PlantX Life Update: Plant Based Food Industry Explodes With New Products

- 5000+ Plant based food products are now listed on the worlds' largest plant niche marketplace.

- Analysts may have paid too much attention to the "meat substitutes" market and related startups, missing out on bigger moves in the broader plant food market.

- The PlantX founder says he now leverages the same community model he piloted alongside Ryan Cohen from Gamestop when they co-founded three single category websites together.

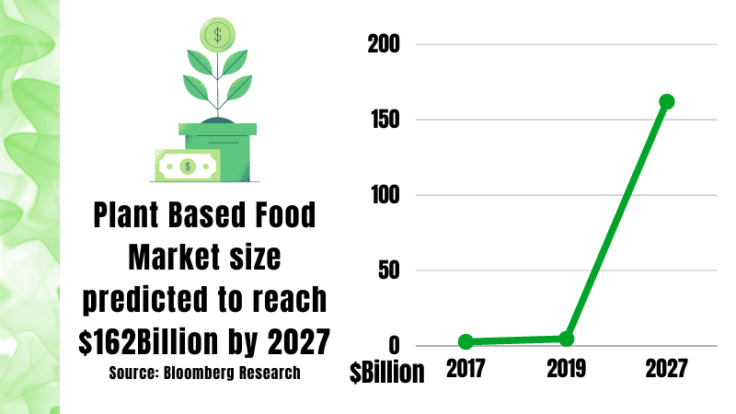

The most captivating part of a trend is often the point at which mainstream players join newcomers and the marketplace becomes crowded. This appears to be the case for the plant based food industry, which is predicted to undergo a near eightfold expansion in less than a decade, to reach $162 Billion by 2030.

For example, this year, Unilever (NYSE:UL) stated a bold ambition to achieve 1.5 Billion Euros in sales by 2025, across categories where products traditionally contained animal-derived ingredients.

Oftentimes, this phenomenon will present analysts with somewhat of a complex puzzle to solve. A case in point would be the question of how to determine market maturity: this is not least due to the proliferation of new products and segments. Consumers are already casting their votes as to which products might become market leaders.

From 2019 to 2023, the spotlight was stolen by the "meat substitutes" segment: For a moment, investors and consumers alike may have been flustered by the likes of 3D steaks and veggie burgers.

After the shakeout: is there life after veggie burgers?

Loyal beef eaters did not want to desert their steaks en-masse. This represented an obstacle to a single segment of "meat substitute" products. The Washington Post, despite its love of ESG and the WEF, called it a "failing category". The consequences for investors? Look at the widely discussed earnings miss from Beyond Meat Inc (BYND) which is still fresh in our minds.

This story seems to have been foretold when the CEO of the Kellogg Company (NYSE:K) Steve Cahillane, predicted a "shake out" of new entrants to the market. Kellogg's calls itself "The original plant-based food company" and is indeed well established to resist challengers.

Yet during this same time, when meat substitutes "failed" investors, other players performed better in the broader category, as they cover more than just veggie meat. A good example was Ingredion Incorporated (INGR), a leader in plant-based food, which reported a net sales growth of 13% in Q4 2022. Besides Ingredion, there is a lot more to suggest that life after veggie burgers will present consumers with a rather wide range of other plant based food products which will be discussed below.

An ESG-spurred investment class with uncommon behavior?

A number of powerful institutions supported the drive towards ESG investing.These include the WEF, BlackRock, governments, other hedge funds and think tanks such as Chatham House. As Luigi Wewege, the president of Caye International Bank said recently: "ESG received a major boost from the most powerful forces in the world."

In comparing two substantial ESG trends, electric vehicles and plant based food, some rather dissimilar characteristics can be observed:

With electric vehicles, the U.S. government had to initiate the trend, when Obama provided Tesla with a $465Million federal loan. The most notable car brands in the world, including General Motors, Ford, Volkswagen and Toyota, all stood back and let a startup do the exploratory work, allowing Elon Musk to be the first mover.

By contrast, in the case of plant based foods: It raked in billions of investment dollars from the private sector which initiated the trend. This dwarfs what the U.S. government did for EV's. A combination of niche startups and well established brands all piled in. This helped generate both supply and demand via strong existing marketing channels.

- Nestle has a substantial plant based food portfolio,

- Coca-Cola (NYSE:KO) launched an oat milk line as well as plant based sweetener known as stevia,

- Walmart (NYSE:KO) now has 1000+ products in its plant based food category, consisting of supplier brands and its own brands.

- Even Philadelphia cheese, which is consumed by around 50 million Americans, launched a plant based "cheese" spread.

- It is yet to be seen which highly anticipated surprises an influential brand like Unilever may bring as part of the abovementioned 1.5Billion Euro pledge.

Meanwhile, PlantX Life (PLTXF:OTC US) which operates the largest online marketplace in the category, increased its SKU's to a stupendous level, listing 5000+ plant based products. The digital marketing research tool AHRefs suggests that PlantX is currently seeing a sharp uptick in search traffic, partly driven by a growth in search demand of at least 15 product lines for which search demand has grown. A recent report from a growth fund stated that PlantX is severely undervalued versus its peers, raising the target nearly eightfold.

