Oil Surpasses $100, Stocks Slump, Dollar Rises As Russia Invades Ukraine

Oil prices broke above $100 a barrel on for the first time since 2014 and stock markets slumped globally on Thursday while Russia's rouble hit a record low as the U.S. dollar rallied after Russian President Vladimir Putin launched an invasion of Ukraine.

Investors sought safety wherever they could with U.S. Treasury prices climbing and gold prices rallying as the invasion brought massive uncertainty in everything from energy supplies and the global economic outlook as well as central banks' policy.

While Wall Street's major indexes pulled off their initial lows, traders were still grappling with a sea of red by midday.

MSCI's gauge of stocks across the globe was last down 2.1% after touching its lowest level since March 2021. Europe's stock markets tumbled with the STOXX 600 index falling more than 4%, to its lowest since May 2021. It finished down more than 3%.

Putin said he had authorised what he called a "special military operation" though Ukraine. Western governments labelled it a full-scale invasion.

U.S. President Joe Biden said "severe sanctions" would be imposed on Russia after the attacks, with Europe's leaders vowing to also freeze assets and shut Russian banks out of their financial markets.

"Even though the invasion isn't a total surprise, the stock market is still taking a sell first ask questions later approach as the geopolitical concerns continue to soar," said Ryan Detrick, chief market strategist at LPL Financial.

"It is just the uncertainty of how serious things could get. Will Europe get involved? Will United States get more involved? We know more serious sanctions are going to come against Russia, but the fallout from that is just uncertain."

Benchmark 10-year notes last rose 10/32 in price to yield 1.9425%, from 1.977% late on Wednesday.

