’s Jeep Cherokee, the Honda Accord and the Nissan Altima.

“Consumers are drawn to the new models in the crossover segment, which feature increasingly efficient engines, yet have more cargo space and a higher ride height than their car counterparts,” said Alec Gutierrez, senior analyst for Kelley Blue Book, the automotive pricing and market information provider. “Meanwhile, after many months of 20 percent gains this year, the full-size pickup truck market is showing signs of slightly slower growth as we move into the 2014 model year.”

© Copyright IBTimes 2024. All rights reserved.