Joe Jonas Lives the 'Fast Life' As Successful Solo Artist [VIDEO&PHOTOS]

Joe Jonas hit the big stage in Mexico City on Aug. 25 to promote his debut solo album--Fast Life. The middle Jonas graced the MTV World stage confidently in a light blue suit and white collar shirt. He rocked the crowd full of thousands as we walked the catwalk and eventually sat on a stool. The singer was also embraced by a fan who jumped on the stage. Jonas seemed relaxed as security removed her from the stage. It's like a #MTV weekend, Jonas tweeted. Right he is! Th...

Investors sanguine as Apple's Jobs steps aside

Apple Inc's first day without Steve Jobs as chief executive looked awfully similar to most other days: its share price beat the broader stock market.

Consumer sentiment sinks in August on government despair

U.S. consumer sentiment sank in August as consumers lost confidence in lawmakers' ability to stave off the threat of another recession, a survey released on Friday showed.

Fed prepared to use tools to spur growth: Bernanke

Federal Reserve Chairman Ben Bernanke on Friday stopped short of signaling further action to boost growth, but said it was critical for the economy's health to reduce long-term joblessness.

Wall Street lower as investors await Bernanke speech

Stocks fell early Friday as investors found few reasons to buy following a volatile week and ahead of a keenly anticipated speech from Federal Reserve Chairman Ben Bernanke.

Hurricane Irene Path: East Coast Residents Board up, Clear Out, as 65 Million Await Storm

Goodnight Irene! a North Carolina resident wrote on their house, which was left boarded up, anticipating the arrival of Hurricane Irene in Nags Head, N.C., The storm's punishing weather from the Carolinas to as far north as Massachusetts threatens at least 65 million people in the storm's track.

Chelsea Transfer Rumours - Have Spurs Threatened Modric?

Chelsea's pursuit of Luka Modric, one of the summer's long-standing sagas, has come to a conclusion according to Tottenham manager Harry Redknapp although reports suggest Daniel Levy has laid out terms to him, threatening him to play or face exclusion from Euro qualifiers next week.

Ocean City Evacuates as Hurricane Irene's Eye Expected to Pass Sunday

Residents in Ocean City, Md. Were ordered to evacuate as the monster storm Hurricane Irene is expected to hit the Maryland shore Sunday.

Tiffany raises forecast as sales rise worldwide

Tiffany & Co raised its full-year profit outlook as more shoppers worldwide bought its jewelry during the bridal season, helping it overcome rising gold and diamond costs and sending its shares up more than 5 percent.

Exclusive: China plans to mop up bank liquidity

China has ordered banks to include their margin deposits in required reserves at the central bank to mop up excessive liquidity, banking sources said on Friday, the latest move in Beijing's campaign to rein in worrisome inflation.

Justin Bieber Christmas Album, Fans Come Up With Name On Twitter [VIDEO]

Justin Bieber engaged with his fans via Twitter for help on his latest album. trying to figure out the name of this christmas album. it is special. we are going to raise alot for charity with it. what is a good name? he wrote early Friday morning.

Second-quarter GDP trimmed, spending raised

The U.S. economy grew slower than previously thought in the second quarter as business inventories and exports were less robust, a government report showed on Friday, although consumer spending was revised up.

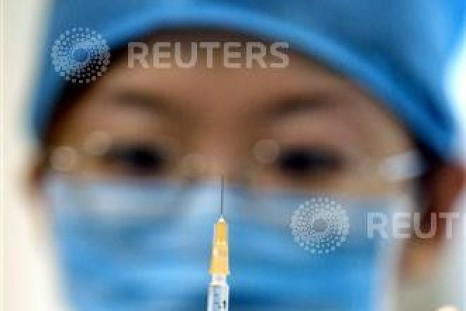

Autism Not Caused By MMR Vaccine, Or Any Others: Report

The U.S. Department of Health and Human Services, which helped guide the Vaccine Injury Compensation Program that funds children who experience side effects from vaccines, has commissioned a report after 17 years that found no link with autism and Type 1 diabetes after taking certain vaccines.

Stock ftures point to lower open ahead of Bernanke

Stock index futures pointed to a lower open on Friday as investors found few reasons to buy following a volatile week and ahead of a speech from Federal Reserve Chairman Ben Bernanke on the economy.

Economy's Growth Much Slower in Q2 than Previously Thought

The economy grew much slower than previously thought in the second quarter as business inventories and exports were less robust, a government report showed on Friday, although consumer spending was revised up.

Bernanke seen stopping short of pledge for QE3

Those expecting Federal Reserve Chairman Ben Bernanke to pull a rabbit from his hat at a retreat for central bankers here on Friday may be in for a letdown.

Second-quarter growth revised down to 1 percent

The economy grew much slower than previously thought in the second quarter as business inventories and exports were less robust, a government report showed on Friday, although consumer spending was revised up.

Analysis: Safe haven assets start to look risky

This year's heady bout of risk aversion on financial markets has ratcheted up demand for gold, U.S. Treasuries and the Swiss franc to levels that suggest they may no longer be the safe havens they are billed as.

Stock futures lower ahead of Bernanke speech, GDP data

Stock index futures edged lower on Friday as investors found few reasons to buy following a volatile week and ahead of a speech from Federal Reserve Chairman Ben Bernanke on the economy.

Arsenal Transfer Rumours - Cahill, Niang and Rosicky News as Wenger Embarrasses Arsenal

Widespread reports have stated that Arsenal had an offer rejected for Bolton defender Gary Cahill as their bid only came within one-third of his valuation.

Analysis: History shows iconic CEOs tough act to follow

How does a company recover from the loss of an iconic leader like Steve Jobs at Apple Inc ?

Stock futures flat ahead of Bernanke speech, GDP data

Stock index futures were little changed on Friday as investors hesitated to make bets on when Federal Reserve Chairman Ben Bernanke would announce a new stimulus plan as a volatile week drew to a close.

Exclusive: China plans fresh move on bank liquidity

China has ordered banks to include their margin deposits in required reserves to mop up excessive liquidity, banking sources said, the latest move in Beijing's campaign to rein in inflation.

Spain to set deficit limit in constitution

Spain reached political consensus on Friday to set constitutional limits on its public deficit and debt, though details were sketchy and there were few signs the accord would persuade markets Madrid can manage its finances.

ABN AMRO cuts 9 percent of jobs in run-up to sale

Nationalised Dutch bank ABN AMRO is shedding 2,350 jobs -- some 9 percent of its workforce -- as the state readies it for a return to private hands.

Will Steve Jobs Return Again?

The impending threat that Apple will see Jobs-less days had been looming since CEO Steve Jobs announced his medical leave in January.

Analysis: 'Safe Haven' Assets Start to Look Risky

This year's heady bout of risk aversion on financial markets has ratcheted up demand for gold, U.S. Treasuries and the Swiss franc to levels that suggest they may no longer be the safe havens they are claimed to be.

Analysis: LG Faces Tough Choices for Mobile Phone Division

South Korea's LG Electronics hasn't been so smart with its smartphone business. Its mobile phone division has suffered five consecutive quarterly losses, cutthroat competition is pressuring it to overhaul the business and its shares have plummeted.

Stock futures signal gains; Bernanke eyed

Stock futures pointed to a slightly higher open for equities on Friday after steep declines in the previous session, with futures for the S&P 500, for the Dow Jones and for the Nasdaq 100 all up 0.2 percent.

Greece sets minimum take-up rate for debt swap plan

Greece said on Friday it would not go ahead with a debt swap crucial to its second bailout if private sector holders of less than 90 percent of the bonds participate, failing to satisfy its international partners.