PPP, EIDL And MSLP: A Guide To Government COVID-19 Loans

When it comes to acronyms, nobody does it better than the U.S. government. And while many acronyms are difficult to untangle, most businss owners know that PPP represents the Paycheck Protection Program, EIDL stands for the Economic Injury Disaster Loan Program, and MSLP is an abbreviation for the Main Street Lending Program. Each is a federal government financing program and each has become increasingly important to the survival of small and medium-sized businesses during the coronavirus pandemic.

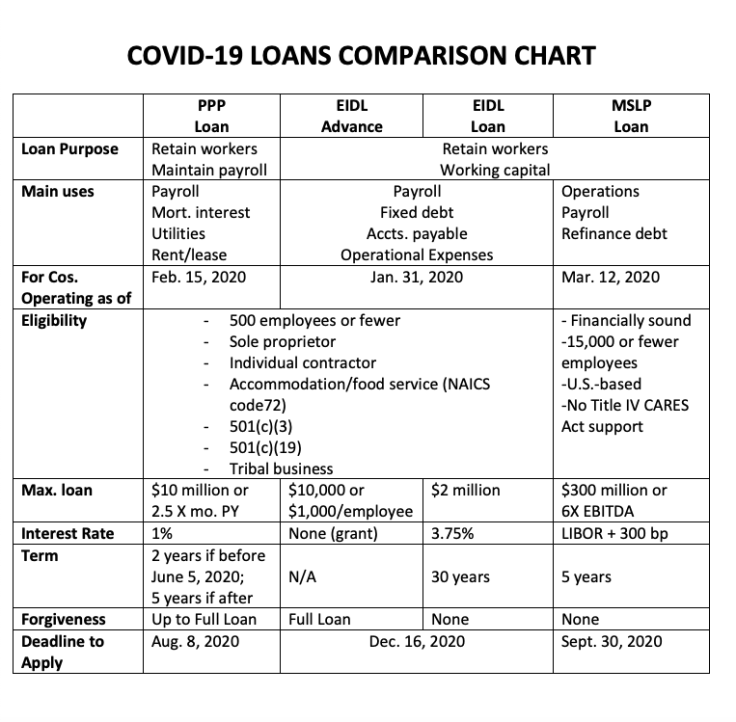

PPP, EIDL, and MSLP loans all provide important financial support to businesses. But they differ in important ways. Basically PPP loans are forgivable but have strict restrictions regarding how the money can be used. EIDL loans are not forgiven (though a companion grant is free) but are less restrictive. MSLP loans, the least restrictive of all, are for SMBs -- generally, those on the larger side --that can't access PPP or EIDL loans or that need additional funding.

Which Loan Should You Pick?

Start by determining which loans your company qualifies for, of course: A loan doesn't make sense for you if you aren't eligible for it. Then think about what you need the funds for, bearing in mind the main purposes of the three loan programs:

- PPP is mostly to maintain payroll and keep employees working.

- EIDL is for operational expenses.

- MSLP is for those who may not qualify for PPP or EIDL or need additional funding if they do qualify.

You are not prevented from applying for all three loans. However, if you receive both PPP and EIDL, you can't spend the funds from both loans on the same type of expenses.

Deciding where to apply involves evaluating your needs and comparing them to the program offerings.There's plenty to consider, so here's a comparison of the main points of each program. As you dig in, keep the application deadlines in mind:

- Aug. 8, 2020, for PPP

- Sept. 30, 2020 for MSLP

- Dec. 16, 2020, for EIDL

Paycheck Protection Program (PPP)

The Paycheck Protection Program (PPP), created by Section 1102 of the CARES Act of 2020, aims to provide small businesses with 100% federally guaranteed forgivable loans. The original legislation was recently amended by the PPP Flexibility Act (PPPFA) of 2020 to make PPP loans more useful to SMBs and on July 4, 2020, by the PPP Extension Act, which makes applications available until Aug. 8, 2020 (the application deadline previously expired on Jun. 30, 2020).

Here are the main points:

Sponsor

A PPP loan is a new type of Small Business Administration (SBA) 7(a) loan sponsored and administered by the SBA. The SBA sets rules and guidelines for PPP loans based on provisions of the CARES Act, which created the program.

Lender(s)

The money comes from approved SBA 7(a) lenders in every state as well as any participating federally insured depository institution, federally insured credit union, community development financial institution, or Farm Credit System institution.