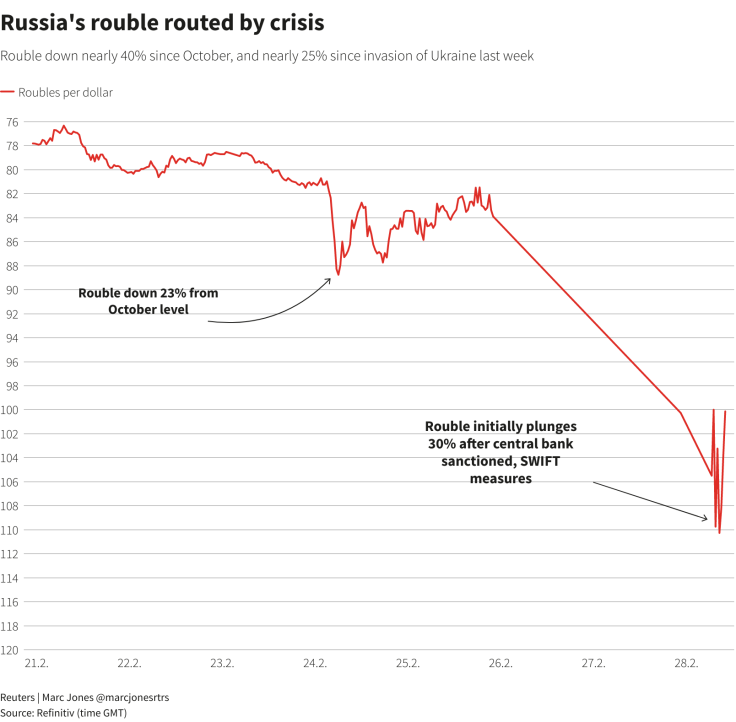

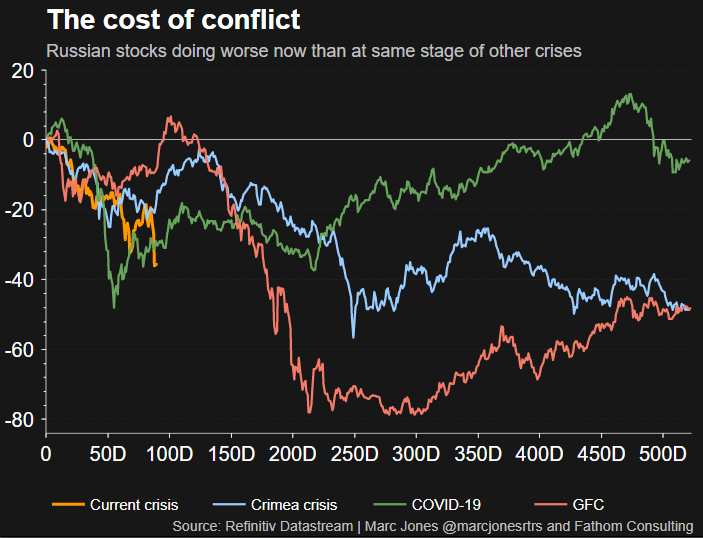

Chaotic moves in Russia's markets saw the rouble hit a record low of 89.9855 against the dollar late Wednesday night. It was last down more than 6% at 86.462 per dollar. There were record declines in Russian stocks, where trading was suspended earlier with the Russia equity index closing down 33% after falling as low as 45.5%.

Ukraine meanwhile was forced to suspend trading in its currency as its bonds crashed violently as investors bet that it could now default again, as it did after Russia's 2014 annexation of Crimea.

"It is complete chaos," said Viktor Szabo, portfolio manager at asset manager abrdn. "Ukraine is untradeable right now and it is carnage in the Russian markets across sovereign and corporate debt".

Graphic: Russia's rouble routed by crisis -

U.S. President Joe Biden met with his counterparts from the Group of Seven allies on Thursday morning to map out more severe measures against Russia with Biden calling the invasion "a premeditated war." Biden planned to make public remarks on the conflict at 1:30 p.m. EST (1830 GMT), according to the White House.

European Union leaders meeting on Thursday were aiming to agree to impose further sanctions on Russia that would have "massive and severe" consequences for Moscow, according to a draft of their summit conclusions.

Missiles rained down on Ukrainian cities and Ukraine's authorities reported columns of troops pouring across its borders from Russia and Belarus, and landing on the coast from the Black and Azov seas.

The assault brought a calamitous end to weeks of market anxiety and fruitless diplomatic efforts by Western leaders.

The global equity rout included a 3.3% dive for the MSCI pan-Asian index.

The Dow Jones Industrial Average fell 600.07 points, or 1.81%, to 32,531.69, the S&P 500 lost 41.56 points, or 0.98%, to 4,183.94 and the Nasdaq Composite dropped 0.46 points to 13,037.03.

In Europe Germany's DAX fell almost 4%, bearing the brunt of the sell-off due to heavy reliance on Russian energy supplies and the amounts its companies sell to Russia. [.EU][.N]

In the FX markets, the dollar was up 1.232%, against a basket of other major currencies, with the euro down 1.41% to $1.1149.

Fears that the war will squeeze global energy supplies saw Brent futures jump more than 9% past $100 a barrel for the first time since September 2014. It last traded at $102.96, up 6.32%. Nearly 40% of the European Union's natural gas and 26% of its crude oil comes from Russia. U.S. crude recently rose 4.29% to $96.05 per barrel. [O/R]

With both Ukraine and Russia also big crop producers, wheat and corn prices surged, while gold was up 0.7% after hitting its highest level since September 2020. [GOL/]

Investors have also been grappling with the prospect of imminent policy tightening by the U.S. Federal Reserve aimed at combating surging inflation. The conflict prompted questions about whether central bankers change or delay their plans or whether the energy price jump would spur them on.

"Higher energy prices will also support sticky inflation which may keep pressure on the Fed to stay on course," said Cliff Hodge, chief investment officer at Cornerstone Wealth in Charlotte, North Carolina.

Graphic: Russian stock suffer heavier losses than GFC and Covid crash -

© Copyright Thomson Reuters 2024. All rights reserved.