Oil Price Spike Could Be Coming Soon As Companies Make ‘Historic’ Spending Cuts To Weather Market Downturn: IEA

Oil and gas companies have canceled more than $100 billion in investments and have slashed tens of thousands of jobs in the past year amid the collapse in oil prices. Now an oil shock may be on the way as those cutbacks drive a significant drop in crude supplies, a senior executive from the International Energy Agency said Wednesday.

“Historic” investment cuts in recent months raise the risk of oil-security surprises in the “not-too-distant” future, Neil Atkinson, head of the IEA’s oil industry and markets division, told reporters in Singapore. He said oil and gas markets need about $300 billion to sustain current levels of production — and nations such as the U.S., Canada, Brazil and Mexico are struggling to keep up.

“There’s a danger as we are reaching a point where we are barely investing upstream,” Atkinson said at the launch of Singapore International Energy Week, Bloomberg reported. “If investment doesn’t resume in 2017 and 2018, we can see a spike in oil prices as oil supply can’t meet demand.”

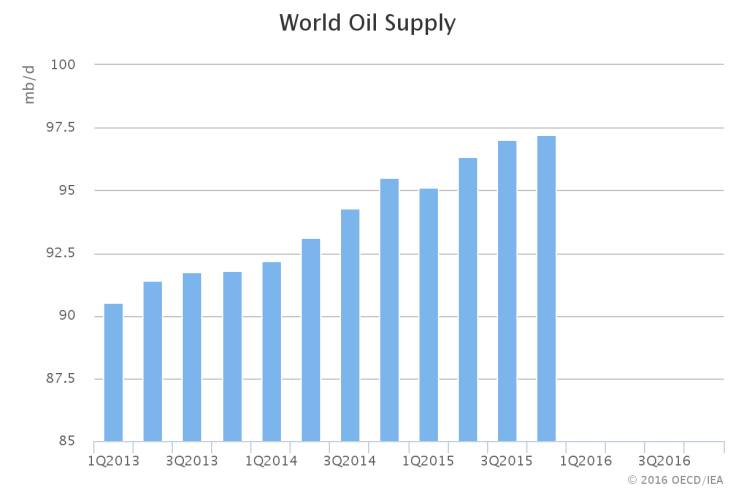

Still, the world is far from an oil shortage right now. Global oil supplies reached 97.23 million barrels a day in the fourth quarter of 2015, about 2 million barrels a day higher than global oil demand, which reached 95.23 million barrels during the same period, the IEA estimated.

The supply glut helped drive down prices from above $100 a barrel in June 2014 to below $30 a barrel earlier this year. Prices had recovered in recent weeks but dipped again Wednesday on worries the supply glut is still building.

West Texas Intermediate, the U.S. oil price gauge, was down more than 4 percent to $39.77 a barrel by 2:30 p.m. EDT after the U.S. government reported a crude build three times above analysts' expectations. The jump marked the sixth consecutive week of record-high inventories. Brent crude, the global benchmark, was trading down 2.87 percent at $40.59 a barrel.

Global oil giants — from ConocoPhillips to Chevron Corp. and BP PLC — have seen their earnings evaporate in the last few quarters, prompting the companies to sell assets, slash dividends and eliminate billions of dollars in spending plans. Oil-dependent economies are suffering significant budget shortfalls and teetering toward fiscal chaos.

Major oil-producing nations are discussing a plan to limit output and reduce the global oversupply to boost prices. Saudi Arabia, Venezuela, Qatar and non-OPEC nation Russia struck an agreement in February to keep output to January levels — so long as other countries join the production freeze. Qatar invited all 13 members of the OPEC cartel and other nations to its capital city in April for another round of talks about the deal.

But IEA’s Atkinson said the production freeze is essentially “meaningless,” since Saudi Arabia is the only country on board right now that could increase output if it wanted to, Reuters reported. Iran has snubbed the initiative, saying it would only consider a freeze once it boosts production by 1 million barrels a day to its pre-sanction levels. Libya has similarly declined Qatar’s invitation as the war-torn nation strives to recover its pre-conflict oil production rates.

The deal is “more some kind of gesture, which perhaps is aimed … to build confidence that there will be stability in oil prices,” Atkinson said at the Singapore industry event.

© Copyright IBTimes 2024. All rights reserved.