The Problem With Apple's Services Strategy

The iPhone powered Apple's (NASDAQ:AAPL) incredible growth over the past decade. But the smartphone market is no longer growing. Global smartphone shipments slumped 4.9 percent in the fourth quarter of last year, and Apple saw unit shipments of its expensive phones tumble 11.5 percent, according to IDC. Boosting prices worked for a while, but not anymore. Apple expects its total revenue to decline in its fiscal second quarter, with non-iPhone growth failing to offset weak sales of its signature product.

With iPhone hardware no longer a growth business, Apple is making a lot of noise about services. The company has an installed base of roughly 1.4 billion devices, presenting a seemingly massive opportunity to sell subscriptions to Apple users. The tech titan unveiled four new servicesat an event on Monday as part of its services strategy, including a news subscription service, a branded credit card, a mobile game subscription service, and a highly anticipated video-streaming service aimed squarely at Netflix.

The bullish argument for Apple, as far as I can tell, goes something like this: "Yeah, the iPhone business is struggling, but growth in services can more than make up for it." Here's the problem I see with that line of reasoning.

The numbers are just too big

First, a note about Apple's services business. The company generated $37.2 billion in services revenue in 2018, up 24 percent year over year. But more than half of that revenue comes from things that aren't really services, in the sense that consumers aren't choosing to pay for them.

The biggest contributor is the App Store, where Apple takes a cut of app sales and subscriptions. The App Store is the only way to buy apps on iOS devices, so consumers have no choice in the matter. The second-biggest contributor is licensing payments Apple receives, most notably from Google to make its search engine the default for the Safari web browser. Again, not really a service.

Services like Apple Music, iCloud, and AppleCare -- which consumers choose to pay for -- generate around $4 billion to $5 billion of annual revenue each, according to estimates from UBS. They're not small businesses, but they are small relative to the scale of Apple. Apple's services revenue, only including things that consumers are choosing to pay for, is much smaller than the reported figure.

Apple needs to grow that portion of its services business by an awful lot, and awfully fast, to make up for slumping iPhone sales. It's a tall order, because the iPhone generates so much revenue. Offsetting even a small decline in iPhone sales with new services is a herculean task.

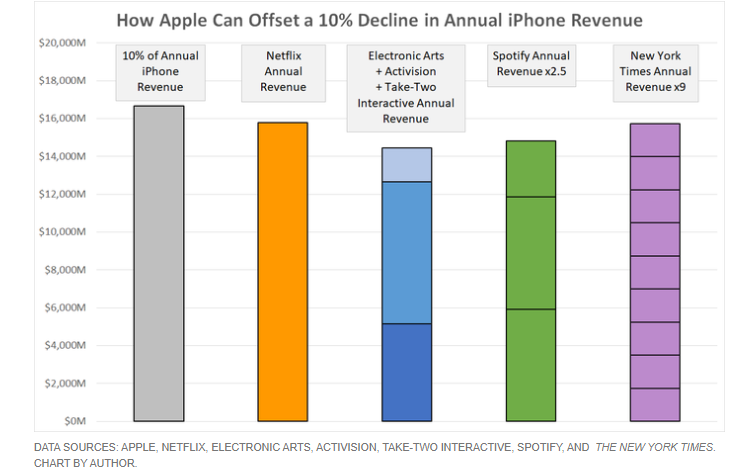

Apple generated $166.7 billion in revenue from iPhone sales in fiscal 2018. If annual iPhone revenue slumps by 10 percent, that's a $16.7 billion hole that the company needs to fill. iPhone revenue fell by 15 percent in the Apple's fiscal first quarter, so a double-digit decline for the year isn't out of the question.

Filling such a large revenue hole with services is going to be hard:

Data sources: Apple,Netflix, Electronic Arts, Activision, Take-Two Interactive, Spotify, and the New York Times. Chart by author.

Even if Apple does manage to build a Netflix-scale video-streaming business, or a massive game subscription business, or a huge news business, profitability is another issue. Are any of these endeavors going to be anywhere close to as profitable as selling iPhones?

Netflix is profitable, but only on an accounting basis. Its cash flow is deeply negative as it pours cash into content. Apple will need to be just as aggressive with content spending to stand a chance. Spotify isn't profitable, and Apple Music likely isn't, either. Apple's news and game subscription services may have the best chance of producing profits, but they're unlikely to become big enough to move the needle.

I don't doubt that Apple will be able to grow its services revenue in the coming years. But if the iPhone malaise is anything more than a short-term phenomenon, services just won't be enough.

This article originally appeared in The Motley Fool.

Timothy Green has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends ATVI, Apple, NFLX, and TTWO. The Motley Fool has the following options: short January 2020 $155 calls on Apple and long January 2020 $150 calls on Apple. The Motley Fool recommends EA and NYT. The Motley Fool has a disclosure policy.