Oil Prices Down As China, Asian Refineries Slow Crude Purchases; Key Data Shows US Inventory Increased For 10th Week In A Row

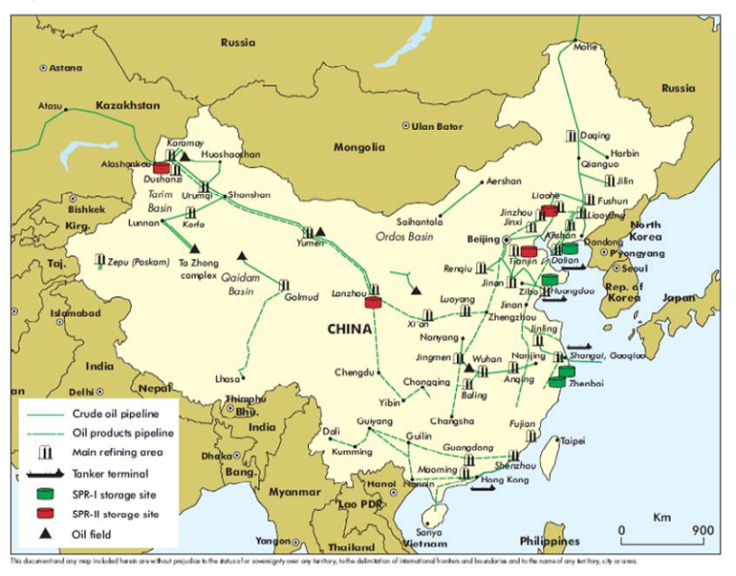

Lured by low crude prices, China has been aggressively adding to its strategic oil reserves for the past eight months, peaking in December when its purchases hit a record 7.2 million barrels per day. Now that available storage tanks are nearly topped off, however, the world’s second-largest oil consumer is pausing its buildup.

The news comes as U.S. oil prices fell Wednesday to a new six-year low as the weekly U.S. oil inventory report from the U.S. Energy Information Administration showed crude inventory increased by 9.6 million barrels last week, higher than analysts had forecast. It’s the 10th week in a row the volume of U.S.-held crude has increased.

U.S. crude for April delivery was down 2.78 percent to $42.25 a barrel on Wednesday while Brent crude’s May contract dropped 2.25 percent to $53.44. On Monday, U.S. crude dropped below $43 a barrel for the first time since the Great Recession in 2009.

China’s drop in oil purchasing isn’t helping to bring oil prices up.

"I don't think there is much space left to fill," a Chinese oil storage executive told Reuters under condition of anonymity. Beijing rarely discusses its strategic oil reserves, but estimates from industry watchers suggest China’s current crude oil strategic reserve is as much as 40 days of supply.

The Chinese government would like to have 90 days’ worth of supply, or about 600 million barrels, but it doesn’t currently have the storage capacity, with some tankers waiting weeks to offload their cargo.

Adding to the drop in Asian oil demand is that Chinese, Indian and Japanese refineries are slowing imports as part of their annual maintenance of facilities, which temporarily curbs some refinery activity. That slowdown is expected to peak in April and May, according to New York-based PIRA Energy Group.

Oil prices began to drop last summer amid the U.S. shale oil boom, European economic slowdowns and an unwillingness of Saudi Arabia to lead OPEC countries to curb output out of concern of losing market share.

Rising U.S. supply and the Chinese slowdown in its reserve building, which could last until later this year when new storage space becomes available, mean oil prices aren’t likely to rebound anytime soon.

© Copyright IBTimes 2024. All rights reserved.