Eligibility

You can apply for a PPP loan if you've been in business since Feb. 15, 2020, and meet any of the following criteria:

- SBA's size standards (either the industry based sized standard or the alternative size standard)

- Sole proprietors, independent contractors, and self-employed persons

- Have a NAICS Code that begins with 72 (Accommodations and Food Services) have more than one physical location and employ 500 or fewer workers per location

- Are a 501(c)(3) non-profit organization, 501(c)(19) veterans organization, or Tribal business concern (sec. 31(b)(2)(C) of the Small Business Act) with: 500 or fewer employees OR meet the SBA industry size standard

In addition, your business can't be engaged in illegal activities or certain other activities such as gambling (casinos) or exotic dancing (strip clubs).

Loan limits

The maximum PPP loan size is 2.5 times the average monthly payroll costs up to $10 million. You can only apply for one PPP loan so it should be for the maximum amount for which you qualify.

Application Deadline

The current deadline to apply for a PPP loan is Aug. 8, 2020. The previous deadline to apply (Jun. 30, 2020) was extended following passage of the PPP Extension Act July 4, 2020. The program could end earlier, however, if the remaining $130 billion in funds runs out.

Application Process

As noted above you apply through an approved SBA lender, however, you can begin the process by filling out the PPP Borrower Application Form (revised Jun. 12, 2020).

Spending the Funds

PPP funds can be spent on payroll, mortgage interest, rent/lease, and utilities. Funds can also be used to pay interest on debt incurred before the coverage period and to refinance an EIDL loan made between Jan. 31 and Apr. 3, 2020. Payroll, which should be the main expense, consists of salary, wages, tips, commissions, paid leave (not covered by FFCRA), dismissal or separation pay, and employee benefits.

Forgiveness

You must apply for forgiveness through your lender using the PPP Loan Forgiveness Application Form (revised Jun. 16, 2020). The amount of your loan forgiven will depend on the percentage of loan funds you spend on payroll costs versus other expenses. You must spend at least 60% of loan funds on qualified payroll expenses and the remaining amount on other eligible expenses to receive full forgiveness of your loan.

Term/Interest Rate/Other

If your loan originated before Jun. 5, 2020, any unforgiven eligible portion will take the form of a two-year loan at 1% interest unless you and the lender agree to extend the loan to five years. Loans originated after Jun. 5, 2020 have a five-year term at 1%. PPP loans require no collateral or personal guarantee no matter the amount of the loan. Loan payments are deferred (interest accrues) for 10 months if you do not seek forgiveness and until you are notified of the forgiven amount by your lender if you do.

Economic Injury Disaster Loan Program (EIDL)

The Small Business Administration sponsors and provides funds for another COVID-19 loan program known as the Economic Injury Disaster Loan (EIDL) program. EIDLs can provide up to $2 million in assistance and also offer an EIDL loan advance (grant) of up to $10,000. The loan advance is automatically forgiven but the loan is not. Further, you can receive the advance and reject the loan if desired. The COVID-19 version of EIDL was also created by the CARES Act. This program, like PPP, has had interruptions, guidance, and recalibration since its inception.

The main points:

Sponsor

The sponsor and funder of EIDL loans is the Small Business Administration (SBA). As with the 7(a) loan program, EIDL existed prior to the COVID-19 pandemic. This version of EIDL is specific to the coronavirus and has special rules and guidelines.

Lender(s)

As noted, the lender is the same as the sponsor: the SBA. This means there is no second entity, as there is with PPP, to further interpret rules and guidelines.

Eligibility

You can apply for an EIDL loan if you've been in business since Jan. 31, 2020, and meet any of the following criteria:

- SBA's size standards (either the industry based sized standard or the alternative size standard)

- Sole proprietors, independent contractors, and self-employed persons

- Have a NAICS Code that begins with 72 (Accommodations and Food Services) that have more than one physical location employing fewer than 500 workers per location

- Are a 501(c)(3) non-profit organization, 501(c)(19) veterans organization, or Tribal business concern (sec. 31(b)(2)(C) of the Small Business Act) with 500 or fewer employees OR meet the SBA industry size standard

In addition, your business can't be engaged in illegal activities or be a strip club or casino.

Loan Limits

Although EIDL loans up to $2 million are technically available, the SBA has capped maximum loan size at $150,000 for this program, plus whatever you qualify for as a loan advance.

Application Deadline

EIDL loan and grant funds will be available until Dec. 16, 2020, or until the $100 billion in additional funding runs out.

