Paulson's hedge funds endure another rough month

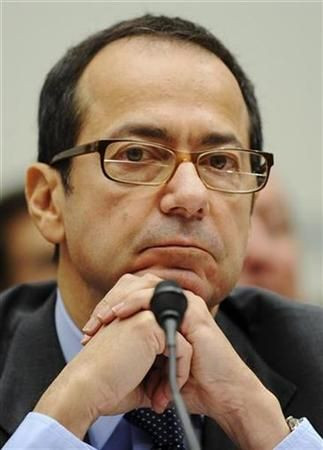

Hedge fund titan John Paulson's flagship funds performed poorly in July and sank further into the red for the year.

The Paulson Advantage Plus fund is down 21.6 percent for the year after the fund fell 4.63 percent in July, according to people familiar with the firm who declined to be identified. The Paulson Advantage fund is down about 15 percent for the year.

The Paulson Advantage funds, which peaked with $19.1 billion in assets under management in March, are losing altitude. The two funds now control about $15.7 billion in investor assets, sources say.

The Advantage funds account for roughly 44 percent of the $35.2 billon in assets under management at Paulson & Co, the hedge fund firm led by the billionaire manager. The two so-called event driven funds long have been Paulson's largest and best known investment vehicles.

The rapid shrinking of the Advantage funds is the result of bad bets and missteps by a star trader who rose to fame in the $2 trillion industry with a big bet that the housing market would collapse.

A good chunk of the $3.4 billion decline in assets under management happened because of the $482 million loss the Advantage funds incurred when Paulson unloaded shares of Sino-Forest, a Chinese forestry company accused of overstating its timber production and results.

His big bets on financial stocks like Bank of America (BAC.N), Citigroup (C.N) and CIT Group (CIT.N) also are wreaking havoc on his portfolio.

Officials with Paulson's firm declined to comment.

On the positive side for Paulson, his Gold Fund is up 2.5 percent for the year as the metal continues to rally because of fears about global economic weakness.

Investors in a special gold class share version of the Advantage funds are faring a lot better. The gold-denominated version of the Advantage fund was up about 5 percent in July and is down 2 percent for the year.

It is believed that 40 percent of Paulson's investors are in the gold class versions of the Advantage funds. The gold share class seeks to take advantage of the surge in gold prices by using exchange traded funds and other investments to convert an investor's dollar exposure into gold.

© Copyright Thomson Reuters 2024. All rights reserved.