All Eyes On EU Summit, Housing and Manufacturing Data: Economic Events For June 25-29

The European Council's June 28-29 meeting will no doubt be the main focus of this week as some hope that new steps can be taken to grapple with the region's debt crisis.

Monsanto, Nike, General Mills: 11 Earnings Reports To Watch, June 25-29

Expectations for U.S. company earnings are on a slippery slope down Wall Street as the euro-zone crisis deepens and economic data around the world disappoints. With one week left in the second quarter, it is a good time to measure revisions in earnings estimates for companies in the S&P 500.

King Coal Has Lost Crown To Natural Gas, Despite Price Decline Forecast

While coal has powered the 19th-century Industrial Revolution, heated homes and generated electricity, the era of King Coal has come to an end.

Shrinking Share Of Exports To Asia Has Cost US Economy A Fortune, Countless Jobs

Four years ago, for every five shipping containers that Asia sent to the U.S., America sent back only two, resulting in gluts of empty containers at U.S. West Coast ports and a widening trade deficit with countries like China and Japan.

Manufacturing Woes Spread From Euro Area To China, And Now They Have Reached The US

Manufacturing has been one of the few bright spots of the otherwise frail U.S. economic recovery, but Markit said weaker overseas demand could be starting to slow hiring in the sector. U.S. manufacturing grew in June at the slowest pace in almost a year and hiring in the sector also slowed.

Why Companies Are Racing To Cut Earnings Forecasts

Expectations for U.S. company earnings are on a slippery slope down Wall Street. While the downward slide in estimates highlights the caution analysts and companies are expressing, investors should also be aware that companies are setting lower goals so that they can look better or be able to ?beat estimates? when the results come out.

Bank Of America Races To Sell Assets (Again) ? A List Of Assets Sold Since 2011

Bank of America Corp. (NYSE: BAC), the lender divesting assets to raise capital, is in talks with Swiss wealth manager Julius Baer Group Ltd. to sell its Merrill Lynch wealth management business outside the U.S.

US Gas Prices Plunge In Time For Independence Day Travel

There?s a silver lining to the bearish global economic news ? a slide in crude oil prices: U.S. gasoline prices fell from their April peak, which will likely prompt more Americans to hit the road for the Independence Day holiday.

US Housing Starts Fall In May, Permits Surge To Highest Level In Nearly 4 Years

Housing starts fell 4.8 percent in May to an annual rate of 708,000, but building permits climbed 7.9 percent to the highest level in nearly four years, the U.S. Commerce Department said Tuesday. Economists surveyed by Reuters had forecast a reading of 720,000.

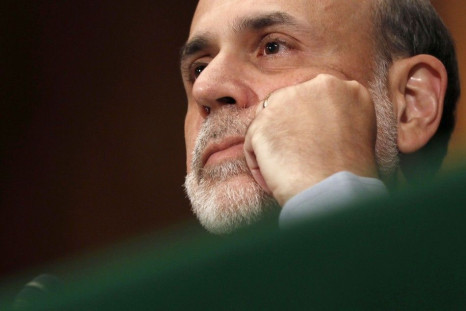

Get Ready For The Fed?s Summer Sequel - Operation Twist 2

The prolonged crisis in the euro zone, coupled with signs that the U.S. economic recovery is faltering, have led to speculation that the Federal Reserve will provide more monetary stimulus, most likely through extending its Operation Twist program, at the June two-day Federal Open Market Committee meeting, which concludes on Wednesday June 20.

Rio+20 Preview: Not The Best Time For Sustainability Talks, Experts Say To Expect Less

Twenty years after the 1992 Earth Summit, world leaders are returning to Rio de Janeiro to negotiate further progress toward sustainable development. However, the potential for this year?s Rio+20 Summit to have a similar impact is less likely.

FOMC Policy Decision and Housing Data Dump: Economic Events For June 18-22

This week's data releases highlight Wednesday's Federal Open Market Committee (FOMC) statement, which will likely present a dovish tone. However, those who are expecting for the announcement of renewed asset purchases will likely be disappointed.

Should Germany Leave The Euro And Reissue Deutsche Mark?

A euro-area breakup might appear to be inevitable at this point. But, instead of Greece being pushed out the door, analysts say an outside-the-box solution to the euro zone's sovereign-debt problem would be for Germany to voluntarily withdraw from the euro and reinstall the Deutsche mark.

