Student Debt: Obama Administration Tries To Block Bankruptcy Courts From Reducing Education Debt

Just a week after the Obama administration began pushing to let Americans reduce some of their education debts in bankruptcy courts, the same Obama administration is trying to block those same courts from reducing other kinds of student debt. The potentially precedent-setting case revolves around 65-year-old Robert Murphy, who has accrued $246,000 worth of education debt for himself and his children from a federal program known as Parent Plus loans.

Murphy, who is unemployed, is asserting to a federal bankruptcy court that he cannot pay back the loans. But as Bloomberg News reports, the Obama administration’s Department of Education “urged the federal judges not to cede any ground to borrowers who say they are in dire financial straits,” even though the administration admits that Murphy’s “further employment opportunities may be limited.” Bloomberg notes Murphy “calculated that even if he were to find a job paying $50,000 per year and then work until he turns 77, his student debt would nonetheless balloon to $500,000.”

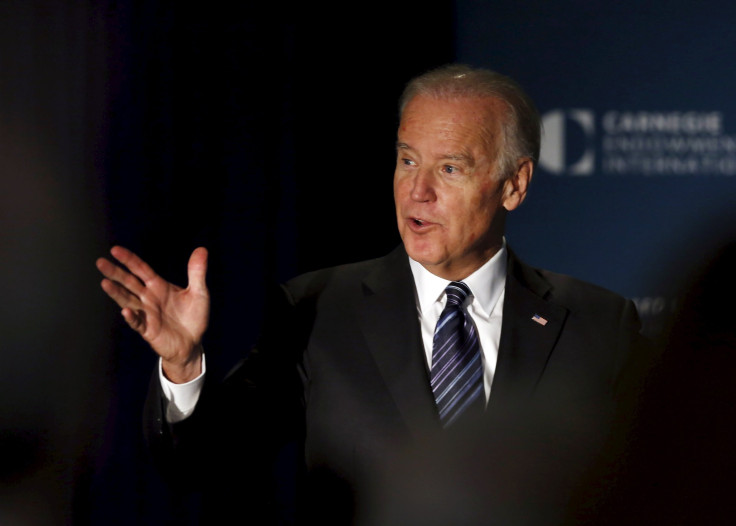

The Department of Education’s move to block the discharge of Murphy’s debts contrasts with the department’s announcement last week that it is now supporting efforts to repeal 2005 legislation -- backed by Vice President Joe Biden while he was a U.S. senator from Delaware -- that helped the financial industry prevent Americans from getting student debt relief when they go bankrupt. The administration’s announcement followed an International Business Times investigation detailing Biden’s role in securing the legislation, and the effects it has had on students.

The Obama administration is drawing a distinction between public and private student loans. The administration last week announced that it wanted to rescind the Biden-backed law that made it harder for students to discharge private education loans, which have skyrocketed in recent years, creating $150 billion in new outstanding debt. In this week’s court case, the administration is saying the same restrictions on discharging student debt should still apply to loans that were offered by the government, which have generated far more debt than private loans.

The bankruptcy restrictions on both public and private loans were backed by Biden during his three decades of work on bankruptcy legislation in the U.S. Senate. Before Biden began working in the 1970s to change the bankruptcy code, bankruptcy courts were permitted to reduce Americans’ public and private student debt. Biden raised almost $2 million from the financial services industry as he backed a series of legislative initiatives making it harder for Americans to reduce many kinds of debt in bankruptcy court.

The Obama administration's intervention in Murphy's federal court case shows that while the White House wants to repeal the 2005 law about private loans, it still supports the previous Biden-backed bankruptcy laws about government loans.

“There are strong grounds for maintaining different standards for federal student loans," the administration explained in its announcement. "Federal loans are not underwritten, have generous terms and protections, and the payments can be limited based on income. Private student loans, by contrast, are underwritten and most do not have a built in income-driven repayment plan.”

© Copyright IBTimes 2024. All rights reserved.