U.S. Non-Manufacturing Grew At a Slower Pace in November, Led By Retail Trade, Mining and Information

U.S. non-manufacturing sector expanded for the 24th consecutive month in November, but at a slightly slower rate, according to a closely watched index released Thursday.

U.S. Rail Volume Post Continued Gains, Led by Sectors Including Automobile, Petroleum Products: AAR

U.S. rail traffic, a snapshot of the weekly economic well-being, continued to climb in late November. During the week ending Nov. 26, U.S. railroads originated 265,304 carloads, up 4 percent compared with the same week last year, while intermodal volume for the week totaled 190,866 trailers and containers, up 3.7 percent compared with the year-ago-period, the Association of American Railroads reported.

Costly Holiday Season National Railroad Strike Averted, For Now

The nation's major freight railroads averted the possibility of an imminent strike, which could hit the retail industry hard during the holiday season, by reaching tentative agreements with two labor unions and agreeing to extend talks with a third late Thursday, just hours after Republican House leaders said they would move to vote Friday an emergency bill to block a strike.

U.S. Jobless Rate Falls to 8.6 Percent, Lowest in More Than Two Years

U.S. added more jobs in November and jobless rate fell unexpectedly to the lowest point since March 2009. Revised data show that hiring in early fall grew faster than initially reported. All signs indicate a moderate recovery in the labor market.

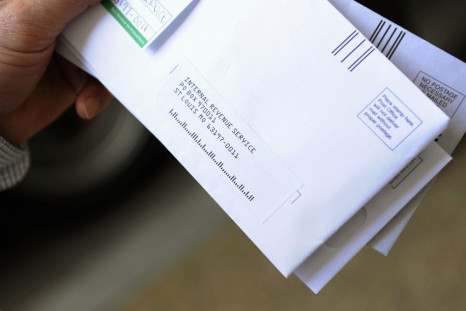

IRS Seeks to Return $153 Million in Undelivered Checks to Taxpayers

The Internal Revenue Service is holding onto $153 million worth of tax refund checks that failed to be delivered to taxpayers. In all, 99,123 taxpayers who should receive refund checks this year did not get them due to mailing address errors.

Discover Ties Credit Card Rewards to Zynga’s FarmVille Expansion: Winter Wonderland

Discover Financial Services (DFS), one of the largest card issuers in the U.S., found a new way to promote its credit card. The company announced Thursday it has partnered with social game developer, Zynga Inc., to help launch an expanded version of FarmVille -- Winter Wonderland.

NORAD Ready To Track Santa’s Flight on Christmas Eve

The North American Aerospace Defense Command is getting ready to track Santa's 2011 journey. The NORAD Tracks Santa website went live on Thursday, featuring a countdown calendar, a kid's countdown village with holiday games and activities that changes daily and video messages from students and troops from around the world.

Wells Fargo Reduces Fixed Rates on Student Loans; New 7.24 Percent Starting Rate Lower Than UBS'

Wells Fargo & Co. (WFC) announced Thursday the reduction of fixed interest rates for many of its private student loans, as the company tries to coincide with peak season and appeal to graduates interested in consolidating their student loan debt, as well as those who are in the midst of obtaining financing for second semester coursework.

U.S. Manufacturing Growth in November Surpasses Expectations

U.S. manufacturing expanded at a faster rate in November and the overall economy grew for the 30th consecutive month, according to a closely watched index released Thursday.

U.S. Jobless Claims up Again, Surpassing 400,000

Latest data on the number of Americans who filed new applications for federal unemployment benefits rose for a second straight week and once again moved above the key 400,000 mark -- the level at which some economists take to mean the economy has to add more jobs than it is shedding. The labor market is still weak, even during the holiday season.

More People Were 65+ in 2010 than Ever Before: U.S. Census Report

The U.S. population 65 and older is now the largest in terms of size and percent of the population, compared with any previous census, according to the new 2010 Census data released Wednesday by the U.S. Census Bureau. The group grew at a faster rate than the total population between 2000 and 2010.

Fed Names Michael Gibson New Head of Bank Supervision

The Federal Reserve Board on Wednesday named Michael Gibson as director of the Division of Banking Supervision and Regulation, an important role that oversees the implementation of Dodd-Frank rules and bank stress tests, effective Jan. 1, 2012.

Fed Beige Book Notes 'Slow to Moderate Growth' in Most Districts

The Federal Reserve said Wednesday that the U.S. economic activity increased at a slow to moderate pace in 11 of the 12 Fed districts. St. Louis reported a decline.

Warren Buffett to Acquire His Hometown Paper

Warren Buffett said newspapers faced the possibility of nearly unending losses and he would not buy most newspapers in the U.S. at any price in May 2009 at a Berkshire Hathaway shareholders meeting. However, the billionaire announced Wednesday that he has agreed to buy Omaha World-Herald Co., publisher of his hometown newspaper the World-Herald.