The CEO of PlantX, Sean Dollinger said: "We act quite similar to an ETF because we provide exposure to the widest range of plant based products. No matter how many brands might come and go, as a marketplace, we're here to stay for the long haul. We help create the industry winners of the industry. Deeper into 2023 we'll be announcing additional partnerships with brands that are very well funded."

Remember Gamestop and Ryan Cohen? The significance of Gamestop $GME, is that the founder of PlantX, Sean Dollinger, worked with Ryan Cohen and co-founded three websites that follow the single category platform idea. Dollinger leverages the same approach as Cohen: They build up strong communities around a niche, serve them with products and information, and build ecommerce platforms at the center of these communities. People like Dollinger and Cohen seem to be very patient with a focus on building valuable communities and valuable relationships with suppliers. This type of strategic patience ultimately led to Gamespot announcing their first profit now in March 2023.

Three marketplaces in particular: Walmart, Amazon and PlantX, all provide interesting data proving just how wide the plant based food product category has stretched.

Strategic matters

Some newcomers to the plant-based food market may have experienced a short moment of glory as they piloted new solo products and ideas, only to lose market share to established players with a strategic advantage and scale. Although one company with a very narrow product range disappointed investors, it does appear that the masters of scale and strategy are yet to make their move: some very big and experienced brands are only just starting to announce their ambitions.

Due to its size, Kelloggs, Unilever and Nestle are examples of well diversified companies, less affected by single category fads which may come and go. Thus, while they are piloting new plant-based protein products, they still retain a wide range of conventional products which acts as a strategic safety net.

However, disregarding all newcomers can also prove to be a miscalculated move. The success stories of Tesla and Amazon stand as testaments to this. These companies introduced innovative and distinct ideas, which were supported by strategic brilliance. Despite facing intense competition from well-established organizations with extensive supply chains and a significant industry presence, they managed to endure and thrive.

Given the appetite to fund ESG companies, some newcomers with funding and a diversified strategy could be poised to create history. For example:

- Tattooed Chef (Nasdaq: TTCF) now sells its products at more than 24,000 U.S stores including 6,000 pharmacies - with high rates of recurring sales, With its own branded products making up 65% of sales and a foothold in Mexico, The U.S. and Italy, CEO Sam Galetti made sure the company moved towards a highly diversified multi-product, multi-country entity.

- By launching "PlantXPress", PlantX emulated Amazon Prime in a way that focuses on people's need for regular meal deliveries, simultaneously driving up the customer lifetime value and recurring revenue. This is all bolted on top of a proven strategy of "building strong, loyal niche communities" which Dollinger piloted successfully with Ryan Cohen when they co-founded Chewy. Dollinger was quick to also launch and acquire more profitable owned brands alongside the 5000+ products they sell from other brands. Now it announced a share exchange agreement, which secured additional funding for more U.S. expansion.

- Tindle produces "plant-based chicken". It already raised $100M+ in 2022 and now its parent company Next Gen Foods, acquired "Mwah", which produces dairy-inspired products: Apparently the fake chicken and fake milk it produces is nearly indistinguishable from the animal products. Next Gen Foods have a marketing strategy that spans North America, Europe and Asia.

Global food - the bigger picture

The global food supply chain is more interdependent than what people may realize. This is underscored by the fact that it will face costly ramifications from the Russia-Ukraine conflict. This only accelerates the need for plant-based food: to ensure greater insulation from supply shocks.

In this context, it is argued that plant-based food protein can support global food security, since a mere "18% of calories originates from livestock", yet 80% of agricultural land is used for farm animals.

Population growth in India and Africa, combined with climate change and conflicts may send global meat prices soaring. As India is headed to become the largest population in the world, with 40% vegetarians, it is also foreseeable that demand for conventional animal meat will rise as a higher GDP lifts more people out of poverty and they seek to indulge in relative luxury.

Africa, which faces chronic food insecurity, will also see considerable population growth. Already many African countries are forced to import beef from Australia, Brazil and Argentina which is far from sustainable.

Many nations and even the U.S. may unfortunately have to learn that although money can be printed to buy beef, nobody can print livestock during times when resources face increased pressure.

Is the industry in the midst of going mainstream?

Some companies have a tradition of timing trends correctly and focussing their R&D accordingly. In the case of Unilever, it sees plant based food going mainstream as early as 2023, for which it cites several important reasons. If Tattooed Chef products are sold across 24,000 stores and 6,000 CVS pharmacies and PlantX listed 5,000 products on its own storefront as well as Amazon and Walmart, the Unilever assertion seems to have merit.

Concluding thoughts:

Strategic thinkers know it is entirely possible to lose one fight but win the war. The one fight we all heard about is "fake meat failed": it appears that many at least tried what Bill Gates suggested. Consumers have not yet found the perfect tasting fake steak or burger. Others are still skeptical of 3D printed "steak" and many more are yet to try out "chicken" and "milk" which seems to be the latest craze.

Watch out for adoption rates: Consider that Americans needed little convincing to make an unknown, expensive brand their top choice in Electric vehicles. Now consider food products, which have a much lower price tag and lower risk to the consumer, produced and sold by "favorite" brands consumers trusted for decades. This makes it harder to dismiss the notion that plant based foods are going mainstream.

There will always be winners and losers, with consumers and investors deciding their fate. In the face of such strong support from important players, this is one industry that seems to have an unfair advantage - albeit justifiably so in favor of the environment.