Poorest Britons Suffer Biggest Pay Squeeze

Britain's lowest-paid workers have seen the biggest squeeze on their pay over the past 12 months, according to figures on Tuesday which suggest the cost of living crisis is likely to prove even more painful than headline figures imply.

British consumer price inflation hit a nearly 30-year high of 5.5% in January and is forecast by economists to reach 8% in April, boosted by a 50% rise in household regulated energy tariffs on top of the impact of Russia's invasion of Ukraine.

Britain's main measure of wages - average weekly earnings - is already struggling to keep up, with pay in the three months to January 4.8% higher than a year before.

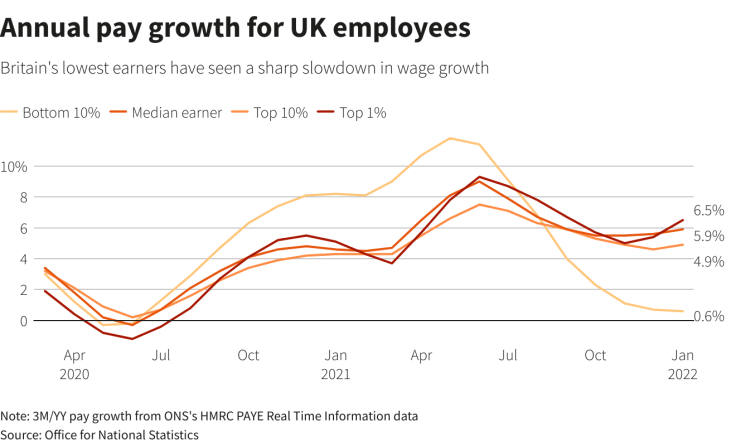

But separate figures based on employers' tax reports showed that pay for the lowest-earning 10% of staff - who make 8,124 pounds ($10,612) a year - has risen just 0.6% over the past year.

By contrast, the highest 10% of earners - who make 57,900 pounds a year - have seen a 4.9% pay rise and the richest 1% have enjoyed a 6.5% pay rise.

"These pay trends help to explain the UK's (tax) revenue-rich recovery, but also means real wages will fall fastest for those who can least afford it," the Resolution Foundation think tank said.

Some of the difference probably reflects distortions as staff move on and off furlough, but top earners have still done best overall since the start of the COVID-19 pandemic. Wages for the lowest-paid 10% have risen 8.1% versus a 9.1% rise for the top 10%.

Britain's main minimum wage rate of 8.91 pounds an hour is due to rise 6.6% to 9.50 pounds an hour on April 1. But most workers will also face a higher tax burden from increased social security charges which take effect at the same time.

Graphic: Annual pay growth for UK employees:

© Copyright Thomson Reuters 2024. All rights reserved.