Oil Prices To Trade Around $40 In First Quarter 2015 As Crude Oil Glut Continues To Grow: Goldman Sachs

Oil prices could trade around $40 a barrel in the first half of the year as the glut of global crude supplies continues to grow, Goldman Sachs analysts forecast this week. Prices that low would force U.S. shale producers to scale back their output, which over time will help balance the mismatch between supply and worldwide demand.

Goldman lowered its forecast for Brent crude, the global benchmark, to $42 per barrel in the first three months, down from a previous prediction of $80 per barrel, the bank said in a new report cited Monday by Bloomberg News. The bank's forecast for U.S. crude was revised down from $70 per barrel to $41 per barrel in the first quarter.

Brent crude futures Monday dropped by 3 percent, to $48.54 per barrel, the lowest level since April 2009, amid continued concerns about crude oil surplus. West Texas Intermediate dipped by 2.6 percent, to $47.10 per barrel, about 50 percent below prices in mid-2014.

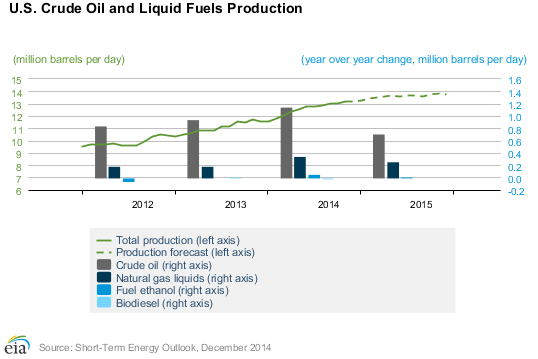

Goldman analysts said that cheaper crude prices this year should slow oil production from Texas’ Eagle Ford shale formation and in the Bakken in North Dakota. Those regions have helped boost U.S. oil production in 2014 to around 8.6 million barrels of crude per day on average, the country’s highest output level in nearly three decades, according to U.S. energy data.

As American production surges, however, global demand for fuel remains weak, dampened by slower-than-expected economic growth in Europe and China and lackluster manufacturing output in the U.S. Major oil producing nations, led by Saudi Arabia, have meanwhile refused to reduce their national crude output, resulting in a global oil surplus of around 2 million barrels per day, Qatar’s energy ministry estimates.

In its note, Goldman said it doesn’t expect Saudi Arabia or other OPEC members will slash production. But it said that U.S. producers could be forced economically to postpone or halt operations if prices hover around $40 a barrel. “To keep all capital sidelined and curtail investment in shale until the market has rebalanced, we believe prices need to stay lower for longer,” analysts wrote in their report. “The search for a new equilibrium in oil markets continues.”

The bank also lowered its six- and 12-month crude forecasts for West Texas Intermediate crude to $39 per barrel and $65 per barrel, respectively, down from previous respective predictions of $75 per barrel and $80 per barrel. Forecasters slashed estimates for Brent crude over that same period to $43 per barrel and $70 per barrel, respectively, down from $85 per barrel and $90 per barrel, the report said.

“This is anchored in our expectation that the slowdown in U.S. shale oil production in second-half 2015 will be sufficient to clear the market overhang and the threat of capital being quickly redeployed to restart U.S. production growth,” analysts wrote.

© Copyright IBTimes 2024. All rights reserved.