PGA-LIV Deal Has US Lawmakers Asking For More Details

US lawmakers began an investigation Thursday into the shock merger of the PGA Tour and DP World Tour with Saudi backers of LIV Golf, taking aim at tax breaks.

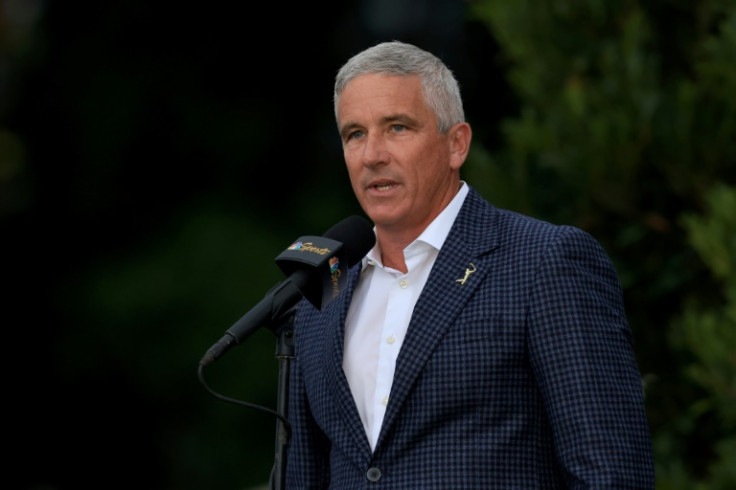

US Senate Finance Committee chairman Ron Wyden, a Democrat from Oregon, sent a letter to PGA Tour commissioner Jay Monahan and other tour leaders asking for the same thing many players seek -- more details about the controversial new deal.

Wyden raised concerns over Saudi Arabia's human rights issues.

"The PGA Tour's involvement with PIF raises significant questions about whether organizations that tie themselves to an authoritarian regime that has continually undermined the rule of law should continue to enjoy tax-exempt status in the United States," Wyden wrote.

"In addition, I believe it is critical that lawmakers understand what risks this arrangement may pose to America's national interests, particularly with respect to foreign investment in US real estate, such as locations neighboring military facilities or sensitive manufacturing centers, and how you plan to mitigate those risks."

Wyden's inquiry came on the same day the Wall Street Journal reported that the US Department of Justice has started a review into the Saudi Public Investment Fund's planned merger with the PGA and DP World tours over anti-trust concerns.

On Monday, US Senate Investigations Subcommittee chairman Richard Blumenthal informed Monahan and LIV chief commissioner Greg Norman his panel had started an inquiry as well over anti-trust issues.

That had been among the issues in a legal fight between LIV and the PGA that was due for court next May but dueling lawsuits were wiped out under terms of the merger deal.

The PGA Tour would remain a non-profit organization while the PIF would be the investors in a connected for-profit group, equity in which reportedly would reward players who stayed with the PGA rather than jumped to record purses and guaranteed deals from LIV.

Monahan has been criticized over the hypocrisy of scolding the Saudis and players who joined LIV only to partner with them, something Monahan said he did for the good of the sport to end the PGA-LIV feud.

"The details that have emerged about the merger agreement thus far also raise broader questions about the appropriateness of the continued tax exemption of the PGA Tour," Wyden wrote.

"It's incumbent on Congress to review whether the tax exemption provided to sports leagues is appropriate in the case of a foreign autocracy seeking to acquire substantial influence in a US sports institution for the clear purpose of trying to cleanse the regime's public image."

Wyden, who seeks a reply by June 23, wants to know about compensation for PGA officials under the deal, noting that Monahan made nearly $14 million in 2021 under recent tax filings and more than $63 million was spent for "top staff" by the PGA Tour.

"I have serious questions about any compensation arrangements, formal or informal, proposed as part of this merger framework intended to personally and financially benefit the already lavishly compensated officers and employees of the PGA Tour," Wyden wrote.

"It is difficult to rationalize how any further increases in compensation to tour executives would be in the best interest of the PGA Tour or further the tour's tax-exempt purpose."

Wyden also questioned the role of Ed Herlihy as PGA Tour Board of Directors chairman and a partner in the law firm reportedly representing the tour in the deal.

© Copyright AFP 2024. All rights reserved.