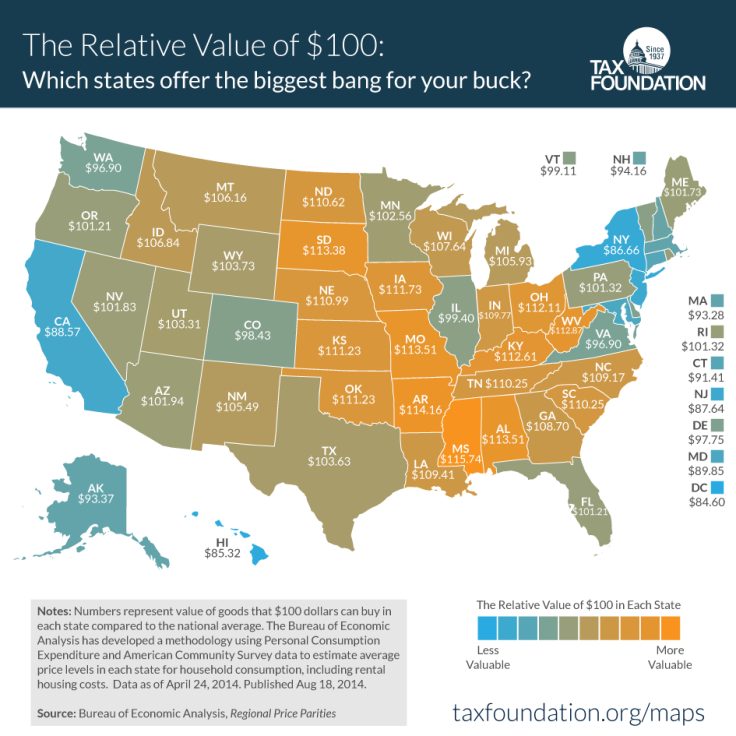

The Real Value Of $100, How Much Is Your Money Really Worth? [INFOGRAPHIC]

It's all about "location, location, location" when it comes to the real value of your hard-earned dollars as it varies significantly by state. The Tax Foundation broke down the real cost of $100 by state and your money goes a long way in Mississippi and Arkansas -- but it’s chump change in Washington D.C. and Hawaii.

The study has some serious implications for your wealth and well-being beyond dispelling that nagging feeling like you have been short-changed. The data illustrates the real purchasing power an individual has. Just because you have a high income, living in a state with higher taxes and higher price levels will sap your purchasing power.

The biggest takeaway from the report, according to Alan Cole, an economist for Tax Foundation, centers on income inequality by state and purchasing power's role in narrowing that gap. "Income inequality among states – after adjusting for purchasing power parity – is much less than the nominal income data suggests. States with lower incomes tend to have lower price levels, and vice versa. For example, Kansas has a slightly higher average income than New York after adjusting for purchasing power," Cole said.

As the organization explains, taxes based on income means New Yorkers pay more in taxes than residents of Kansas which, factor in with cheaper prices for goods, leads to higher purchasing power for Kansas residents. "A poor person in a high cost area – like Brooklyn or Queens - may be artificially boosted out of the range of income where they are eligible for welfare programs, despite still being very poor. At the same time, many people in low-price states may be eligible for welfare programs despite actually being much richer than they appear," reads the report.

For Cole, "income data without context is a poor measure of people's well-being."

© Copyright IBTimes 2024. All rights reserved.