Application Process

Application for both EIDL loan and loan advance is made through the SBA using the updated Disaster Loan Assistance Application. If you wish to be considered for a loan advance (free money) you must note that as part of your loan application. Remember, you do not have to accept an EIDL loan in order to receive (and keep) the loan advance.

Spending the Funds

Unlike the PPP, both the EIDL loan and loan advance are considered working capital loans. The money may be used to pay fixed debt, payroll, accounts payable, and other bills that could not be paid due to the coronavirus pandemic. The funds are not intended to be used to replace lost sales, provide profit, or finance expansion projects. They can also not be used to pay down long-term debt.

Forgiveness

The EIDL Loan Advance is automatically forgiven and you do not have to apply for forgiveness. The EIDL loan is not forgiven and will be treated as a loan as outlined below.

Term/Interest Rate/Other

The interest rate for EIDL loans is 3.75% with terms of up to 30 years. If your EIDL is for $25,000 or less, no collateral is required. If it is for $200,000 or less, no personal guarantee is required. Loan payments are deferred (interest accrues) for one year following disbursement of your loan.

Main Street Lending Program (MSLP)

The Main Street Lending Program (MSLP) is the brainchild of the Federal Reserve, which administers but does not provide funds for the program. It was actually created before the COVID-19 pandemic and designed to support lending to small and medium-sized businesses that were in sound financial shape. Now, the program, which officially opened Jun. 15, 2020, has been restructured to provide additional funds for SMBs that received PPP or EIDL loans and need more or did not qualify for either. The program has three facilities: the Main Street New Loan Facility (MSNLF), the Main Street Priority Loan Facility (MSPLF), and the Main Street Expanded Loan Facility (MSELF).

Here are the main points of the MSLP:

Sponsor

The MSLP is sponsored by the Federal Reserve but funding comes from approved lenders similar to the PPP program.

Lender(s)

Eligible lenders, approved by the Federal Reserve, provide the funds, 95% of which are purchased by the Main Street SPV. The lending institution maintains possession of 5% of the debt.

Eligibility

To be eligible for an MSLP loan your business must:

- Have been established prior to Mar. 13, 2020

- Have been in sound financial condition before the onset of COVID-19

- Not be an ineligible business as modified and clarified by SBA regulations for PPP loans

- Have 15,000 employees or fewer OR 2019 revenue of $5 billion or less

- Be a U.S. business

- Participate in only one of the Main Street facilities

- Not have received support under Title IV of the CARES Act (passenger air carriers)

If you receive a PPP or EIDL loan you may still apply for and be granted an MSLP loan, provided you qualify.

Loan limits

There are both maximum and minimum loan amounts. The minimum loan amount is $250,000. The regular maximum is $35 million, capped at 4 times EBITDA. It is possible to for certain borrowers to qualify for up to $300 million, capped at a threshold of 6 times EBITDA. Each of the three loan facilities --MSNLF, MSPLF, and MSELF --have different loan minimums and maximums depending on your existing debt. (Full details are available on the facility term sheets linked below.)

Application Deadline

Unless extended by the Federal Reserve, the Main Street Lending Program SVP will stop accepting loan applications after Sept. 30, 2020.

Application Process

To receive an MSLP loan, you must submit an application along with any other documentation required by the Eligible Lender. Lenders set their own underwriting standards to determine whether they will lend funds to you and can make a loan contingent on a promise from the MSLP SPV to purchase participation in your loan. More details are available on the MSNLF, MSPLF, and MSELF term sheets which set the minimum standards for each type of MSLP loan. A lot of additional information is available on the Federal Reserve Bank of Boston MSLP website.

Spending the Funds

Borrowers seeking these loans must commit to undertaking reasonable efforts to retain workers and maintain payroll. Recipients of funding under MSLP are also required to follow restrictions related to compensation, stock repurchases, and dividends that apply to direct loan programs under the CARES Act. MSLP funds cannot be used to pay down existing debt.

Forgiveness

MSLP loans (all three facilities) are not eligible for forgiveness.

Term/Interest Rate/Other

All three types of MSLP loans have terms of five years with both principal and interest deferred for year one and principal deferred for year two. The interest rate is LIBOR + 300 basis points. Beginning in the third year, the amortization schedule is 15% in year three, 15% in year four, and 70% in year five. Each of the three types of MSLP loans has its own security requirements, available on the term sheets for each facility.

© Copyright IBTimes 2024. All rights reserved.