Oil Prices Surge On Falling US Shale Output, Rebalancing Supplies In IEA Oil Market Report

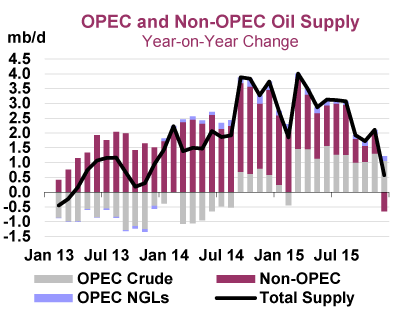

Falling U.S. oil production will help to rebalance the oil market next year, but the decline won’t last for long: Cost-cutting and more-efficient operations will gradually drive U.S. output to record levels by the beginning of the next decade, the International Energy Agency said Monday.

Plunging crude prices in the past two years have forced U.S. drillers to shelve new projects and cap wells as their revenue evaporates and bankruptcy looms. Output of U.S. shale oil — also called light tight oil — is projected to decline by 600,000 barrels a day in 2016 and by a further 200,000 a day in 2017, the Paris-based energy watchdog said in its medium-term oil market report.

Worldwide, oil inventories will increase by just 100,000 barrels a day next year and fall by around 400,000 a day in 2018, the agency said.

Shrinking supplies will “gradually rebalance” global oil markets by 2017, with a corresponding boost in oil prices, according to the IEA.

Oil prices have plunged 70 percent since their mid-2014 peaks to around $30 a barrel, spurred by fears of a global supply glut and signs of slower-than-expected demand growth. Oil-producing nations and private companies have responded by axing hundreds of billions of dollars in exploration and production projects.

Brent crude, the global benchmark, rose over 5 percent to $34.70 a barrel before 9 a.m. EST. U.S. crude was up 6.5 percent to $31.57 a barrel, up from its mid-February low of below $27 a barrel.

A fall in the U.S. oil rig count and a bounce in global stock markets have also supported crude prices. U.S. drilling rig numbers last week fell to their lowest level since December 2009, near the start of America’s shale boom, Baker Hughes Inc. found in its closely watched report.

In the longer term, oil producers could add just 4.1 million barrels a day between 2015 and 2021, down sharply from the total growth of 11 million a day in the 2009-15 period, the IEA said. The decline reflects sharp cuts in global oil exploration and production spending. Capital expenditures are expected to fall 17 percent in 2016, following a 24 percent cut in 2015 — the first time since 1986 that upstream investment would drop for two consecutive years, the energy agency said.

“It is easy for consumers to be lulled into complacency by ample stocks and low prices today, but they should heed the writing on the wall: The historic investment cuts we are seeing raise the odds of unpleasant oil-security surprises in the not-too-distant-future,” Fatih Birol, the IEA’s executive director, said Monday ahead of the report’s launch at a Houston energy conference.

Still, the agency said it expects U.S. oil production to rebound from its dip, with America becoming the largest contributor to global supply growth over the next five years. U.S. output could reach an all-time high of 14.2 million barrels a day by 2021 thanks to “a gradual recovery in oil prices, combined with further improvements in operational efficiencies and cost-cutting,” according to the report.

Iran will lead gains from OPEC. Freed from Western sanctions, Iran oil output is expected to rise from 1 million barrels a day to 3.9 million a day by 2021, the IEA said.

“The market will begin rebalancing in 2017 — and by 2021 the United States and Iran are seen leading production gains among non-OPEC and OPEC countries, respectively,” the report said.

© Copyright IBTimes 2024. All rights reserved.