Puerto Rico’s Debt Addiction Was Fed By Banks That Passed Risk To Bond Buyers

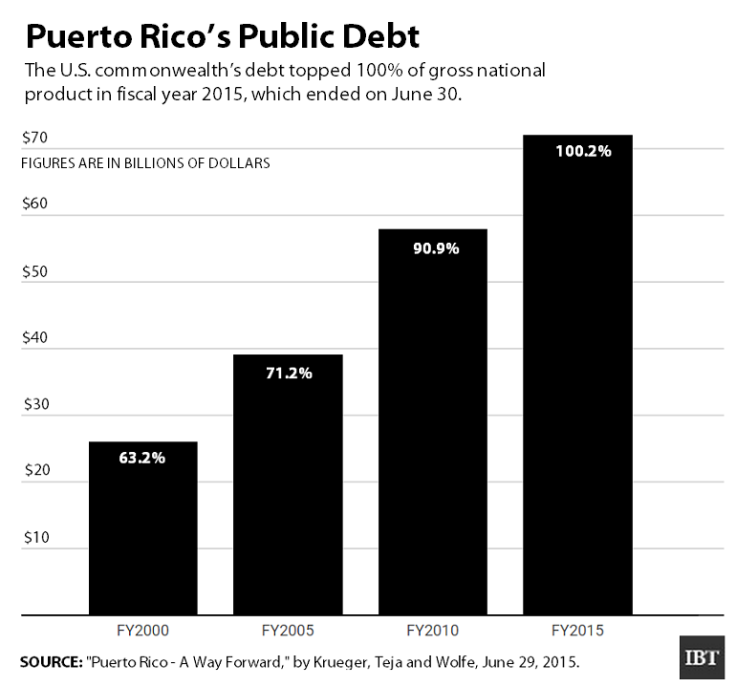

After a decade of economic stagnation and high unemployment, Puerto Rico is at a precipice of insolvency with no way to pay off its massive $72 billion debt. The commonwealth’s politicians, policymakers and populace all bear some responsibility. San Juan’s political leaders have spent years dodging unpopular measures such as tax increases and pension cuts to address the island’s weak economic growth and deficit spending.

But as the government teeters on bankruptcy, Wall Street is also to blame.

According to the industry’s critics, banks acted as enablers to Puerto Rico’s credit addiction for years while collecting billions in fees, imposing often onerous terms and then passing much of the risk off to bond buyers in public debt markets.

“We’ve seen banks do this time and again,” says Saqib Bhatti, director of the ReFund America Project, a group that studies the financial sector’s detrimental effect on public finance. “They take advantage of these broader issues facing local governments and offer solutions aimed at driving these governments deeper and deeper into debt.”

Puerto Rico’s problems began to swell after 2006 when a tax incentive that lured U.S. mainland companies – notably pharmaceutical manufacturers – expired. And just as the island was grappling with a downturn in private sector investments, the Great Recession spoiled any hope of increasing tax revenue. Meanwhile, costs related to infrastructure needs and public pensions continued to swell.

In the last nine years, the situation forced San Juan to accumulate tens of billions of dollars in debt—on a per capita basis, more than any U.S. state. Wall Street’s biggest banks have been eager to underwrite these loans because of the handsome fees they attract. Earlier this year, for instance, a group of banks including Barclays, Morgan Stanley, JP Morgan and Bank of America-Merrill Lynch charged Puerto Rico $28.1 million in underwriter fees to issue $3.5 billion in bonds.

And because bankers can pass the debt off to investors in the bond market, they are able to shed their exposure to the risk that Puerto Rico might default on its loans.

“The unambiguous winners in the bond game were the underwriters and the bond sellers,” said Orlando Sotomayor, an economist at the University of Puerto Rico. “The losers will clearly be the bondholders, of which about a third are now hedge funds.”

An analysis by the Wall Street Journal in 2013 estimated that banks and investment houses earned $1.4 billion in fees on $61 billion in lending to Puerto Rico from 2006 to 2012, raising questions from regulators about whether the banks were fully transparent to investors about the risks of buying the securitized debt.

Some of Puerto Rico’s loans carry punishing terms. Bhatti estimates that about $5 billion of Puerto Rico’s debt is in the form of so-called capital appreciation bonds (or CABs). CABs prohibit the borrower from paying down the principal or the compounding interest for years, allowing the debt to grow. The terms are so onerous that in 2013 California lawmakers limited the amount of interest the state could be charged to $4 for every $1 borrowed after some school districts ended up paying as much as 20 times the amount they borrowed.

“Even that reduced amount is outrageous,” said Bhatti. “The fact that this was considered a reform shows you just how much you can wind up paying.”

Banks have happily underwritten Puerto Rico’s borrowing for years because they’ve been able to pass the debt on to investors attracted to high-yield bonds. The bonds are also attractive because investors are exempt from paying state, local and federal taxes on their gains.

And Puerto Rico’s special status with the U.S. – that is, a commonwealth which shares a currency and is prohibited from filing for U.S. bankruptcy protections without congressional approval – has led investors to assume the risk of default is lower than it would be for securitized debt from an emerging market economy. The U.S. Federal Reserve’s post-recession monetary policy has spurred a bond rally, too, which helped whet appetites for Puerto Rico’s debt.

“In a low interest-rate environment, investors reach for higher yields, and coupled with the tax advantages that Puerto Rico has, that higher-yield investment becomes attractive,” Garry Schinasi, an independent adviser on global financial stability issues and former member of the IMF’s capital markets surveillance unit. “But there’s no question that in the case of Puerto Rico the risk was mispriced to some extent.”

Meanwhile, the willingness banks to lend to Puerto Rico allowed San Juan to delay crucial and unpopular reforms until the debts became insurmountable.

Puerto Rico is due to make $5.15 billion in debt payments in its 2016 fiscal year, which starts Wednesday, according to Washington-based investment firm Height Securities. That’s more than half of the proposed $9.8 billion budget for the next fiscal year.

On Wednesday, sales taxes and other government levies will go up in order to raise revenue to service Puerto Rico’s debt. Lenders will be first in line for collection before the money trickles down to public services, which will exacerbate the public’s frustration and cause more political gridlock on austerity measures. “People are going to pay higher taxes and wonder why the benefits aren’t immediately felt,” said Height Securities analyst Daniel Hanson.

© Copyright IBTimes 2024. All rights reserved.