FedEx, Adobe, Oracle: 9 Earnings Reports To Watch June 18-22

Wall Street's pessimistic outlook on corporate profits was proved wrong by surprisingly strong first-quarter results. However, will the second-quarter earnings season tell a different story?

June Empire State Manufacturing At Lowest Level In 7 Months

Manufacturing in the New York region hardly expanded in June as orders and sales cooled, the New York Federal Reserve's Empire State Manufacturing Survey showed Friday.

American Airlines-US Airways Merger: Who Wins, Who Loses?

US Airways has been very publicly circling AMR Corp., the bankrupt parent of American Airlines. Yet industry experts expressed concerns that, while a potential merger would be a boon to the labor unions, the flying public would end up footing the bill.

Russia Printing Money For Cash-Strapped Syria: Report

Helicopter gunships aren't the only things Russia is giving Syria; now the Kremlin is printing money for the cash-strapped Damascus regime. But whereas the former makes Assad's regime stronger militarily, the latter may be contributing to an inflation rate that is now more than 30 percent.

Euro Zone April Industrial Output Slumps, Recession Likely In Q2

Euro zone industrial production in April showed the steepest decline in four months and economists point to this data as an early indication that the euro area's narrow escape from technical recession in the first quarter is unlikely to last very long.

What Happened To Corporate America's Mountain Of Unused Cash?

That massive pile of cash corporate America has been sitting on for years is shrinking, and the reason it's declining bodes well for the nation's economy.

Spanish Bond Yields Draw Closer To Euro-Era Highs Again

The reassurance provided by the ?100 billion ($125 billion) Spanish banking bailout last Saturday has already waned, and on Tuesday morning, the country's 10-year bond yields rose again to 6.67 percent, drawing closer to euro-era highs of 6.8 percent.

China May Data Wrap: A Mixed Bag Of Results Calls For More Stimulus

China's May data dump over the weekend and on Monday painted a mixed picture of the economic health of the world's second-largest economy.

J&J To Pay $2.2 Billion To Settle Risperdal Probe - Report

Johnson & Johnson (NYSE: JNJ) has agreed to settle a probe into sales of its antipsychotic drug Risperdal and other medications for as much as $2.2 billion, Bloomberg reported Monday, citing two people familiar with the matter.

Retail Sales, Manufacturing And Trifecta Of Inflation Data: Economic Events For June 11-15

This week's data releases could reignite hopes that the Federal Reserve will soon provide more policy stimulus. May's producer price index and consumer price index should show that inflationary pressures are easing, with the latter falling below the Fed's 2 percent target rate. Retail sales and industrial production figures for May are likely to come in on the soft side, as well.

Fiscal Cliff: If You Aren't Worried, Here's Why You Should Be

While the euro zone fiscal crisis has grabbed the spotlight, the U.S. faces its own fiscal crisis. The simultaneous onset of tax increases and spending cuts scheduled for Jan. 1 -- which will trigger unless Republicans and Democrats can agree on a balanced budget solution -- will likely send the economy plunging off a $720 billion fiscal cliff and into the arms of another recession.

China's May CPI Rises At Slowest Pace In 2 Years; PPI Fell More Than Expected

China's inflation cooled in May, giving Beijing more wiggle room to loosen policy and stimulate growth. Its consumer price index rose by 3 percent, and its producer price index fell by 1.4 percent.

China May Data Preview: CPI Drop Leaves Door Open For More Easing

A deluge of data is due over the weekend and next week, including almost all of China's key barometers of economic health. The worsening European debt crisis is casting a pall over everything, and has slowed down growth in the world's economic powerhouse.

Logitech To Cut Workforce By 13%, Or 450 Jobs

Logitech International Logitech International SA (Swiss: LOGN), the Swiss computer mouse maker, said Friday it will eliminate about 13 percent of its workforce, or 450 jobs, as part of its restructuring program after lowing profit outlook three times in less than a year.

Can Splurging Chinese Firms Save Europe?

Not a chance.

Euro Zone To Fall Into Recession In 2Q, But Will ECB Ride To Rescue?

The euro zone avoided recession with zero growth in the first quarter, but it seems to have run out of luck. Recent data out of the single currency bloc has led economists to conclude with confidence that a recession is looming and the European Central Bank may not act Wednesday.

US Economists Warn The Fed Is Setting Us Up For Deflation

Home prices are stagnant, crude oil is tumbling and copper has fallen to a seven-month low. Inflation is not the problem. What is the problem is inflation's evil twin, deflation.