Pratt & Whitney And Rolls Royce (RR) Partnership Cancellation Won’t Be Big Comfort For General Electric (GE), In Aerospace Universe

Rolls-Royce Holdings PLC (LON:RR) and United Technologies Corporation (NYSE:UTX) unit Pratt & Whitney’s decision to spike a joint aircraft engine venture will come only as a minor victory for General Electric Company (NYSE:GE), the world’s No. 1 engine-maker.

Although the two companies cited regulatory hurdles, that probably wasn’t the key consideration, said William Blair & Co. industrial analyst Nick Heymann to International Business Times.

Instead, Pratt likely wants to keep its impressive geared turbofan engine technology to itself. Pratt beat out General Electric with aggressive sales of its turbofan engines at the 2013 Paris Air Show, stealing much of General Electric’s typical 60 percent share of orders this year.

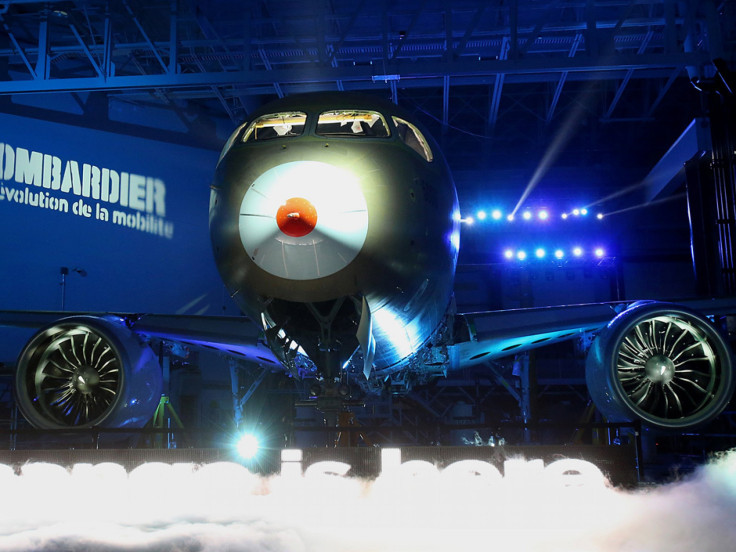

Pratt & Whitney’s PurePower engine saw a major success on Monday, as Bombardier, Inc. (TSE:BBD.B), tested it in its widely watched maiden launch of its C-Series jet.

“This first bit of performance and exposure on the C-Series first flight is reverberating extremely well, in terms of performance of the engine, fuel consumption reduction, and noise emissions,” Heymann said.

“I just think they wanted to fly alone,” said Heymann, referring to the cancellation of the joint venture with Rolls Royce. “When you’ve got something that’s really good, why do you want to share it?”

General Electric’s equivalent engines feature less than half the reduction in carbon and noise emissions compared to Pratt’s superior model, according to Heymann.

Still, General Electric’s aviation business looks to be holding up well. In its latest quarterly call, the company noted commercial engine orders were up 81 percent, amounting to $2.5 billion.

The company shipped 596 commercial engines in the second quarter. Pratt & Whitney announced 1000 new orders at the Paris Air Show, though net sales at Pratt for the quarter only rose to $3.6 billion from $3.4 billion.

General Electric is emphasizing its aviation business as part of its $6 billion annual research spending, so that its technology can thrive and move markets for at least another generation, according to a Citigroup Inc. (NYSE:C) research note from Wednesday.

GE will also enjoy a nice little boost from the $11 billion worth of the Boeing Company (NYSE:BA) 777X jets which Deutsche Lufthansa AG (FRA:LHA) ordered on Thursday.

GE engines for that plane sell for about $14 to $15 million apiece, said Heymann.

© Copyright IBTimes 2024. All rights reserved.