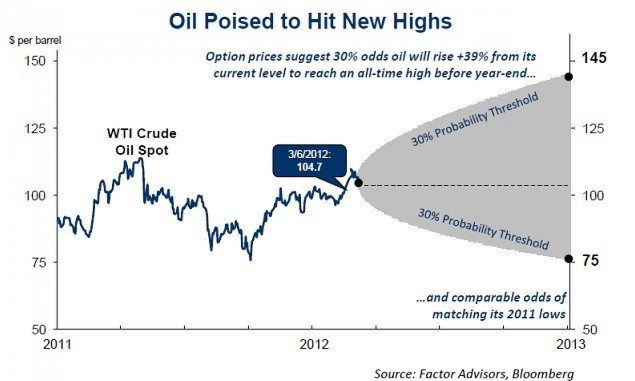

Oil Price Forecast 2012: 30% Chance WTI Tops Record $145

The options market has a bullish view on oil prices this year.

Levels of implied volatility in the options price of West Texas Intermediate crude suggest a 30 percent chance that WTI will rise 39 percent or more by the end of 2012 and exceed the all-time high of $145 per barrel, set in July 2008, according to Factor Advisors, a New York asset-management firm.

WTI crude oil settled at $106.16 per barrel on Wednesday.

The price of a vanilla, or standardized, option -- given the strike price, expiration date, risk-free interest rate and price of the underlying asset -- implies the market's view of the likelihood that the underlying asset will change by a certain magnitude within a certain time frame.

One reason traders are bullish on oil is the prospect of stronger U.S. economic growth, which would boost demand for oil. The United States is the largest consumer of oil at 19 million barrels per day.

The latest official U.S. jobs report surprised to the upside, showing a payrolls gain of 243,000 in January. If employment numbers, along with the nation's housing market, continues to improve, traders will only get more bullish on oil.

Hopes of faster U.S. economic recovery, however, isn't the only thing pushing up the expectation of oil prices.

The S&P 500 Index has only a 9 percent chance of rising more than 38 percent before year's end, options prices suggest.

Traders are also bullish on oil from the supply side.

Tensions with the West over Iran's nuclear program is fraught with uncertainties and potentially disastrous consequences.

In the best-case scenario, a compromise is reached and Iran's oil exports return to previous levels. If no deal is struck, the West could strengthen its sanctions against Iranian exports. But if Israel or the United States attacks Iran, the country's output could stop altogether.

In a nightmare scenario, Iran could block the Strait of Hormuz, a passage through which 20 percent of oil traded worldwide flows, according to the U.S. Energy Information Administration. Or, in a desperate move, Iran could attack Iraq or even Saudi Arabia, the latter of which is the world's biggest exporter.

On the off-chance the worst-case scenario materializes, oil prices could jump $60 per barrel from their current levels, Robert McNally, president of Rapidan Group, an energy consulting firm, told Bloomberg News.

© Copyright IBTimes 2024. All rights reserved.