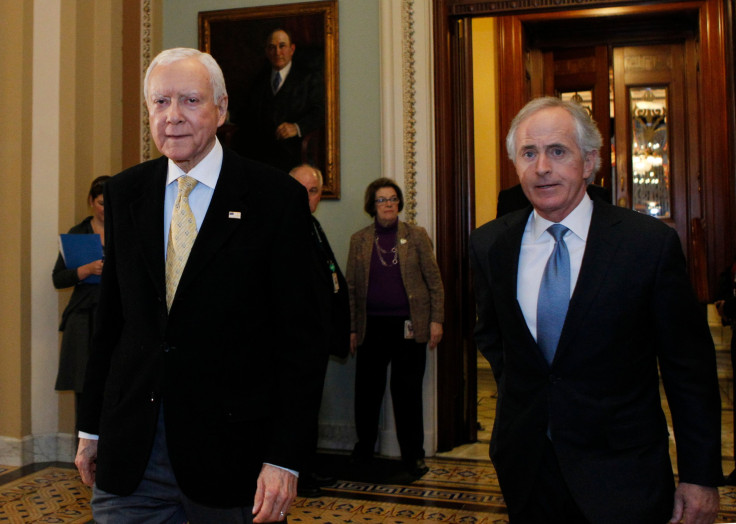

Senator Orrin Hatch Says He Wrote Tax Provision At Center Of Corker Controversy

Sen. Orrin Hatch, R-Utah, on Monday admitted he crafted a controversial tax provision, which could personally enrich Sen. Bob Corker, House Speaker Paul Ryan, President Donald Trump, and top Republican lawmakers directly overseeing the bill. The provision could additionally benefit the real estate industry — which has been one of Hatch’s largest sources of campaign donations.

In his letter explaining the situation, Hatch did not dispute that Corker and other Republicans who have large ownership stakes in real-estate-related LLCs stand to reap a personal windfall from the legislative language he added to the final bill. Instead, Hatch insisted the controversial provision wasn’t new, but was in fact included in the version of the bill passed by the House earlier this month. He wrote that the claim “that a new pass-through proposal was created out of whole cloth and inserted into the conference report is an irresponsible and partisan assertion that is belied by the facts.”

Hatch’s characterization of the provision was disputed by tax experts Monday, who said the Republican senator’s process argument was factually false.

“Chairman Hatch’s letter is an exploration of an alternative tax universe not previously known to science,” Edward Kleinbard, former chief of staff of Congress’s Joint Committee on Taxation, told IBT.

“[The provision’s] only connection with the House bill is that it rewards owners of capital intensive businesses, like wealthy real estate investors, but the measure of those rewards and the new provision’s design have no relationship to the House bill,” said Kleinbard, currently a law professor at the University of Southern California.

Earlier this month, Corker cast the lone Republican “no” vote on the Senate version of the bill, which did not include the provision, but instead created a 20 percent deduction on income from “pass-through” entities, such as LLCs and S-Corps, that pay out wages to employees. But Friday, he announced he would vote “yes” on the final reconciled bill, which included the controversial new provision. That provision extended the deduction to income pass-throughs with large property holdings but few or no employees, effectively subverting efforts by Senate Republicans to ensure that the new tax break was limited to businesses paying out wages to employees.

Following an International Business Times investigative report detailing how Corker could personally benefit from the new provision, Corker faced a firestorm of criticism for switching his position on the $1.5 trillion legislation. On Saturday, he told IBT he could not have changed his vote out of self-interest because he had in fact not read the bill and was unaware of the provision. As criticism grew over the weekend, Corker sent a letter to Hatch, chair of the Senate Finance Committee, asking him to provide an explanation of how the provision ended up in the bill.

In a letter Monday morning addressed to Corker, Hatch said that the provision was a compromise between the House- and Senate-passed tax bills that had generally been considered before. Hatch asserted that no senator, including Corker, had asked him to put the provision into the final legislation, writing “I am unaware of any attempt by you or your staff to contact anyone on the conference committee regarding this provision or any related policy matter.”

