Oh Snap! Social Media Firms Sink After Bleak Warning From Snapchat Parent

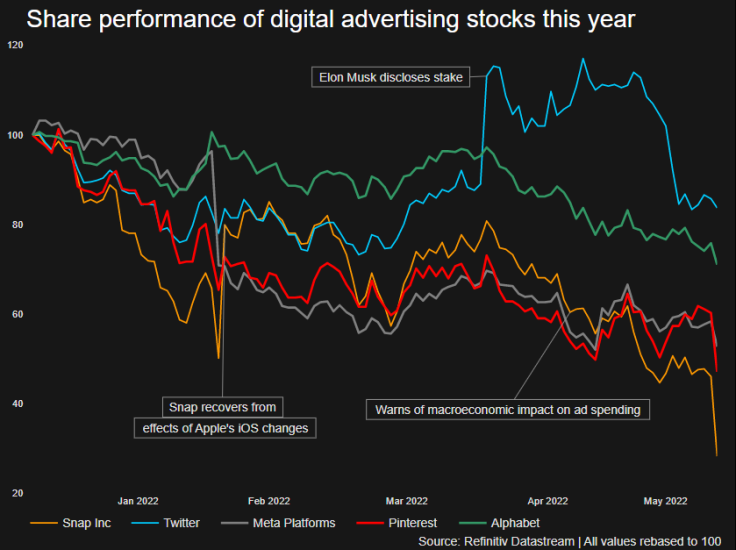

Snap Inc's shares plunged nearly 40% on Tuesday after a profit warning from the Snapchat parent signaled tough times ahead for the once-booming digital ad industry, sparking a sector-wide selloff.

The company was on course to erase more than $14 billion in market value, while Meta Platforms, Pinterest, Twitter and Google-parent Alphabet were altogether set to lose nearly $140 billion if losses hold.

Snap said on Monday it expected to miss quarterly revenue and profits targets that it set just a month earlier and would have to slow hiring and lower spending.

The bleak view from one of the sector's most known players underlines how the Russia-Ukraine war, surging inflation and rising interest rates are hobbling social media companies at a time when they had just started recovering the impact of changes to Apple's iOS operating system.

"Snap is a proxy for online advertising and when you see weakness there then you automatically think Facebook, Pinterest and Google," said Dennis Dick, a trader at Bright Trading LLC in Las Vegas.

"Once you start thinking about Google, that's when the markets starts to sell off."

Tuesday's selloff comes days after a Bank of America fund managers survey indicated investors are becoming increasingly bearish on tech stocks, a stark reversal to a bullish trend in the past 14 years.

Analysts also said Snap's outlook for core profit suggested expenses will outpace its revenue growth, given headcount was up 52% in the prior quarter. The company also faces pressure from TikTok and a shift in ad budgets to Google and Facebook, they added.

"There's a lot to deal with in the macro environment today," Chief Executive Officer Evan Spiegel said at a tech conference on Monday.

Graphic: Digital advertising stocks this year -

© Copyright Thomson Reuters 2024. All rights reserved.