Private Equity Investments In Africa Are Up 136% This Year And Here’s Why: Ernst & Young

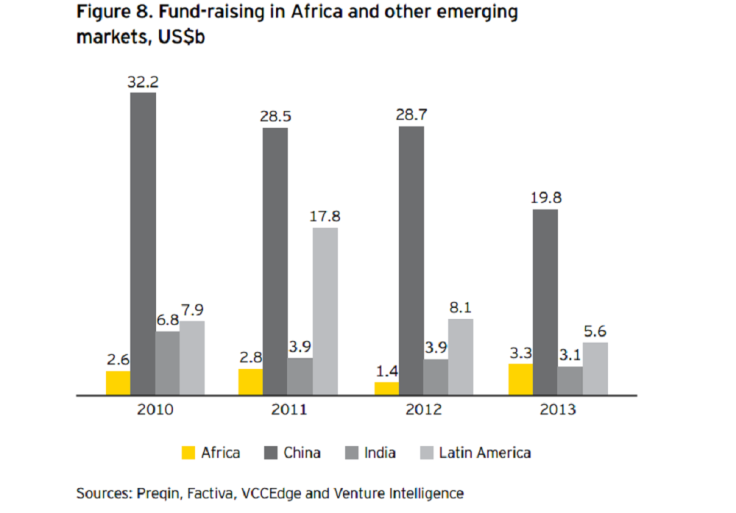

The $3.3 billion in private equity funding raised last year for African ventures is the highest annual amount since 2007 and represents a 136 percent increase since 2012, according to a recent report from Ernst & Young.

Interestingly, the increase “is in marked contrast to Latin America, China and India, which all recorded significant falls in fund-raising in 2013,” the reports states.

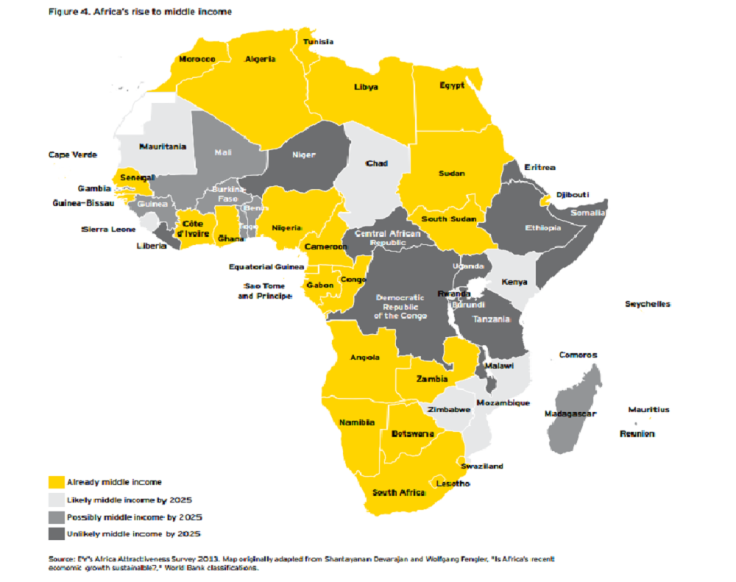

One of the reasons is the fast-growing middle class in many countries on the continent. More than a third of those countries expect to see economic growth greater than 7 percent in the next few years, and the big players are starting to notice.

Though the landscape is still dominated by smaller domestic investors, “large global PE firms are looking at the market to capitalize on investment opportunities available on the continent,” according to the report, which came out earlier this month.

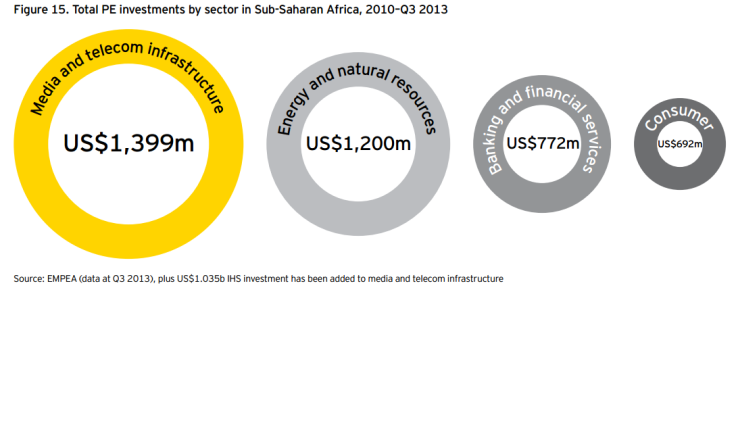

These heavyweights are looking to invest in projects like telecoms, banking and natural resources that will grow with this new, lucrative market.

“Sectors benefiting directly and indirectly from the growth of the African consumer should continue to attract much of the investment targeted at the region,” the report reads.

Investments in banking and financial services were worth $156 million last year, accounting for 13 percent of the total.

London-based Actis Capital LLP put $95 million into a South African company called Paycorp Holdingd Ltd., a banking service provider and ATM deployer.

Media and telecommunications is another growing area, representing more than 9 percent of all private equity investments in Africa since 2010. Last year, the sector raised more than $1.23 billion in sub-Saharan Africa.

Mobile phone providers Etisalat and Airtel reportedly own between 5,000 to 18,000 towers across the continent.

Other notable deals include a $1.04 billion investment in IHS Mauritius Ltd. from investors including Emerging Capital Partners. A company backed by Helios Investment Partners recently announced an acquisition of 1,140 telecoms towers from Vodacom Tanzania.

Infrastructure is another growing field attracting big investments.

For instance, a firm owned in part by a Blackstone-managed fund recently helped develop a hydroelectric project in Uganda that nearly doubled the country’s electricity supply.

“Africa needs huge infrastructure investment in order to meet the needs of its growing and increasingly urbanized population, especially in electricity and transport infrastructure,” the report reads.

The resources sector has also attracted substantial funds.

The American firm Warburg Pincus recently invested $600 million in Delonex Energy, an oil and gas exploration project focusing on Central and East Africa. And Helios Investment Partners recently acquired a minority stake in an oil and gas production venture owned jointly by two Brazilian companies.

Though oil and mining companies aren’t typical private equity targets, “the slowdown in demand from China for resources has created a window of opportunity to buy natural resources companies at relatively lower valuations,” the report reads.

The Chinese slowdown is just one of many larger economic factors making big investors interested in all sectors of African investment. But it’s still a work in progress.

The average size of a private equity transaction last year was $60 million, but the E&Y report notes that the real number is likely much less since smaller investments are still the norm.

“Many of the PE investments in Africa go to businesses owned by families or entrepreneurs, and these tend to be smaller companies,” the report reads.

These projects are less likely to be reported, so it’s difficult to gauge the exact scope. But one thing is clear: Investors big and small are certainly taking notice.

© Copyright IBTimes 2024. All rights reserved.