Palladium Set to Soar in 2012: Survey

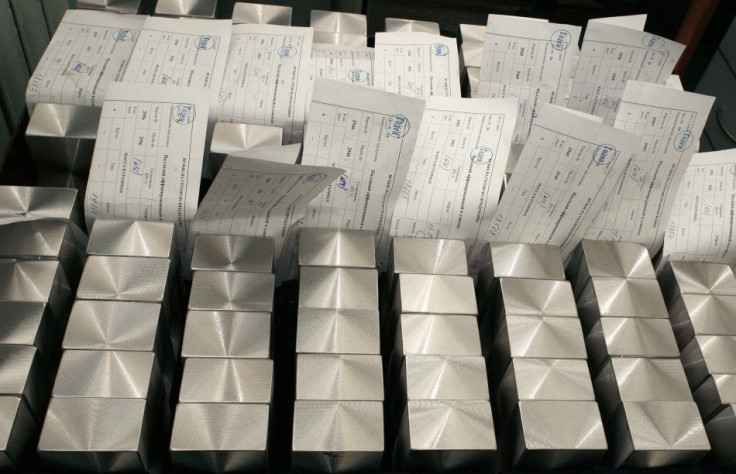

Palladium prices are set to soar this year, buoyed by high levels of speculative buying, unwavering industrial demand and the general upward price pressure many commodity metals are seeing in a zero-interest rate environment, according to a report issued Thursday.

The median estimate of 11 analysts surveyed by Bloomberg News found palladium was likely to average $850 per ounce in the final quarter of 2012, a jump of 31 percent from its current price of approximately $645 an ounce. That 2012 gain widely exceeds median gains for other precious metals, the analysts noted. Analysts expect gold to rise by 15 percent, silver by 13 percent and platinum by 9.8 percent, according to Bloomberg.

Palladium is expected to surge on sharply higher purchases by palladium-tracking exchange-traded products, which have risen 14 percent this year so far, and a less-severe-than-feared slowdown in Chinese automobile demand. Motor vehicle sales are important for palladium because more than 60 percent of the metal ends up in vehicles' anti-pollution devices.

I like palladium the best among precious metals, it's relatively cheap compared to the others, Bart Melek, head of commodity strategy at TD Securities, told Bloomberg. Palladium has fallen more than 3 percent this year, even as other metal commodities, including silver and platinum, have posted double-digit percentage gains.

Besides high demand and low price, analysts noted palladium's tight supply: Russia's stock pile of palladium will be exhausted this year and South Africa's palladium mines have faced frequent shutdowns from strikes and safety violations.

Palladium futures contracts for June delivery, the most widely traded contracts on the New York Mercantile Exchange, were down over 0.5 percent Thursday, dropping to $644.60 per ounce in afternoon trading.

© Copyright IBTimes 2024. All rights reserved.