Pop-ups Take Over For Malls Facing An Uncertain Post-Pandemic Future

Business leaders are looking at short-term options and pop-up stores for area malls as part of a strategy to remain agile as the pandemic doldrums drag on.

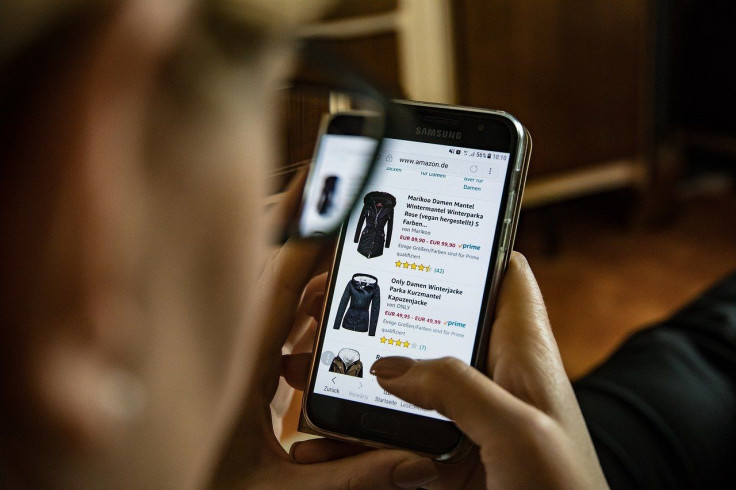

Macy’s this week said it made an aggressive move to slash inventory as part of a plan to close some 125 brick-and-mortar stores by 2023. Posting a rare profit during a fourth-quarter that saw mounting cases of COVID-19 in the pre-vaccine environment, the retailer said its digital sales were up some 21% from 2019.

Reporting from CNBC on Friday found about 14% of the leases for retail market space, some 1.5 billion square feet, are set to expire this year. That leaves property owners such as Tanger Factory Outlets scrambling to fill the vacated space.

Corie Barry, the CEO of Best Buy, said the company was retooling for more of a digital role, furloughing thousands of employees, but training some for a more digital future.

“As we look to the near-term, there will be higher thresholds on renewing leases, as we evaluate the role each store plays in its market, the investments required to meet our customer needs, and the expected return based on a new retail landscape,” she was quoted as saying.

VP Corp., the parent company of shoe brands Vans and Timberland, said it was refocusing its strategy so it could have a more flexible response to future shopping trends.

“The way we structure our leases now allows us to be quite nimble, quite agile, and ... we can pivot as consumer behavior changes,” CFO Scott Roe told CNBC.

In the lucrative Fifth Avenue shopping district in New York City, leases are still at a premium. But Stephan Yalof, the CEO of Tanger, said short-term deals may be part of the future.

“A number of deals that actually started out as pop-up or short-term leases ... we’ve extended the terms of those leases,” he said. “So that seems to be a trend.”

© Copyright IBTimes 2024. All rights reserved.