U.S. Private Sector Adds 206,000 Jobs in November

Employment in the private sector rose 206,000 from October to November and small businesses contributed to more than half of the growth.

U.S. Third-Quarter Productivity Revised Down to 2.3 %

U.S. workers in the nonfarm business sector increased their productivity between July and September by the most in a year and a half, but grew at a slower rate than initially expected.

November Layoffs Remain Flat From October but 11-Month Toll Surpasses 2010 Year-End Total

U.S. job cuts dropped 13 percent from the same month a year ago. Yet, with still one month remaining in 2011, the 11-month total of 564,297 has already officially surpassed the 497,969 people employers let go in the past year.

Even Warren Buffett Can’t Stop Bank of America’s Stock From Plunging

So far, it has been a tough week for the troubled Bank of America Corp. (BAC). The firm's stock hit a new 52-week low Tuesday, dropping more than 3 percent to $5.03 a share, the lowest level since March 12, 2009. After the market closed, more bad news came as Standard & Poor's downgraded the bank's long-term credit rating by a notch to A- from A.

No Fees for Oregon U.S. Bank ‘ReliaCards’ under New Agreement

Oregonians who get jobless and child support payments via ReliaCards will be able to receive free and unlimited point-of-sale, bank teller and U.S. Bank ATM transactions, under a new fee structure reached by Oregon Treasure Ted Wheeler and U.S. Bank.

Fraud in U.S. on the Rise, Led by Asset Misappropriation, Cybercrime

Forty-five percent of U.S. respondents reported that their organization had suffered fraud in the previous 12 months, compared to 35 percent in 2009. Economic pressures, incentives, and opportunities are a significant motivator for economic crime.

U.S. Consumer Confidence Jumps to Four-Month High, Beats Estimate

U.S. consumers are loosening their purse strings over the Black Friday weekend as their confidence in the economy increased to a four-month high. After six months of steady declines, consumers' assessment of current conditions finally improved.

U.S. Firms Added Jobs Offshore, Cut Jobs At Home

U.S-based multinational corporations added almost 3 million jobs to their payrolls in foreign countries between 1999 and 2009, while slashing 864,600 jobs at home, as they become increasingly dependent on foreign sales. Is tax holiday a viable solution?

Banks Benefited From Nearly $8 Trillion Bailout

While big U.S. banks assured investors they were financially healthy during the financial crisis, they also quietly approached the Federal Reserve for more bailout money. As of March 2009, the Fed committed $7.77 trillion to rescue the financial system, which is more than half the value of everything produced in the U.S. that year. The amount dwarfed the Treasury Department's better-known $700 billion Troubled Asset Relief Program, or TARP.

Consumer Debt Fell in Third Quarter, Fed Reports

More consumers are pulling back from the housing market, which pushed down their debt levels during July through September, the New York Federal Reserve said Monday.

Modest Job Gains Expected in Early 2012

The past Black Friday weekend saw record breaking sales figures as consumers are feeling more comfortable to purchase again. Job market outlook for early 2012 could provide another gentle boost to consumer spending, which accounts for as much as 70 percent of all U.S. growth.

U.S. Credit Rating Unaffected by Super Committee Failure, For Now

The failure of the Super Committee to reach a budget deal wouldn't immediately affect the U.S. credit rating, according to Moody's Investors Service, Standard & Poor's Ratings Services and Fitch Ratings, but the rating agencies are keeping a watchful eye on developments.

Fifth Third Bancorp Settles with SEC over Securities Trading

Fifth Third Bancorp and the Securities and Exchange Commission settled on Wednesday allegations the bank failed to adequately notify all investors of a material event. The bank neither admitted nor denied the allegations but agreed not to violate disclosure rules.

Jobless Claims Numbers Indicate Positive Trend for Jobseekers Despite More Job Cuts

Latest data on new claims for unemployment sent mixed signals to the market, showing that while the week ended Nov. 19 was the third straight week for initial claims to hold below 400,000, a mark that most economists believe is essential for the economy to add more jobs than it is shedding, application for jobless insurance increased 2,000 to 393,000.

DOJ Debit Card Fee Review Signals Warning for Banks

The U.S. Department of Justice said it is reviewing statements and actions by big banks and their trade associations to see if they have violated antitrust laws through coordinated action to raise consumer debit card fees. But experts say an actual investigation is fairly unlikely.

Why America's Swipe-based Credit Cards are Outdated, Can Expose You to Fraud

America may seem to be at the forefront of innovation and technology, but when it comes to credit card payment systems, we're still a step behind.