Oil Prices: Crude Drops Below $40 After OPEC Members Agree To Maintain High Output

Oil prices plunged Friday after OPEC gave no indication it was ready to end a policy of flooding global markets with crude oil in a bid to maintain market share against its rivals. The news sent the price of U.S. crude to less than $40 a barrel for the first time since late August.

At a tense meeting in Vienna, the group decided to raise its production limit for the first time in years to more accurately reflect the true amount of crude the 12-nation bloc has been producing. OPEC's poorer members, such as Ecuador, have been pressuring wealthier counterparts like Saudi Arabia to reel back on output because it's harming their national budgets.

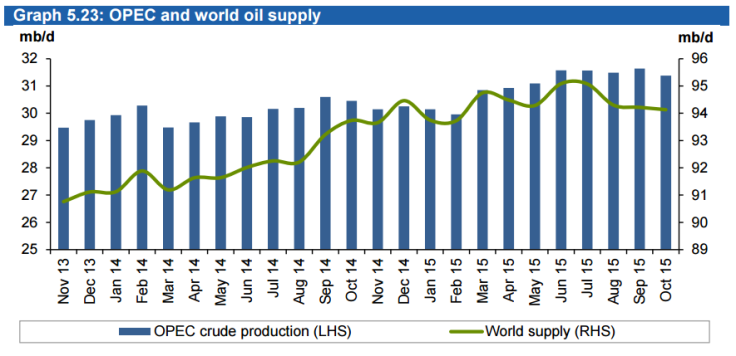

For the past two years, OPEC has exceeded its self-imposed crude production limit of 30 million barrels per day. The 12-nation group decided Friday to raise that limit to 31.5 million to reflect more accurately what OPEC has been producing. OPEC said in its recent monthly status report its members produced an average of 31.4 million barrels per day, down from 31.6 million in September.

In a world awash with crude, U.S. drillers have shut down operations and global giants such as Exxon and Chevron have scrambled to cut costs amid plunging profits.

West Texas Intermediate crude oil, the U.S. benchmark for oil prices, dropped 2.26 percent to $40.15 per barrel for January delivery on the New York Mercantile Exchange, recovering slightly after dipping to $39.90. Brent crude, the global benchmark for oil prices, fell 1.28 percent to $43.28 for January delivery on the London ICE Futures Exchange.

Energy stocks retreated on the news, too.

Shares in Exxon Mobil Corp. (NYSE:XOM) dropped 0.48 percent to $78.08 in midday trading in New York. Chevron Corp. (NYSE:CVX) fell 0.71 percent to $88.24. U.S.-traded stock in British oil giant BP PLC (NYSE:BP) dropped 2.1 percent to $32.58 while France’s Total SA (NYSE:TOT) fell 2 percent to $47.24.

© Copyright IBTimes 2025. All rights reserved.