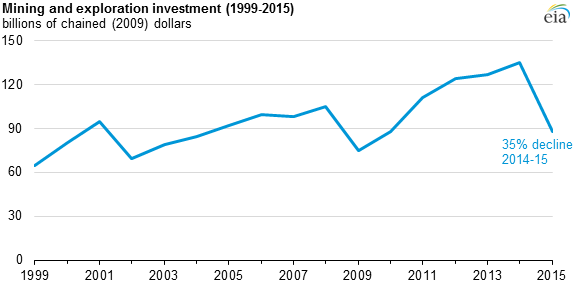

Oil Price Crash: US Mining And Exploration Investment Falls 35% As Energy Companies Curb Spending

U.S. energy companies slashed mining and exploration investment by more than a third last year as tumbling oil prices forced cutbacks, new U.S. economic data show.

Spending on wells and mines fell to $87.7 billion in 2015, a 35 percent drop from 2014 investment levels of $135 billion, the U.S. Bureau of Economic Analysis recently estimated. Oil and gas producers drove the bulk of that decline as companies shelved large exploration projects and laid off tens of thousands of workers amid shrinking revenues.

U.S. oil prices have dropped by almost three-quarters over the last 20 months, plunging from more than $100 a barrel in June 2014 to around $28 a barrel Wednesday.

American and global oil supplies are surging while petroleum demand is growing less quickly than expected, fueling fears of a supply glut. Worldwide, oil and gas companies have canceled an estimated $380 billion in projects since the oil-price downturn began in 2014, Wood Mackenzie analysts estimated in January.

“Companies are very, very reluctant to spend, because they see the macro situation of just too many barrels out on the market,” said Jeff Barron, an industry economist at the U.S. Energy Information Administration in Washington. “It’s not a very ripe time for them to try and generate returns.”

The $87.7 billion investment figure reflects the BEA’s advance analysis for fourth-quarter and full-year 2015 results, which is subject to revision.

Last year’s 35 percent investment cut is the second-largest year-over-year decline since the BEA started tracking the sector in 1948. The biggest drop was from 1985 to 1986, when investment fell 41 percent amid a similar plunge in oil prices, Barron said.

U.S. coal companies also slashed investments last year as plunging prices, weakening demand and ballooning debt loads forced a handful of companies — including Arch Coal and Alpha Natural Resources — to file for bankruptcy protection. Shares of Peabody Energy Corp., the world’s largest private-sector coal company, have lost more than 98 percent of their value since February 2015.

But Barron said the coal industry accounted for only a fraction of the decline in 2015 mining and exploration investment. “Spending in coal has been down for a long time,” he said.

Across the economy, U.S. gross domestic product grew 2.4 percent in 2015, the same rate as in 2014, according to the BEA's advance estimates.

© Copyright IBTimes 2024. All rights reserved.