Hatch did not dispute that Corker voted against the Senate bill when it restricted him from getting a personal benefit, and then switched his position and announced his support for the final bill after it included Hatch’s language.

A Debate Over Process, Not Substance

Hatch acknowledged that he put the provision into the bill — and federal financial disclosures show Hatch’s wife owns a real estate LLC worth up to $500,000 that earned up to $15,000 of income in 2016. Donors from the real estate industry — which could also benefit from the provision — gave Hatch more than $515,000 during his 2012 reelection campaign.

In his letter, Hatch focused primarily on the process by which he inserted the provision into the final bill, rather than on the substance of the provision itself. He argued that a version of the provision was included in the House version of the bill.

“Through several rounds of negotiations, the House secured a version of their proposal that was consistent with the overall structure of the compromise,” Hatch wrote.

Hatch asserted that the House bill — which Corker never voted on — included a section that “provided a special tax rate for pass-through income and included a ‘prove-out’ option for capital-intensive businesses,” but also acknowledged that “the Senate bill did not include a prove-out option for capital-intensive businesses like the one contained in the House bill.” He then declared: “It takes a great deal of imagination — and likely no small amount of partisanship — to argue that a provision that has been public for over a month, debated on the floor of the House of Representatives, included in a House-passed bill, and identified by JCT [Joint Committee on Taxation] as an issue requiring a compromise between conferees is somehow a covert and last-minute addition to the conference report.”

Experts familiar with the specific workings of how the tax break is formulated said that while there are some general similarities between the House bill and the conference report, Hatch sculpted a brand new provision for the final bill — one that was not in the previous versions of the legislation.

“The mechanism that suddenly appeared in the conference committee was entirely new,” Matt Gardner of the Institute on Taxation and Economic Policy, which opposes the bill, told IBT in an email. “While the concept of giving a special pass-through carve-out to owners of real estate is, sadly, not new, the way in which the conference committee subverts the pass-through break is entirely new.”

Steve Rosenthal, a former tax attorney at Ropes & Gray, agreed.

“The House bill allowed lower rates for qualified income from pass-through businesses, but did not have a wage guardrail,” said Rosenthal, a senior fellow at the Urban-Brookings Tax Policy Center, in an email. “The Senate bill added a wage guardrail, to limit the lower rates to income from businesses with substantial payrolls. The Senate copied the wage guardrail from another rule in the tax code today. The Conferees followed the Senate bill, but lifted the wage guardrail for real estate and, perhaps, other businesses without substantial payrolls. The rule in the Code today does not lift the guardrail for real estate and other businesses without substantial payrolls. The House bill did not have any wage guardrail to lift.”

Seth Hanlon, a former Obama administration adviser on the White House National Economic Council, said Hatch’s argument strained credulity.

“When they say ‘capital-intensive taxpayers,’ they mean passive, wealthy investors that own valuable assets but don’t employ many people,” he told IBT in an email. “When they say ‘prove-out,’ they mean a special trap-door from limits on the new passthrough loophole that allows wealthy real estate magnates to get an even bigger tax break. This special trap-door was not in the Senate bill that Corker voted against. And ironically, the Senate bill based the design of its passthrough loophole and the so-called ‘wage guardrail’ on a bill from then-House Majority Leader Eric Cantor that the House passed in 2012. That bill did not have this special trapdoor for wealthy owners. This is a new provision added to the bill, and not unveiled until Friday night.”

Hanlon also asserted that the Republicans were trying to use an arcane process argument to deliberately distract attention from how Corker and other lawmakers will personally benefit from the provision.

“It’s telling that Republicans are not even trying to defend this carveout on its merits,” he told IBT. “And that’s because it’s an indefensible giveaway to people like Bob Corker and Donald Trump. It is a special, new tax break that goes to rich investors, tilting the tax code in their favor and away from people who work for a living. And it’s one of the ugliest parts of a bill that raises health care premiums, raises taxes on millions of Americans, and explodes deficits.”

Experts estimate Corker could save as much as $1.1 million because of the tax break.

Alex Kotch contributed reporting to this story.

© Copyright IBTimes 2025. All rights reserved.